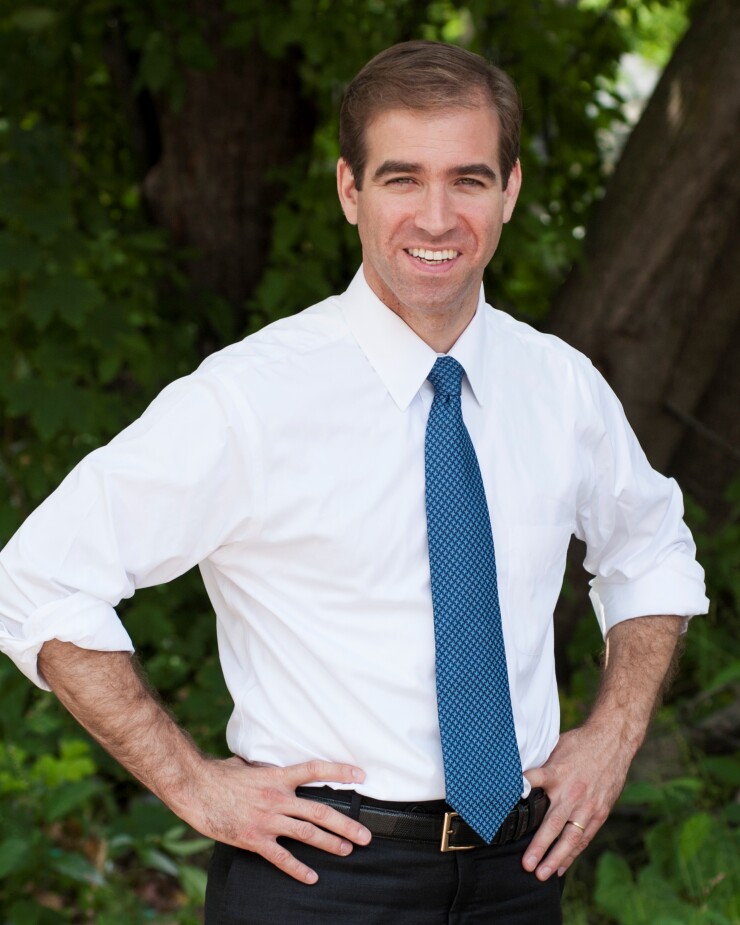

Connecticut capital Hartford expects to go broke and file for Chapter 9 bankruptcy within 60 days if state leaders cannot agree on a full budget, Mayor Luke Bronin said Thursday afternoon.

"If the state fails to enact on a budget and continues to operate under the governor's current executive order, the city of Hartford will be unable to meet its financial obligations," Bronin said in a

Bronin, whose office has hired Greenberg Traurig LLP to explore restructuring, presented state leaders three options, one of which includes bringing bondholders to the table. Both S&P Global Ratings and Moody's Investors Service rate the city's bonds junk.

City Treasurer Adam Cloud and Court of Common Council President Thomas Clarke co-signed the letter.

Connecticut has operated under Malloy's executive orders since July 1 while the state legislature is still working out a biennial budget for fiscal 2018 and 2019. Malloy expects to present a new compromise budget on Friday.

Under Malloy’s most recent executive order, state aid for 123,000-population Hartford is down to $213 million from the $275 million it received last year.

The city is staring at a nearly $50 million deficit for fiscal 2018 and projects a roughly $83 million shortfall for FY2023.

According to Bronin, one option would give Hartford "just enough additional assistance" to avoid short-term liquidity problems without the structural overhaul and the necessary investment to reinvigorate the city.

"This might be the path of least resistance, but it's also the path that leads to a less competitive Connecticut," said Bronin.

Failure to adopt a budget or writing off Hartford as a lost cause would force a bankruptcy filing, the mayor said. A third option, he said, would be a "farsighted, collaborative approach."

That includes reimbursing the city for its disproportionate share of non-taxable property -- or about half of overall property; enable relief for the city in labor contracts; and forcing bondholders and other stakeholders to the table.

Malloy has said he would favor a joint effort for the city to sidestep Chapter 9. "They have to do something. We have to do something," he said at the Municipal Forum of New York in July.

Debt-service payments are on the rise, thanks to pushed-out refundings now due. The city had a $3.8 million payment in September and another one of $26.9 million, including tax anticipation notes, due next month. Debt service is projected at $44 million and $57 million in fiscal 2018 and 2019, respectively.

In addition, Hartford realized $16.5 million in labor concessions in FY17 but only $4 million the following year.

Connecticut has its own problems. The state faces a biennial revenue gap of up to $5 billion and bond rating agencies have hit it with six downgrades over the last 18 months.