Boeing has a big headache. But the Washington state economy remains healthy enough to avoid infection from the airplane maker's woes.

The continuing safety grounding of Boeing's bread-and-butter airliner, the 737 MAX, after two crashes did not stop Moody's Investors Service from

“If you look back 15 years, we were always talking about Boeing, but it is not as significant as it once was,” said Ken Kurtz, a senior vice president with Moody’s Investors Service.

Boeing has continued to run its 737 MAX production line in the Seattle suburb of Renton for the five months the plane has been grounded. There is so far no target date for a return to service after Boeing software was implicated in two crashes that killed 346 people.

The grounding, while a credit negative for the company, has not impacted employment or state tax revenues to date and Moody’s wrote that a prolonged reduction of 737 MAX production, not currently foreseen, should not have a significant impact on the state.

“Washington’s GDP [gross domestic product] growth has led all of the states in the U.S. over the last five years,” said Kurtz, adding that the growth has been driven by the technology sector. The state GDP increased 5.7% in 2018, the highest among the states, and higher than the nation’s 2.9% growth rate, according to a June 6 report from the state’s Economic and Revenue Forecast Council.

“The rating upgrade is a reflection of everything the state has done well in the past, including being a business-friendly state, and the onus is on us to continue that pattern, because it is working for us,” said Washington Treasurer Duane Davidson.

In decades past, troubles at Boeing, which maintains a massive manufacturing presence in the Seattle area, spread quickly through the local economy. But the story has evolved.

Washington is also Microsoft, Amazon, Costco and agriculture such as cherries, apples, hops and wine, said Jason Richter, the state’s deputy treasurer for debt management.

“The biggest thing reflected by the ratings upgrade is the incredible strength of the economy,” Richter said. “The population is also growing, which means there are a lot of infrastructure needs.”

Washington’s population reached 7.5 million in 2019 after growing by 118,000 residents over last year primarily as a result of migration, the state’s Office of Financial Management reported in June. The majority of the growth has occurred in the state’s metro areas including Seattle, Bellevue, Tacoma and Spokane.

The Legislature passed fuel taxes and license fees in 2015 as part of a transportation revenue package to fund significant transportation investments over the next 16 years, according to a January state credit analysis published by S&P Global Ratings.

Washington’s transportation revenue forecast council forecasts total transportation revenues of almost $6.5 billion for the current biennium and about $6.6 billion for the upcoming biennium.

The revenue forecast includes the new revenue from the 2015 transportation package, S&P analysts wrote, which will help support $5.3 billion in authorized and planned GO bond issuance for the total program.

The Legislature approved a $10 billion transportation budget that takes a significant step toward replacing the Interstate 5 Bridge over the Columbia River, which revives a project scrapped in 2013 because of opposition to linking the bridge to the Portland, Oregon, light rail system.

Microsoft also plans to expand its headquarters by 2.5 million square feet, invest $150 million in transportation, and employ as many as 8,000 new employees within the next five to seven years, S&P wrote.

The upgraded rating will help secure lower interest rates as the state issues debt to meet the transportation needs of the growing population, Richter said.

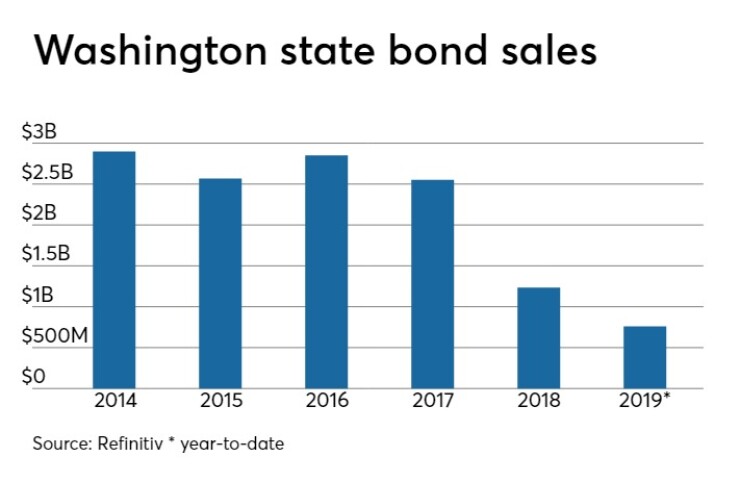

The state has three sales planned for the fall. The first, a $749.9 million competitive sale involving a mix of tax-exempt and taxable general obligation bonds split into three tranches, is slated to price Sept. 10.

