A state agency wants a Florida court to decide who is responsible for setting toll rates on a bridge financed with bonds that have been in default for eight years.

The Florida Department of Transportation filed a

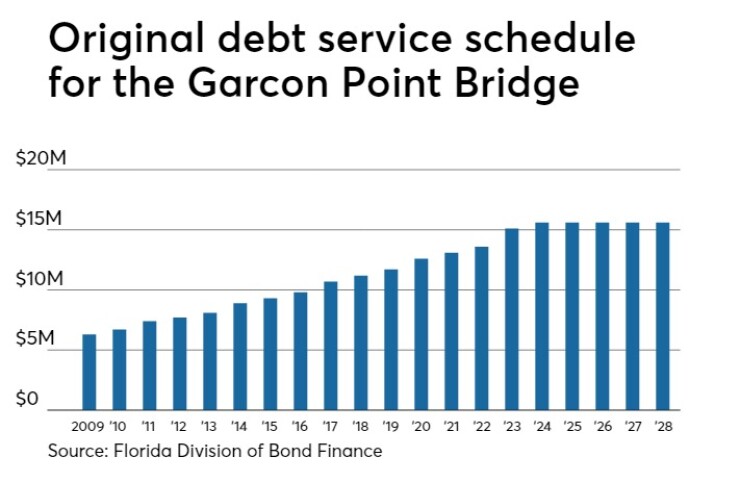

The toll revenue bonds financed the construction of the 3.5-mile, two lane Garcon Point Bridge in northwest Florida. Traffic on the bridge never met projections and toll collections couldn’t keep pace with a back-loaded debt service schedule.

Bridge tolls haven’t been increased since 2011, the same year the authority first defaulted on its bond payments. The board for the authority hasn't met in years after its members quit.

The FDOT has also requested that a judge dismiss the December 2018 lawsuit filed by the bond trustee, UMB Bank NA. UMB contends that the bridge authority, first in line to set toll rates, is defunct and that a lease-purchase agreement now makes FDOT responsible for collecting tolls in accordance with the bond resolution, and conducting traffic studies to determine if tolls should be increased.

“None of the parties are content with the status quo,” FDOT attorneys said in Monday’s filing. “The authority cannot raise tolls because it has no appointed board members.”

The FDOT disputes that it has the responsibility to increase tolls, even though the agency hired a traffic and revenue consultant to study rates.

The state road agency is asking the court to interpret its responsibilities under the 1996 lease-purchase agreement, which requires that FDOT collect bridge tolls and remit the revenues to the trustee. The LPA also requires FDOT to pay for the costs of operating, maintaining, repairing, and insuring the bridge from its own budget until the bonds mature.

“The department seeks a declaration to resolve the uncertainty over whether the LPA requires the department to only establish and collect tolls based on recommendations from traffic consultants hired by the authority, or whether the department can establish and collect tolls based on recommendations of traffic consultants hired by the department,” Monday’s filing said.

UMB, which said its suit against the FDOT was filed at the direction of a majority of bondholders, is asking the judge to order FDOT to raise the tolls and to pay it more than $75 million in damages. The damage amount reflects what UMB said it believes are upward toll adjustments that could have been implemented since the bonds first went into default.

The crux of the issue is that the SRBBA hasn’t had a full board since 2014, when most members resigned in frustration over pressures to raise toll rates as required by bond documents. The lone remaining board member resigned in December 2015.

While the authority’s enabling legislation calls for a seven-member board to oversee toll bridge operations, neither the governor nor the Santa Rosa County Commission have made their three appointments each to the board since the 2014 and 2015 resignations. The seventh board member is the local secretary for the FDOT.

“This motion for summary judgment on the counterclaim aims to seek to resolve the uncertainty of the department’s obligations under the LPA and bond resolution to set tolls,” FDOT’s filing said.

The FDOT said UMB sent it a letter in 2018 saying that the agency was not setting tolls in accordance with the bond resolution, and asking it to retain a traffic consultant to do a study.

Using its “broad-ranging statutory authority” over Florida’s highway system, FDOT said it hired the consulting firm CDM Smith to study toll rates on the Garcon Point Bridge.

In a February report, the firm recommended that tolls be increased for two axle vehicles with transponders to $4.50 from $3.75 on July 1, 2019, and tolls for cash users increase to $5 from $3.75. Currently, there is no differential in rates between those users. CDM Smith also recommended toll rates be increased for other vehicle classes.

