The tax bill on the verge of passing Congress and the specter of federal budget cuts cloud an otherwise stable fiscal outlook for New York City, according to the watchdog Independent Budget Office.

“While specific risks from large scale changes in U.S. tax policy are clearer today than they were a year ago much still remains uncertain and this year’s November financial plan remains what could yet again be described as a placeholder pending final enactment of a tax bill and agreement on the federal budget,” IBO said Wednesday in its

That plan put the city’s budget at just under $86 billion for fiscal 2018.

De Blasio has been highly critical of President Trump since he took office last January, and of the tax bill in particular.

“Now is the time to get even louder,” said the mayor, re-elected to a second and final four-year term in November.

The economic and revenue forecasts in the November plan are little changed from the budget the city adopted in June, said IBO, which cited continued slow growth in the local economy and tax revenues.

“The updated financial plan has lowered the current year business income tax forecast in response to a modest decline in collections so far this year, but otherwise left the de Blasio administration’s tax revenue forecast unchanged,” said the report. “With major changes to the federal tax code imminent, many of these forecasts will certainly need to be re-evaluated in the near future.”

In a separate

“From tech to healthcare, from education to the arts, industries that support working New Yorkers matter,” said Stringer. “We have to keep diversifying so that we aren’t too reliant either on Wall Street or jobs that would be susceptible to being lost in the event of a downturn. But we have to embrace a thoughtful approach.”

His “New York City’s Economy Has Become More Diverse: So What?” report was issued as the city approaches the 10th anniversary of the recession.

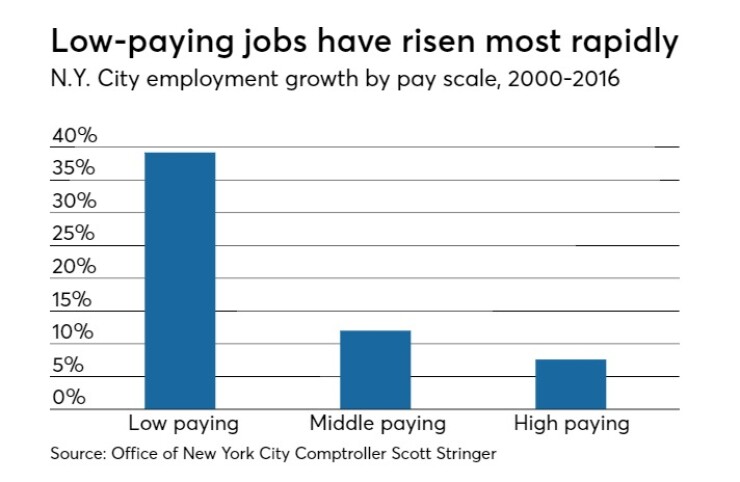

Stringer said that between 2000 and 2016, New York City’s economy has become “modestly more diversified.” Since the 2008 recession, he said, the number of jobs in the city has risen by 15.8%, while the number of jobs on Wall Street has fallen by 5%.

Despite the increase in economic diversification, he added, the city still trails many other major metro areas — ranking 22nd among the 30 largest metropolitan areas, including Cleveland; Phoenix; Pittsburgh; Orlando, Fla.; Charlotte, N.C.; and Kansas City, Mo., all of which have significantly smaller economies.

For the first time since taking office, de Blasio’s financial plan does not count on using a surplus in the current fiscal year to reduce the following year’s budget gap. As a result, said IBO, his stated gap—$3.2 billion—for the upcoming fiscal year is larger in absolute terms and as a percentage of planned city spending.

“In prior years, the de Blasio administration had initiated citywide savings programs that created enough additional resources to create surpluses in the November plan,” said IBO. “The savings program issued as part of the November plan is relatively modest compared with prior years.”

The current savings program provides $234 million of additional resources in the current year and $238 million in the next. Nearly 70% of this saving is the result of reductions in planned debt service expenses and fringe benefit adjustments resulting from a smaller-than-estimated city workforce, according to IBO.

The president’s budget proposal before Congress would reduce federal funding of critical services at many city agencies, notably Housing Preservation and Development and the New York City Housing Authority.

In addition, said IBO, the elimination of funding for the Community Development Block Grant program would cut funding to more than 20 agencies that provide a wide variety of services in low-income neighborhoods citywide.

The city’s Health + Hospitals unit stands to lose hundreds of millions of dollars of operating funds under President Trump’s budget proposals.

“Already struggling to stay economically viable, a loss of such magnitude could permanently cripple the city’s public hospitals,” said IBO.

Based on IBO’s re-estimates, de Blasio’s plan overstates city-funded expenses in four major areas: debt service, health insurance, public assistance and sanitation. While de Blasio reduced its forecast for 2018 debt service costs by $38 million in the November plan, IBO estimated that his administration still overstated debt-service costs in the current year by $99 million.

Although the Mayor’s Office of Management and Budget’s 2018 variable rate bond interest assumptions are at 3.44% for tax-exempt bonds and 6.0% for taxable bonds, these rates remain well above current levels.