The municipal bond market was hit with two deals Wednesday that highlight the rising profile of special obligation offerings in the market.

One day after it offered the Chicago Sales Tax Securitization Corp.’s tax-exempt bond deal to yield-hungry buyers, Goldman Sachs priced the taxable part of the sale on Wednesday. At the same time, Goldman priced the sale of Connecticut’s special tax obligation bonds.

“In general, these special sales tax deals are being looked at cautiously, and I think are not being evaluated based on face value," said one New York trader.

Goldman priced Chicago’s $303.975 million of Series 2018B taxables at par to yield 3.82% in 2048, about 87.5 basis points above the comparable Treasury security of 2047.

The taxables have an expected average life of 27.2 years and are subject to a make-whole call feature.

The trader said that the 2048 maturity yield is about 87 basis points above the comparable treasury and 25 BPs above the taxable AAA muni 30-year yield. The exempt piece that priced yesterday, saw wider spreads than its first sale in December.

On Tuesday, Goldman priced the corporation’s $376.275 million of Series 2018A tax-exempt bonds. The tax-exempts drew 42 investors, was two times oversubscribed, and generated present value savings of 6.3%. The bonds refunded city GOs.

“Despite a changing market environment and ratios, these refunding bonds priced approximately 275 basis points tighter than similar maturities on the city’s most recent general obligation pricing just last year, demonstrating the strength of this credit and ability to achieve significant debt service savings on behalf of taxpayers,” Chicago’s chief financial officer Carole Brown said in a statement late Tuesday.

The city listed spreads on the December tax-exempt securitization at 26 basis points to 39 basis points on maturities from 2020 to 2030 and lists the spreads on the Tuesday sale at 52 basis points to 61 basis points on the maturities from 2031 to 2048 with 5% coupons, and 96 basis points on a 2048 tranche with a 4% coupon. All compare favorably to 329 basis point to 338 basis point spreads on 12-year to 17-year maturities in a 2017 GO sale.

Brown said while spreads widened, she disagreed with the calculation that the spread had doubled on Tuesday’s 2031 tax-exempt maturity from the 2030 maturity in the December deal. The city lists the spread on the December deal at a 39 basis points spread based on where the comparable AAA benchmark closed on the day of the pricing. The Bond Buyer calculated the spread at 24 basis points based on the yield at which the market closed the previous day. Yields saw a big drop throughout the day of the December pricing. The yield on Tuesday’s 2031 maturity was more than 40 basis points higher than the December 2030 maturity, reflecting the higher prevailing rates in the current market.

Cabrera Capital Markets, Janney, Blaylock Van, Estrada Hinojosa and Siebert Cisneros Shank & Co. were members of the underwriting group.

The deal is rated AA by S&P Global Ratings and AAA by Fitch Ratings and Kroll Bond Rating Agency.

Goldman also priced Connecticut’s $800 million of Series 2018A special tax obligation bonds for transportation infrastructure purposes.

“The Connecticut deal saw good demand,” the trader said. “There is a lot of money for munis 10-years and in, but not many buyers 15-years and out.”

The

The

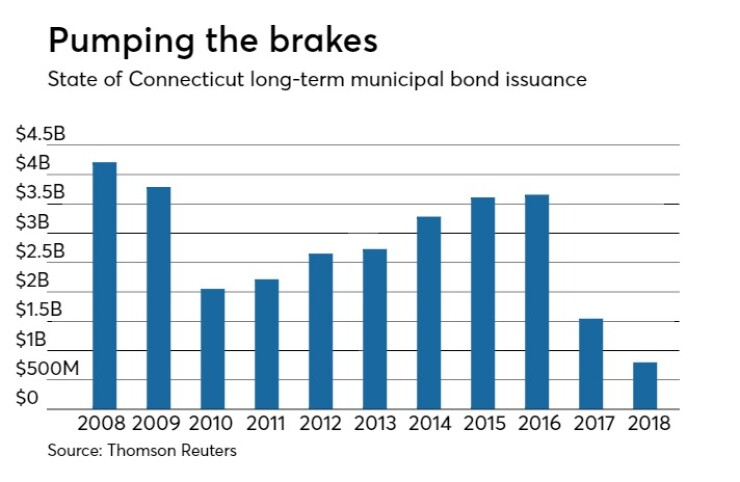

Since 2008, the Constitution State has sold about $30.54 billion of bonds, with the most issuance occurring in 2008 when it sold $4.21 billion and the least amount in that span, prior to this year, in 2017 when it sold $1.54 billion.

Bank of America Merrill Lynch priced the Massachusetts School Building Authority’s $395 million of Series 2018A subordinated dedicated sales tax bonds for institutions after holding a one-day retail order period.

The issue was priced as 5s to yield from 1.25% in 2018 to 2.66% in 2038. A 2043 maturity was priced as 4s to yield 3.43% while a 2048 maturity was priced as 5 1/4s to yield 3.08%.

The deal is rated Aa3 by Moody’s, AA by S&P and AA-plus by Fitch.

BAML also priced the city and county of Honolulu’s $304.785 million of wastewater system revenue bonds for institutions after holding a one-day retail order period.