While the consultant recommended the new toll rates, it also said the result would “optimize revenue potential while still falling short of full toll rate compliance.”

CDM Smith also recommended reexamining the rates for fiscal 2021 because there are two competing freeways nearby.

In its list of counterclaims, FDOT has asked the court to determine if LPA requires it to hire traffic consultants and establish a new toll schedule; whether setting the new tolls would require the consent of all bondholders; whether CDM Smith’s recommended toll increases can be implemented; and if these actions would impermissibly “limit or alter the rights of the bondholders.”

The suit is pending before Judge John Cooper in Leon County Circuit Court.

The Florida Legislature created the SRBBA as an agency of the state in 1984 to finance and build the Santa Rosa Bay Bridge System to create a regional transportation loop connecting Interstate 10, US-98, and I-110 to reduce travel time between Northern Santa Rosa County and Navarre, Gulf Breeze, and Pensacola Beach.

The Garcon Point Bridge opened in 1999, after the bridge authority issued $75.5 million of fixed rate, current-interest bonds and $19.5 million of capital appreciation bonds to finance its construction. Toll collections never met consultants’ projections and when reserves were exhausted the debt went into default.

Under the lease-purchase agreement, FDOT said it was owed $25.3 million for operations and maintenance costs as of June 30, 2017, and that it expected to incur another $16.2 million of costs through 2028. The reimbursement of those expenses is subordinate to the payment of the SRBBA’s bonds.

UMB contended in its lawsuit that the LPA requires FDOT to “establish and collect tolls” if the bridge authority is not setting tolls in accordance with the rate covenant and the bond resolution.

“This was an intentionally-created backup mechanism…to protect the bondholders in the event the authority failed for any reason to discharge its obligations,” UMB’s suit said. “This was another material inducement offered by the legislature and the authority — including the ‘step-in’ contractual obligation of FDOT to set tolls — upon which the bondholders relied in purchasing the bonds.”

In a May 14 court filing, the FDOT disagreed with the trustee’s interpretation.

Nothing in the bond resolution or the lease-purchase agreement “expressly authorizes the department to retain a consultant or firm to act as traffic consultants for the purpose of recommending the authority’s schedule of tolls,” FDOT’s filing said.

UMB declined to comment for this story. The trustee said that it only provides information on the Municipal Securities Rulemaking Board’s EMMA filing system.

The last filing on EMMA was March 15, when UMB posted a traffic and revenue report on the bridge provided by FDOT. It said that a little over $680,000 in toll revenue was collected in August 2018.

The trustee accelerated the outstanding bonds on Jan. 1, 2013, declaring all principal immediately payable. The bonds were originally issued with final maturity in 2028 — a 32-year life.

In 2017, the Florida Division of Bond Finance conducted a study requested by the Legislature to determine the feasibility of the state’s Turnpike Enterprise restructuring the bonds and acquiring the bridge.

The study estimated that the debt would not be paid off until 2064, if tolls remained at the same level as they were in fiscal 2017. By then the final bond payment would be “beyond the expected useful life of the bridge.”

The division’s study also discussed the possibility of litigation being filed by the trustee, though at the time a suit had not been filed. “It is not clear whether FDOT would prevail in the event that a lawsuit is filed,” it said.

“If the ongoing default is not addressed in some meaningful fashion, the dispute over toll setting responsibility with the trustee and bondholders will likely degenerate into persistent, time-consuming, and costly litigation,” the study said.

The proposed restructuring of the bonds was rejected by some lawmakers during their 2018 legislative session. While some called it a bailout, the plan suggested by the Division of Bond Finance would have imposed haircuts of between 27% and 45.5% on bondholders.

The Santa Rosa Bay Bridge Authority issued uninsured bonds with underlying ratings of BBB from Fitch Ratings and BBB-minus from S&P Global Ratings. Moody's Investors Service assigned a Baa2 rating in March 1998.

With toll collections underperforming projections and a back-loaded debt service payment schedule, the authority had no funds for operations and hadn’t done an audit since at least 2000. The debt service reserve fund was depleted in March 2012.

Between 2011 and 2013, all three rating agencies downgraded the bonds below investment grade and withdrew their ratings.

ACA Financial Guaranty Corp. insured $19.06 million of bonds in the secondary market.