Public-private partnerships and value-capture transactions can help "make up the resource gap" in transportation infrastructure funding, according to a New York City business leader.

"We have to find some new solutions," Kathryn Wylde, president and chief executive of Partnership for New York, said at Tuesday's annual meeting of the

Corporate leaders have begun to weigh in on how subway, bus and commuter rail breakdowns and delays have affected the tri-state region's economy. Questions linger about funding for such projects as the proposed Gateway tunnel connecting New York and New Jersey, and a recurring revenue source for the Metropolitan Transportation Authority, the state-run agency that operates subways and buses in the city.

According to Wylde, provisions in President Trump's infrastructure plan and Gov. Andrew Cuomo's proposed fiscal 2019 budget could enable transit agencies to execute P3 projects and real-estate value capture deals through transit improvement districts.

"New York is way behind other world cities and way behind much of the rest of the country in terms of a mechanism," she told the planning organization, which covers New York City, Long Island and the lower Hudson Valley.

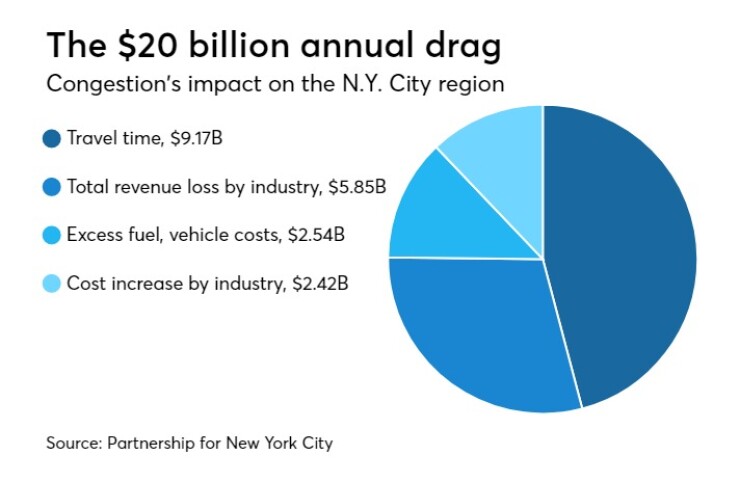

Wylde, whose organization favors congestion pricing, was part of Cuomo's 15-member Fix NYC advisory panel, which advised on solutions to the crisis. A report by the partnership said traffic congestion could cost the region $100 billion over five years.

The council on Tuesday adopted its work program for 2018-19 and named Nassau County Executive Laura Curran as co-chair, succeeding Putnam County Executive MaryEllen Odell. The other co-chair is New York State Acting Transportation Commissioner Paul Karas.

Lawmakers could tweak language in Cuomo's proposal over the next month as they push toward an April 1 budget deadline. Mayor Bill de Blasio opposes the transit district, contending it would illegally force the city to contribute more to the MTA.

"[It was] not crafted to be particularly understandable and is a little provocative, but the concept is really important," said Wylde.

She cited reports that JPMorgan Chase is negotiating to purchase air rights over Grand Central Terminal to build a 70-story skyscraper, using provisions of the new Midtown East rezoning.

"Now here we have $11 billion going into East Side Access underneath Grand Central," said Wylde. "The MTA isn’t even at the table.”

Wylde is wary of proposals to backstop the MTA through more taxes.

"From a business perspective we’re not really ready to say we need more taxes to fund the MTA until we see that we’ve gotten a far better system for project execution," she said,

In addition, said Wylde, this is the wrong time to pitch more taxes, given that New York State stands to lose about $14.3 billion per year because of the loss of the state and local deduction on federal income taxes.

The MTA is one of the largest municipal issuers with roughly $38 billion of debt.

"Whether you talk about fares or about debt, essentially we’re pretty full up in terms of what we can support out of the MTA operating budget for debt and what part is reasonable in terms of fares and tolls," said Wylde.

Business leaders were essential in getting the state legislature to approve the MTA's initial five-year capital plan in the early 1980s. According to Richard Ravitch, the MTA chairman at the time and a former lieutenant governor, foreign corporate ownership makes such engagement a harder sell today.

"That's the challenge to a large degree because not only are people in the business world more international in nature ... [but also] in the 70s, most them owned the premises they occupy,” Ravitch said in a Bond Buyer

Ravitch gave predawn tours of decrepit parts of the subway system, including rail yards, to business leaders including David Rockefeller of Chase and Walter Wriston of Citigroup. They in turn lobbied Republican leaders in Albany for a tax package to backstop the MTA's first capital plan.

"Citibank was an international institution, and Walter Wriston was not a raving liberal. He was rather conservative politically,” said Ravitch. “But he cared deeply about New York City.

"He was tough to deal with, but when push came to shove, he supported the things that were necessary in order to make sure that the infrastructure maintained a level of utility that was necessary to keep the economy going."

Wylde favors New York City executing its own design-build contracts, and preserving some form of an infrastructure development corporation instead of an infrastructure bank.

"I don’t think more debt is the answer and banks aren’t in the business of giving away money. Most other cities, regions or countries have put together development entities that are able to attract equity and attract public financing, but in terms of a public bank, it’s just another way of saying more debt.”