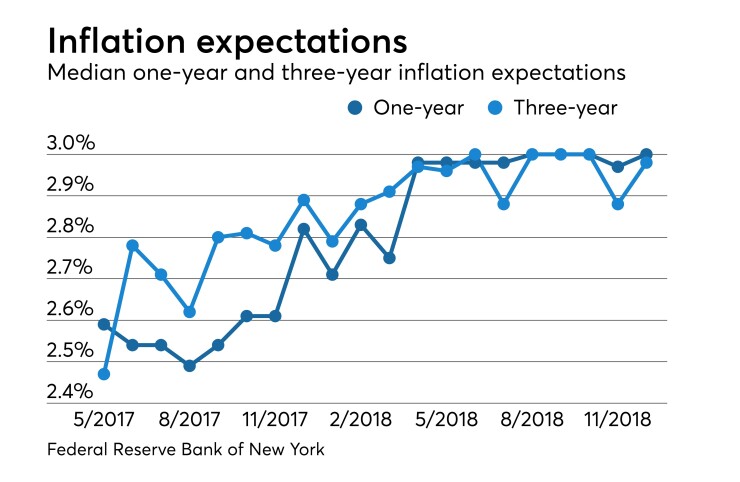

Consumers’ inflation expectations held for the short-term, but ticked up for three years, as respondents expect the unemployment rate to climb, according to the December Survey of Consumer Expectations, released by the Federal Reserve Bank of New York on Monday.

Median inflation expectations remained 3.0% for a one-year period and rose to 3% from 2.9% for a three-year horizon.

“Mean unemployment expectations — or the mean probability that the U.S. unemployment rate will be higher one year from now — increased for the third consecutive month from 35.8% in November to 38.8% in December, reaching the series’ high since October 2016,” according to the survey. “The increase was broad-based across age, education, and income groups.”

The expected earnings growth for one-year grew to 2.5% from 2.0%. Respondents without a college diploma showed the largest gain. The mean perceived probability of losing one’s job in the next 12 months declined to 13.8% from 14.7%, while the mean probability of leaving one’s job voluntarily in the next 12 months fell to 21.1% from 22.8%.

The probability of finding a job, if one lost his/her current job, grew to 58.8% from 58.6%.

Median one-year ahead home prices are expected to grow 3.0%, off from 3.1% last month.

Median household spending expectations held at 3.5%.