The outlook for federal changes to the municipal bond laws remained uncertain Wednesday with the presidential election and partisan control of the U.S. Senate undecided.

The public finance industry would gain from the reinstatement of tax-exempt advance refunding and other muni-friendly measures under a Democratic sweep of the White House and both chambers of Congress.

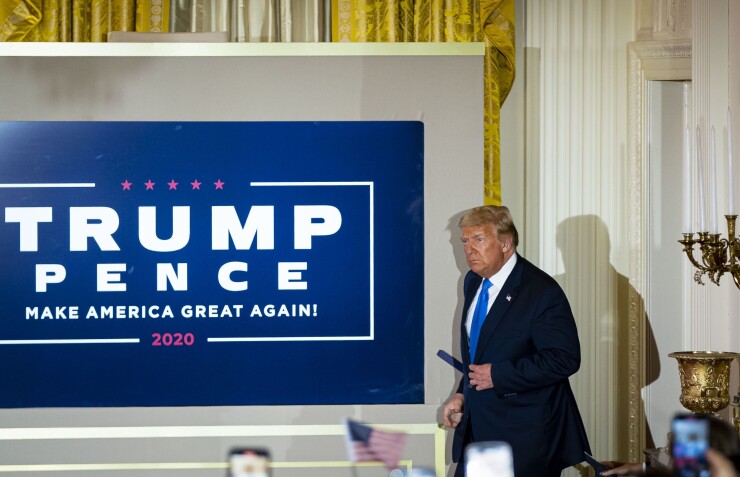

A second term for President Donald Trump and continued Republican control of the Senate would dash most of those hopes.

The outcome of the presidential election remained undecided because no immediate winner was being declared in the three key battleground states of Michigan, Pennsylvania, and Wisconsin, the Associated Press reported.

Neither candidate had cleared the 270 Electoral College votes needed to carry the White House, said the AP, even after declaring President Trump the winner in the crucial state Florida, the largest of the swing states.

Former Vice President Joe Biden, who has other paths to a victory, flipped Arizona, a state that has reliably voted Republican in recent elections.

Trump overnight claimed premature victory from the White House and said he would take the election to the Supreme Court to stop the counting.

Biden, on the other hand, urged patience to his supporters and said the race “ain’t over until every vote is counted, every ballot is counted,” the AP reported.

Democrats need to gain at least three Senate seats and to win the presidency to erase Republican's control of the Republican with a 53-47 majority. Democrats would control a 50-50 Senate if Kamala Harris becomes vice president. Democrats need a four-seat Senate gain under a second Trump term.

The uncertainty over Senate control remained after two Democratic pickups in Arizona and Colorado were offset by a Republican pickup in Alabama.

That’s because no winner was immediately declared in six Senate races involving vulnerable Republican incumbents in the five states of Alaska, Georgia, Maine, Michigan, and North Carolina. The sixth race, also in Georgia, is for an open seat.

One Georgia Senate race is headed for a Jan. 5 runoff because neither GOP Sen. Kelly Loeffler nor Democrat Raphael Warnock, a Black pastor at the church where the Rev. Martin Luther King Jr. preached, received the 50% of the vote needed for victory.

Republican Senate candidates elsewhere held their party’s control in contested races in South Carolina, Iowa, Texas, Kansas, and Montana.

Trump and the Republican-controlled Senate have stood by the 2017 Tax Cuts and Jobs Act as a major achievement during Trump’s first term. The tax bill terminated tax-exempt advance refunding.

If Trump is re-elected, his administration would seek to make permanent expiring provisions of the TCJA and also cut the capital gain tax to 15% from the current 20%.

Achieving either of those goals would be difficult because Democrats are expected to keep majority control of the House.

Biden, on the other hand, has a tax plan that calls for reinstatement of the top individual income tax rate of 39.6% for households earning over $400,000. Municipal bond industry experts predict that change would result in an increase in individual investor demand for tax-exempt bonds.

Biden would presumably support the public finance measures already outlined by House Democrats in their stalled Moving America Forward Act infrastructure plan while President Trump has not weighed in on the specifics.

Speaker Nancy Pelosi said recently that Biden’s Build Back Better infrastructure plan has many elements that are similar to the House’s infrastructure legislation.

Reinstatement of tax-exempt advance refunding, creating a new series of direct-pay bonds, and increased limits for small borrowers to use bank-qualified bonds are among the muni-friendly tax provisions contained in this wide-reaching package of legislation that Senate Republicans have blocked from consideration.