BRADENTON, Fla. – A bankruptcy court judge has approved a purchase price for a Georgia hospital system that was higher than the negotiated stalking-horse bid.

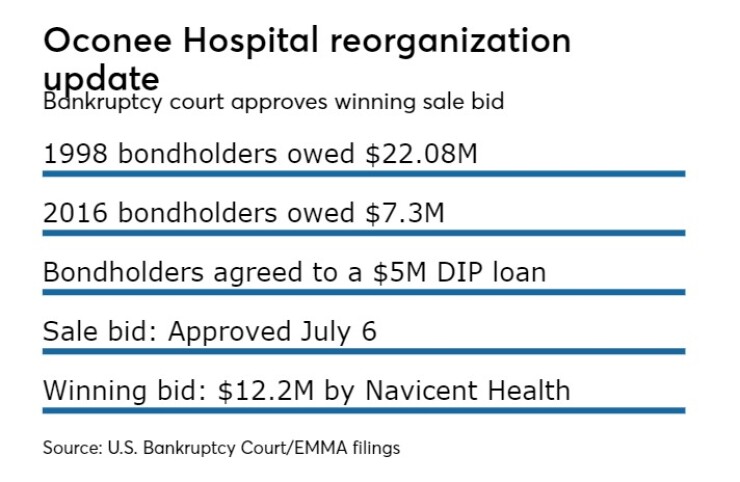

The Oconee Regional Medical Center will be sold for $12.2 million to Navicent Health Inc., a central Georgia health system that had a management services agreement with Oconee in 2014 that included a bond payment guarantee. The management agreement was terminated about a year later.

U.S. Bankruptcy Judge Austin E. Carter approved the sale to Navicent July 6, based largely on the difference in the cash purchase price that had been offered by the $12 million stalking-horse bid negotiated with Prime Healthcare, according to a July 19 notice to bondholders.

“Proceeds from the sale to Navicent Health are not expected to generate funds for payments of principal or interest on the bonds,” the bond trustee, U.S. Bank NA, said on the Municipal Securities Rulemaking Board’s EMMA filing system.

Oconee has about $29.3 million of outstanding debt, according to court documents.

Certain obligations of the hospital and expenses of the bankruptcy proceedings have payment priority over the payment of principal and interest on the bonds.

U.S. Bank said it is too early to project if there will be proceeds other proceeds from the sale of hospital assets that were not included in Navicent’s bid to apply toward the bond debt.

The 140-bed Oconee Regional Medical Center continues to operate in rural Milledgeville after its parent, Oconee Regional Health Systems Inc., filed for Chapter 11 bankruptcy May 10.

Bondholders agreed to provide a $5 million debtor-in-possession loan to the hospital, which is a 501(c)(3) nonprofit, to cover operating expenses as the case proceeds.

The DIP loan was approved on June 12, according to court records.

By agreeing to offer the DIP loan, creditors such as bondholders can limit the extent of their losses, according to bankruptcy attorney Noel Boeke, a partner at Holland & Knight LLP.

“This bankruptcy is playing out just about like other bankruptcy case involving a quick sale,” Boeke said in May. “There’s nothing unusual about any of this.”

By providing the DIP loan, he said bondholders are first in line to be repaid for the loan at the conclusion of the case and are in a better position to control the return on their bonds.

Boeke previously predicted that bondholders could end up receiving as little as 20 cents on the dollar.

Some of the hospital bonds are still trading, according to EMMA.

On July 10, a customer bought $100,000 of bonds maturing in 2028 for about 8 cents on the dollar. No yield amount was listed. The bonds were issued on behalf of Oconee by the Baldwin County Hospital Authority in 1998.