The state also has a $144 million tax-exempt GO refunding sale planned for Sept. 26 that will be handled through negotiation. Citi is lead manager with JPMorgan, Morgan Stanley, Siebert Cisneros Shank & Co and UBS as co-managers.

It will also sell $101 million in certificates of participation on Sept. 24 in a competitive deal. Montague DeRose and Associates and Piper Jaffray are the financial advisors for all of the deals and Foster Pepper LLC is bond counsel.

The state has historically favored competitive sales, but Davidson said his office reviews each deal with its finance team before making a determination.

“The tradition here has been to sell bonds competitively, but we don’t take for granted that it’s always the best way,” Davidson said. “We consult with the finance team to determine if that’s the best route. We do put some thought into it.”

A key reason Washington is doing the refundings as a negotiated deal is that the final maturity goes out to 10 years, which appeals to retail investors, Richter said.

“It also helps to share the workload a bit, because we have so many bond sales coming up,” he said.

The 2019-20 biennium marks the state’s first budget cycle following the conclusion of six years of litigation surrounding the state’s education funding, according to S&P.

In June 2018, the Washington Supreme Court found the state government compliant with its McCleary ruling of 2012, which found the state had systematically underfunded its public education system. The ruling led to significantly increased education spending in Washington over several budget cycles. Officials report that state K-12 funding for public schools has increased 67% since the 2011-2013 biennium, according to S&P.

The robust economy has enabled the state to increase reserves even as it began increasing spending to meet the McCleary decision, Kurtz said.

In Moody’s most recent 2019 report on state medians released in July, Washington ranks No. 11 at 3.77% of its net tax-supported debt as a percentage of state gross domestic product.

“In terms of debt alone, they remain above the median, but they are coming down,” Kurtz said. “Our methodology puts more weight on debt and pensions combined, rather than just debt alone, and they look good with the combined numbers,” Kurtz said.

The state pension liability is currently 89% funded, Richter said.

"They continue to issue a lot of debt, but they have a lot of capital needs associated with growth, largely to do with transportation. The population growth is bringing their debt ratio down,” Kurtz said.

The state had increased its focus on debt affordability and voters approved a constitutional amendment tightening the constitutional debt limit to a percentage of revenues, according to a February report from Fitch Ratings, which rates Washington AA-plus with a stable outlook. Washington is one of four states of which 90% of its debt comes from GO sales. The other three are Georgia, Hawaii and Tennessee, according to Moody’s July 19 report on state debt medians.

The state also has healthy reserves at $3.4 billion as of June 30, 2018, which is about 14.3% of revenues, Kurtz said. The state also expects to be about the same by year-end 2019 and just slightly lower in 2020, he said.

S&P, which rates the state AA-plus with a stable outlook, said it considers Washington’s approach to financial management strong.

“Well-established economic and revenue forecasting, and increasingly refined debt management practices and oversight, served the state’s credit quality well during the recession and its aftermath,” S&P analysts wrote.

The state may not be vulnerable to Boeing's troubles, but the trade war with China was mentioned as a concern by both rating analysts and state officials.

“Trade represents a downside economic risk for the state,” Richter said. “A lot of that is trade with China. China is the state’s top trading partner, then Canada. Korea and Japan are third and fourth. Though the state trades a lot with China, we have the other three stable partners that bring stability to our trade operations.”

A sharp falloff in the housing market or sustained weak demand for key state exports, fueled by a strong U.S. dollar, changes in trade policy or slower-than expected growth from China could result in downside pressure on the state’s rating, S&P wrote.

“Washington’s economy could be particularly vulnerable to escalating trade tensions,” S&P analysts wrote in the Jan. 25 report. “The state remains an important gateway for trade with Asia and Canada, and ranks third in the nation in annual export value and first in export value per capita.”

Exports to China have declined for four consecutive quarters, according to a May report from the state’s Economic and Revenue Forecast Council.