A new generation of muni market rising stars is eager to help finance U.S. infrastructure through hard work and innovation as the market adapts to a tax code that eliminated advance refundings and a renewed regulatory push for transparency.

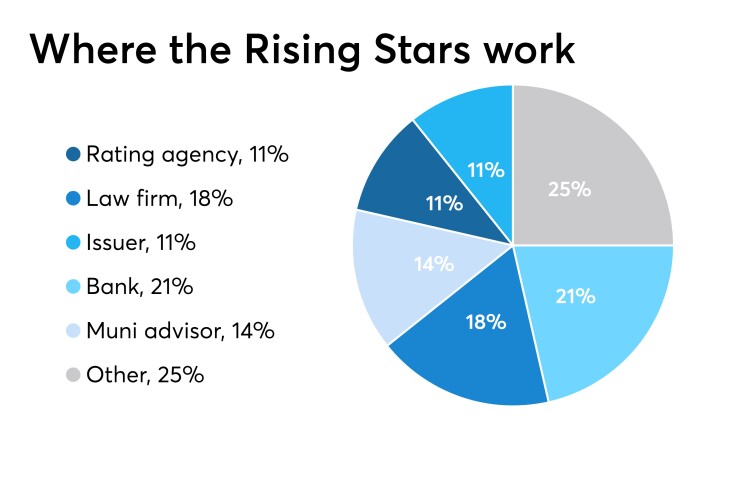

The 28 members of The Bond Buyer's 2019 class of Rising Stars are ready to take on the challenges of the contemporary muni market with technology, entrepreneurial zeal, and a spirit of genuine appreciation for everything at stake in their work. They are investment bankers underwriting transactions that transform communities, and they are issuer officials trying their best to serve those communities. They are municipal advisors, bond lawyers, and credit analysts working coast to coast.

Their journeys, in many cases, have been winding paths. But these under-40 professionals have found a home in a market that benefits from their talents.

“I was fortunate to begin my work in a public diplomacy role,” said Jamie Brooke Forseth, a partner and head of credit research at Whitehaven Asset Management in New York. She worked for the U.S. ambassador to Finland, Forseth said, but became interested in the capital markets while in business graduate school at Yale.

“I think what attracted me to munis in particular was my background in politics and policy,” she said.

Forseth said the industry is experiencing a change in how analysts think about municipal credits in the wake of major municipal bankruptcies in Detroit and Puerto Rico, taking a more holistic view in their analysis. She has a broad mandate at Whitehaven, which she said allows her to challenge herself and her abilities as an analyst.

“It’s an opportunity to have an entrepreneurial hat,” Forseth said. “It constantly challenges me and keeps me on my toes.”

Elizabeth Andreev, a director at UBS Securities, described her route into municipals as “circuitous.” Andreev, 36, was working with mortgage-backed securities at the beginning of her career, but found a new path in munis after the Subprime Mortgage Crisis.

“It’s fascinating that one day I could be working on a financing for a minor league ballpark, and the next day we’re switching gears and working on a port,” Andreev said.

Andreev said that one of the biggest changes she has seen in her career has been with respect to the information available to investors. With the launch of the Municipal Securities Rulemaking Board’s EMMA website in 2009 and a number of improvements since, as well as regulatory changes and the proliferation of third-party data providers, muni bond investors have access to more information now than at any time before.

“One of the most important innovations we’ve seen is on the transparency front,” Andreev said, pointing particularly to the emergence of new yield curves. “That’s very important to buyers.”

Tozar Gandhi, 37, an associate director at IHS Markit, said he began his career with little knowledge about the municipal market but is now trying to be innovative in the high-yield space. Gandhi heads the firm’s high-yield team, dealing heavily in Puerto Rico and healthcare credits.

“There is much more detail coming in the muni space, especially in evaluating high-yield credits,” Gandhi said.

Gandhi said his team uses software to gather data from financial statements, making work that was traditionally labor-intensive for an individual more efficient.

“What we have been doing over the past couple of years is leveraging technology to make the process faster and better,” he said.

Dan Noonan, 36, a vice president and manager of the muni underwriting desk at Fidelity Capital Markets, said he enjoys the fact that his work also does good for communities. But Noonan also said he believes that the process for coming to market in the municipal space is “inefficient,” and that technology can play a role in determining the best use of capital.

“I think there’s a lot that can be done in terms of the efficiency in which we come to market,” he said.

Andre Ayala, 36, a director at Hilltop Securities in Dallas, began his career at a boutique firm that had a European infrastructure business. That provided him some of his initial exposure to the type of work done in the muni market, and he now spends most of his work week providing issuers the benefit of his knowledge as a municipal advisor.

Ayala said there is innovation going on in the muni market, and more that needs to happen as well. He pointed to his own firm’s work on municipal utility districts (MUDs) in Texas, which are political subdivisions approved by the Texas Commission of Environmental Quality and provide certain utility services within their boundaries. Ayala said his firm was able to improve the borrowing power of a MUD by getting the Texas Attorney General’s office to approve the monetizing of future revenues, rather than only the proven flow of money.

“Over time, we have been perfecting that model,” Ayala said.

Swap Financial’s Peter Clerc, 33, is on the cutting edge of the municipal swaps and derivatives market. He acknowledged that swaps are still dealing with some “overhang” from deals that went bad over the last decade and left many issuers wishing they could get out of them.

“I think we’re, just in the last couple of years, starting to see new types of swap transactions that the industry wrote off,” Clerc said, explaining that issuers turn to derivatives to hedge out risk. But issuers now want an embedded cancellation option in many deals, Clerc said, which are essentially analogous to call options in more traditional financings.

Clerc said he also thinks swaps will have a role to play as issuers seek to find a replacement for advance refunding, which under the tax code that took effect in 2018 cannot be done on a tax-exempt basis.

No one can be sure what the next challenges and opportunities facing the muni market will be. Fluctuations in the economy, regulatory shifts, and other changes are sure to keep market participants on their toes. But whatever those challenges and opportunities may be, the Rising Stars are well-positioned to apply their innovative thinking to ensure that the muni market keeps getting the work of states and localities done.