The plunge of the financial markets amid COVID-19 stands to push up pension costs — and budget strain — for New York City.

The question is how severe.

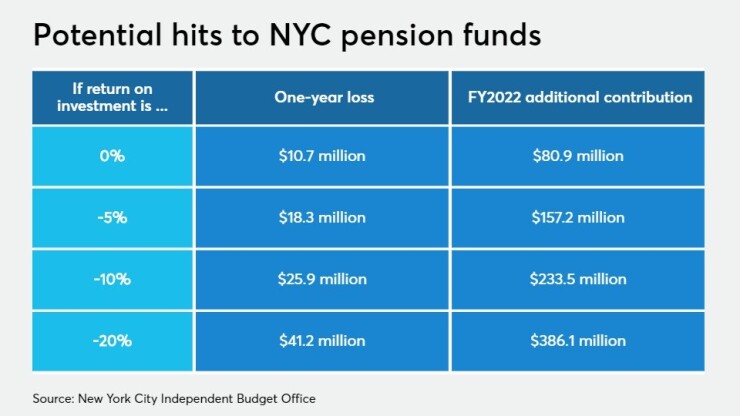

If the stock market decline cuts the overall value of its five pension funds 20%, matching the loss in the 2008 recession loss, it could cost New York about $386 million annually in added pension spending over 15 years, according to the nonpartisan

Nationally, exposure of state and local governments to pension risk is resonating with bond rating agencies.

“Without a dramatic bounceback of investment markets, 2020 pension investment losses will mark a significant turning point where the downside exposure of some state and local governments' credit quality to pension risk comes to fruition because of already heightened liabilities and lower capacity to defer costs,” said Tom Aaron, vice president at Moody’s Investors Service.

At the end of fiscal 2019, the focal point of IBO’s study, the five plans under the New York City Retirement System held $153 billion in assets on behalf of city workers.

Assuming the system met its 7% return-on-assets benchmark in the current fiscal year, the pensions’ assets would add roughly $10.7 billion in value.

“The NYCRS pension portfolios’ diversified investments, a mix of higher-risk equities with more stable assets like U.S. treasuries and highly rated corporate bonds, shelter it from volatility within specific sectors,” said Robert Callahan, IBO’s budget review analyst.

“Although given the unprecedented global economic impact of the current pandemic, losses seem inevitable.”

A 0% return, or $10.7 billion loss, could mean an additional $81 million contribution in fiscal 2022.

“The City of New York provides the largest share of the employer contribution to NYCRS and therefore would feel the greatest impact of the shortfall in pension returns, but other public and semi-public entities including the New York City Housing Authority, NYC Health + Hospitals, and some charter school networks would also be affected,” Callahan said.

The five pension funds are the New York City Employees’ Retirement System; the Teachers’ Retirement System of the City of New York; the New York City Police Pension Fund; the New York City Fire Pension Fund; and the New York City Board of Education Retirement System.

A

Under TRS’ contribution policy, city contributions rise quickly in response to investment shortfalls.

“The trade-off is greater risk to the city budget of sharp contribution increases in short time periods, relative to other commonly used contribution policies,” said the report, by Don Boyd, Gang Chen and Yimeng Yin from the Center for Policy Research at the University at Albany’s Rockefeller College.

“Second, unlike any other public pension plan we are aware of, in addition to the regular retirement benefit TRS members may contribute to a tax-deferred annuity program that offers guaranteed fixed returns backed by the defined benefit pension fund and thus by city taxpayers,” they wrote.

According to Boyd, the tax-deferred annuity stands put in light of the plummeting markets.

“Stock market declines of recent weeks illustrate the potential risk to city taxpayers,” he said.

“If TDA assets fall short of the guarantee by 10% — for example, if TRS were to lose approximately 3% in 2020 — then TRS will have to make up the difference. TDA had approximately $25 billion of assets at the end of 2019, so this would mean a guarantee payment of approximately $2.5 billion, ultimately funded by city taxpayers.”