The $219.265 million of senior Series 2018A first bond resolution bonds were priced to yield from 3.29% with a 3.25% coupon in 2035 to 3.28% with a 4% coupon in 2038. A triple-split 2042 maturity was priced as 3 3/8s to yield 3.45%, as 4s to yield 3.35% and as 5s to yield 3%; a split 2047 maturity was priced as 3 1/4s to yield 3.52% and as 5s to yield 3.07%.

The $34.47 million of senior Series 2018B first bond resolution refunding bonds were priced as 5s to yield from 1.43% in 2018 to 2.05% in 2025.

The $42.015 million of junior Series 2018A taxable second bond resolution refunding bonds were priced at par to yield from 2.20% in 2018 to 3.20% in 2026.

The $9.035 million of junior Series 2018B second bond resolution refunding bonds were priced as 4s to yield from 1.48% in 2018 to 2.10% in 2025.

The senior bonds are rated Aa2 by Moody’s and AA by Fitch and the junior bonds are rated Aa3 by Moody’s and AA-minus by Fitch.

And BAML priced the Regents of the University of Michigan’s $137.055 million of Series 2018A general revenue bonds.

The issue was priced to yield from 1.40% with a 5% coupon in 2019 to 3.14% with a 4% coupon in 2040. A 2043 maturity was priced as 4s to yield 3.18% and a 2048 maturity was priced as 5s to yield 2.91%.

The deal is rated triple-A by Moody’s and S&P.

BANL also priced the Maine Turnpike Authority’s $150 million of Series 2018 turnpike revenue bonds.

The issue was priced to yield from 1.92% with a 5% coupon in 2024 to 3.27% with a 4% coupon in 2042; a 2047 term bond was priced as 5s to yield 3.07%.

The deal is rated Aa3 by Moody’s and AA-minus by S&P and Fitch.

JPMorgan Securities priced the Connecticut Health and Educational Facilities Authority’s $275 million of revenue bonds, a remarketing, for Yale University.

The $125 million of 2003 Series X-2 bonds were priced at par to yield 1.80% in 2037 with a mandatory tender date of 2021.

The $150 million of Series 2010-3 bonds were priced at par to yield 1.80% in 2049 with a mandatory tender date of 2021.

The deal is rated triple-A by Moody’s Investors Service and S&P.

In the competitive arena on Wednesday, the Kershaw County School District, S.C., sold $129 million of Series 2018A general obligation bonds.

JPMorgan won the bonds with a true interest cost of 2.7629%. The issue was priced to yield from 1.42% with a 5% coupon in 2019 to 2.97% with a 4% coupon in 2033.

The deal is insured by the South Carolina school district credit enhancement program and rated Aa1 by Moody’s and AA by S&P.

Secondary market

The MBIS municipal non-callable 5% GO benchmark scale was weaker in late trading.

The 10-year muni benchmark yield rose to 2.427% on Wednesday from the final read of 2.393% on Tuesday, according to

The MBIS benchmark index is updated hourly on the

Top-rated municipal bonds finished weaker on Wednesday. The yield on the 10-year benchmark muni general obligation rose five basis points to 2.20% from 2.15% on Tuesday, while the 30-year GO yield gained five basis points to 2.78% from 2.73%, according to the final read of MMD’s triple-A scale.

U.S. Treasuries were also weaker in late activity. The yield on the two-year Treasury rose to 2.08% on Wednesday from 2.06% on Tuesday, the 10-year Treasury yield gained to 2.65% from 2.62% and the yield on the 30-year Treasury increased to 2.93% from 2.90%.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 81.9% compared with 81.9% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 94.0% versus 94.0%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 46,441 trades on Tuesday on volume of $11.94 billion.

California, Texas, and New York were the three states with the most trades on Tuesday, with the Golden State taking 12.863% of the market, the Lone Star State taking 10.652% and the Empire State taking 8.939%.

Treasury sells 2-year FRNs, 5-year notes

The Treasury Department Wednesday auctioned $15 billion of two-year floating rate notes with a high discount margin of zero, at a zero spread, a price of par. The bid-to-cover ratio was 3.38. Tenders at the high margin were allotted 97.36%.

The median discount margin was negative 0.010%. The low discount margin was negative 0.035%. The index determination date is Jan. 22 and the index determination rate is 1.430%.

Treasury also auctioned $34 billion of five-year notes, with a 2 3/8% coupon, a 2.434% high yield, a price of 99.723821. The bid-to-cover ratio was 2.48. Tenders at the high yield were allotted 53.03%. All competitive tenders at lower yields were accepted in full. The median yield was 2.390%. The low yield was 2.328%.

How the marketing of munis will change

Munis have changed a tremendous amount in the past five years, but the evolution is not complete, with more to come, a strategist says.

"We are moving towards the democratization of information, although we are not all the way yet,” Stephen Winterstein, managing director of research & chief strategist at Wilmington Trust Investment Advisors, Inc., said. “Munis lends itself more to a retail environment, going through evolution and it is going to involve a complete restructuring about how bonds come to market.”

Winterstein spoke at the TAAB fixed income 2018 evolutionary tipping point conference panel discussion about municipals, in New York Tuesday. This was the first time that the event featured a panel about municipals.

The municipal market and fixed income in general have started to join the

“In last five years so, we have seen the brokers-brokers come directly to the buy side, with no middle or third party facilitator,” he said. “The benefits between the two differ, depending on market conditions. In an illiquid market, it is nice to go through the old school, more disclosed, route for example.”

— Yvette Shields and Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.