CHICAGO — Michigan-based Trinity Health, one of the nation’s largest Catholic health care systems, will invest up to $150 million over the next five years as part of its acquisition of Mercy Health System if the deal is approved by an Illinois review board.

If the transaction closes, it will be Trinity’s second acquisition of a Chicago-area hospital in a year. The system acquired Loyola University Health System in July 2011. Trinity agreed to invest $400 million through 2018 in Loyola as part of that deal.

Mercy and Trinity announced in early November they had signed a letter of intent to negotiate a union.

Documents filed Dec. 20 with the Illinois Health Facilities Planning Board show that the two entities hope to close the deal by April 2012.

After closing, Trinity would invest $40 million in cash in the 159-year-old stand-alone Mercy to finance ongoing capital projects.

Trinity would then spend $100 million over the next five years to finance upgrades in capital, information systems, and equipment needs.

An additional $10 million would be available if Mercy reaches an operating cash-flow margin of at least 8% in fiscal 2015 and continues to receive Medicaid provider tax program payments in 2016 and 2017, the documents said.

“With the potential affiliation with Mercy System, Trinity continues its commitment to strengthening Catholic health care in the Chicago area and across the nation,” the documents said. “Trinity and Mercy share complementary missions and similarities in legacy and have had a strong collaborative relationship for several years.”

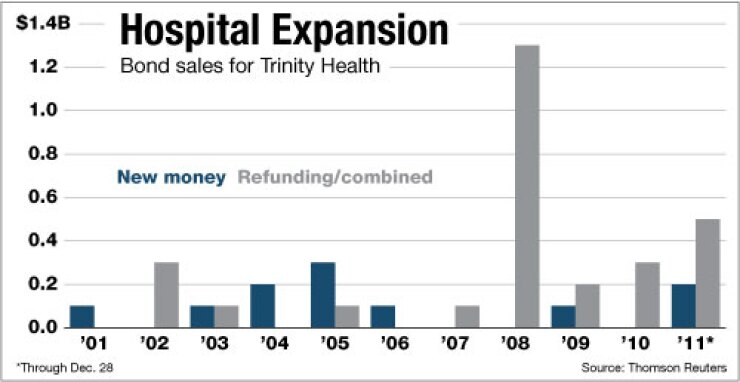

Trinity operates 48 hospitals in 10 states. It has $3.1 billion of outstanding debt and reported more than $7.4 billion in unrestricted revenue in fiscal 2011. Standard & Poor’s, Fitch Ratings, and Moody’s Investors Service each rate Trinity double-A with stable outlooks.

The merger would give Trinity an added foothold in the Chicago-area market. Mercy operates a 479-bed hospital on Chicago’s south side and 11 clinics throughout the area.

The system carries a below-investment grade rating due to its long struggles, though it has seen recent improvement in operating performance. It generated $248 million in revenue in fiscal 2010.

The merger marks the latest consolidation in the hospital sector. The Midwest alone has seen five mergers in the last year, including Ascension Health of St. Louis, the nation’s largest nonprofit system, which is in talks with Alexian Brothers Health System of suburban Chicago.