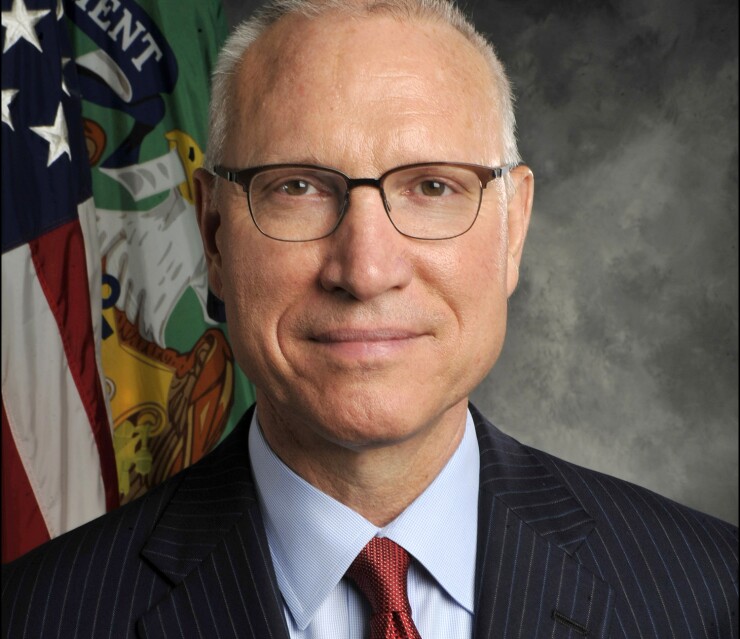

The Federal Reserve has added veteran muni banker and former Treasury official Kent Hiteshew to its staff, beefing up its municipal market expertise as it appears poised to wade into the market in response to the economic effects of COVID-19.

A Fed spokesman confirmed Thursday that Hiteshew had been hired, but declined to elaborate on his role. Hiteshew had recently been working as a strategic advisor at Ernst & Young and as a senior fellow at New York University. From 2014-2017, Hiteshew was the first director of Treasury’s Office of State and Local Finance, serving as Treasury’s point person on Puerto Rico.

Muni market sources welcomed the news of Hiteshew joining the Fed, pointing to his long career in the market and understanding of the financial needs of states and localities. The news comes just as Congress is on the verge of passing legislation that would grant the Fed explicit authority to purchase munis in an effort to stabilize the market that has been hit hard by the economic slowdown resulting from social distancing.

The Fed already began purchasing short-term municipal debt through a program to backstop money market funds, but the bill expected to become law in the coming days encourages Treasury to work with the Fed to provide liquidity to the market for state and municipal securities.

Hiteshew was one of the key people who staffed President Barack Obama’s Build America initiative. He and his team released a Build America report in 2015 with recommendations for financing infrastructure. He was the architect of the idea for qualified public infrastructure bonds (QPIBs), a hybrid between governmental and private activity bonds that could be used for governmentally owned facilities that have long-term leases or concessions with private parties.

During his last two years at Treasury, Hiteshew managed the department’s response to Puerto Rico’s economic, fiscal and debt crisis, engaging in day-to-day crisis management. He played a key role in developing the Obama administration’s four-pronged policy and legislative plan for the commonwealth and in the adoption by Congress of PROMESA, the Puerto Rico Oversight, Management, and Economic Stability Act as well as the creation and support of Its mandated seven-member Oversight Board.

Hiteshew joined Treasury after a 30-year career in public finance on Wall Street. He worked with JPMorgan overseeing public finance for the Northeast region and the firm’s housing finance group. He also worked at the now-defunct Bear, Stearns & Co. for 18 years and earlier at Morgan Stanley and now defunct Drexel Burnham Lambert. He held various positions in New York City at a time when the city was just coming out of its control board era.

It was not immediately clear whether Hiteshew, a New York resident, will resume his previous practice of spending the majority of the week in Washington before returning home each weekend. He will likely not be traveling for at least the next several weeks due to the virus, sources said.