Connecticut officials have touted positive trends in the capital markets of late, citing actions by S&P Global Ratings and Kroll Bond Rating Agency.

How far the state can carry the momentum may hinge on another Wall Street dynamic: economic growth.

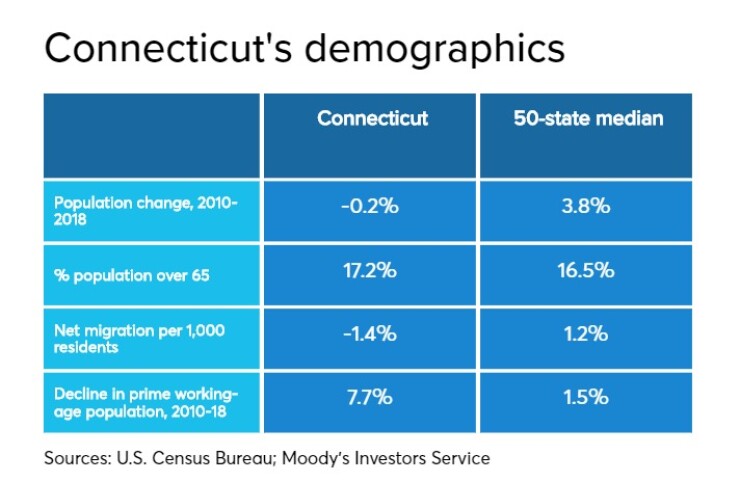

Moody’s Investors Service, in a mixed-grades commentary, said it expects Connecticut’s economy to remain sluggish throughout next economic cycle. Still, said Moody’s, governance changes and the bolstering of its rainy-day fund make the state better prepared for any downturn than in 2007.

“Moody’s gave Connecticut a shout-out, emphasizing the rainy-day fund,” Gov. Ned Lamont said at the Dec. 18 meeting of the State Bond Commission, which he chaired. “But they also gave us some warning. They said you’re one of the states that’s near the bottom of the barrel when it comes to job creation and economic growth.”

A major challenge for Lamont and lawmakers this year will be how to fund transportation improvements. A bond bill that includes the long-divisive matter of highway tolls is before the legislature.

According to Moody’s, Connecticut's economy has lacked momentum in the years since the Great Recession, a sign that little improvement is likely once growth resumes following a downturn or recession.

“Since the 2007-09 financial crisis, the state has suffered from weak job growth with lower-wage jobs accounting for much of the growth,” Moody’s said. “An inefficient transportation infrastructure remains a hindrance. The hobbled economy places the state at a disadvantage when competing with other states for business and residents.”

Connecticut has boosted its reserves, with the state budget office projecting that its rainy day balance will rise to $2.8 billion by the end of fiscal 2020 from just $213 million three years earlier. Moody’s also said the state’s finance sector has become less volatile, reducing the severity of economic swings.

S&P in March revised its outlook on Connecticut’s general obligation bonds to positive from stable, marking the first outlook or rating upgrade in 18 years. Kroll in July elevated its outlook to stable from negative.

“It’s not a cause for celebration, but it is a moment to recognize that there are some things that we’re doing right,” state Treasurer Shawn Wooden said, citing the rainy day fund and a restructuring of the state teachers retirement fund.

The state still has low ratings for a state government: A from S&P, AA-minus from Kroll, A1 from Moody’s and A-plus from Fitch Ratings.

According to Wooden, the state’s nearly $900 million GO sale on Dec. 11 reflects renewed investor confidence. Retail orders received during this period exceeded $511 million, surpassed only by the record $828 million in March.

The December bond sale, led by Citibank and Rice Financial, consisted of two series: $700 million of 2020 Series A bonds to fund state grants and capital improvements statewide. In addition, $194.6 million of 2020 Series B bonds were issued to refund existing bonds to lower interest rates for $12.6 million in savings.

The overall interest cost was 2.57% on the $700 million 20-year Series A, the lowest on a comparable 20-year bond issue since 2016.

Since January 2019, the state has issued $529 million in refunding bonds for $68 million in savings over the life of the bonds, according to Wooden.

Over the past year, he said, all state bond sales have experienced lower pricing spreads. Last month, Connecticut’s GO 20-year bond maturity sold at a 55 basis point spread to the index, with 62 basis points on the March issuance.

They marked the lowest 20-year pricing spreads on a GO sale since August 2015, when Connecticut GOs were at double-A.