Want unlimited access to top ideas and insights?

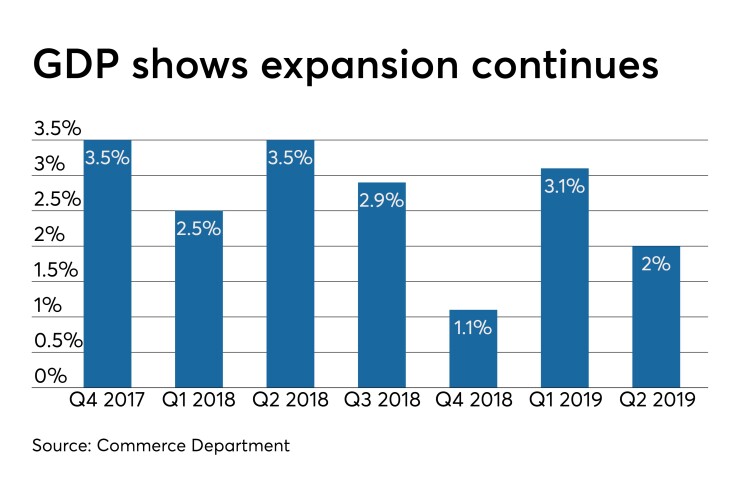

While gross domestic product growth in the second quarter met expectations at 2.0%, business investment was less than previously estimated, according to Commerce Department figures released Thursday.

Commerce reported business investment dropped 1.0% in the quarter, compared with the earlier estimate of a 0.6% decline, as the start of an impeachment inquiry in Congress added to uncertainty in the market.

The Federal Reserve cited weak business spending as a concern when policymakers made two 25 basis point cuts in the Federal Funds target interest rate earlier this year.

Consumers continue to fuel the economy, and consumer spending grew 4.6% in the quarter, its fastest pace since the last three months of 2014. But economists are concerned that the trade war with China, which has lowered consumer confidence levels, will cause a drop in spending.

“The mix of the revisions paint a somewhat weaker picture of structural and residential investment and consumer spending that was offset by upward revisions to government spending,” said Scott Anderson, chief economist, Bank of the West Economics.

"The revisions to various components of the GDP report were modest, but on the margin are consistent with a subdued environment for business investment," said Steven Friedman, managing director of global fixed income for MacKay Shields LLC. "Recent survey indicators suggest that this weakness has extended into the third quarter."

The announcement that the House will begin an impeachment inquiry against President Trump heightened concerns for investors.

“It is too soon to tell whether the House inquiry will reveal any impeachable offense, much less lead Congress to remove the president,” wrote Paul Christopher, head of global market strategy, and Darrell Cronk, president of Wells Fargo Investment Institute in a note. “But we foresee some potential impacts on legislation that could matter to investors.”

While a trade deal would distract the electorate from impeachment news, Christopher and Cronk don’t see that as a likely outcome. Impeachment proceedings could derail a prescription drug pricing deal or an infrastructure bill since lawmakers would be tied up and won't have time to debate these issues.

The markets haven’t reacted much to news of an impeachment inquiry, and Wells Fargo Investment Institute doesn’t expect this “to alter our current investment strategy — yet.” While the bar for impeachment has not been high, it has yet to result in removal of a president. although President Nixon resigned rather than face the prospect of removal.

“More to the point, we believe the economy is likely to keep growing in the coming 12 months, and an economic recession does not seem imminent,” the authors write. “Yet, the increase in risks — especially political risks — has been a significant headwind to markets since May, and we expect additional volatility in the coming weeks and months.”

Jobless claims

Meanwhile, the labor market remains strong, as initial jobless claims rose 3,000 to 213,000 in the week ended Sept. 21, while continued claims slid to 1.65 million in the week ended Sept. 14 from 1.665 million a week earlier, the Labor Department reported Thursday.

Pending home sales

Pending home sales climbed 1.6% in August, after a 2.5% drop in July, the National Association of Realtors said Thursday.

“It is very encouraging that buyers are responding to exceptionally low interest rates,” NAR chief economist Lawrence Yun said. “The notable sales slump in the West region over recent years appears to be over. Rising demand will re-accelerate home price appreciation in the absence of more supply.”

Sales rose in all four regions, with the West posting a 3.1% increase, the Northeast and South each climbing 1.4%, and the Midwest up 0.6%.

While low interest rates will help drive home sales, the 2.0% decline in new home sales year-to-date could be an issue, Yun said. “The hope is that housing starts quickly move into higher gear to meet the higher demand. Moreover, broader economic growth will strengthen from increased housing activity.”

Manufacturing

The Federal Reserve Bank of Kansas City’s September Manufacturing Survey’s composite index, released Thursday, narrowed to negative 2 in September from negative 6 in August.

“Regional factory activity continued to decline in September, though not as much as last month,” said Chad Wilkerson, vice president and economist at the Bank. “Although the employment index dropped further this month, firms as a whole indicated 2019 employment expectations have increased slightly since the beginning of the year.”