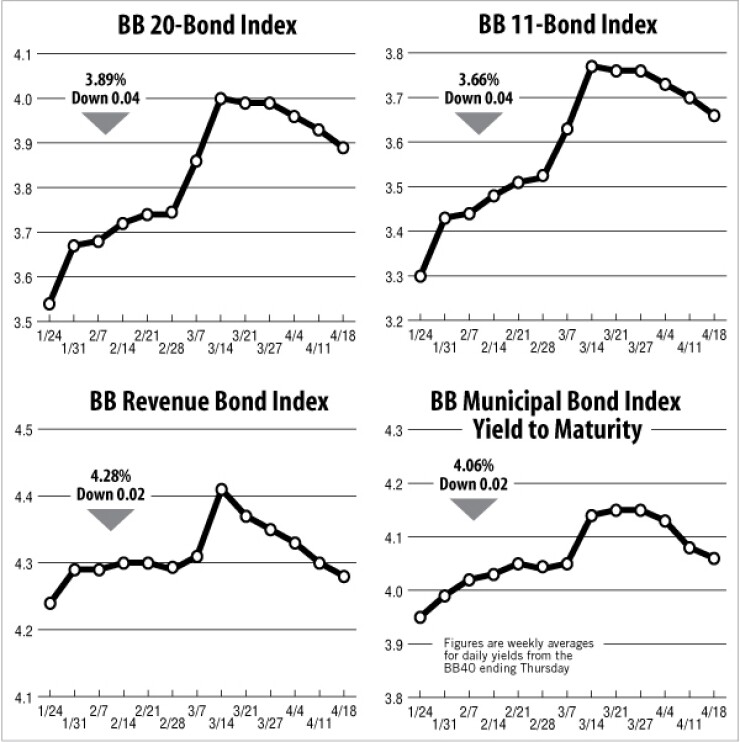

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, declined two basis points this week, to 4.06% for the week ending April 18, 2013. It is the lowest weekly average for the yield to maturity since the week ended March 7, 2013 (six weeks ago), when it was 4.05%.

The 20-Bond GO Index of 20-year general obligation yields declined four basis points this week, to 3.89%. It is at its lowest level since March 7, 2013 (six weeks ago), when it was 3.86%.

The 11-Bond GO Index of higher-grade 20-year GO yields also dropped four basis points this week, to 3.66%, which is its lowest level since March 7, 2013 (six weeks ago), when it was 3.63%.

The Bond Buyer’s Revenue Bond Index, which measures 30-year revenue bond yields, fell two basis points this week, to 4.28%. It is at its lowest level since Jan. 24, 2013 (12 weeks ago), when it was 4.24%.

The yield on the U.S. Treasury’s 10-year note declined 11 basis points this week, to 1.69%, which is its lowest level since Dec. 6, 2012 (19 weeks ago), when it was 1.58%.

The yield on the Treasury’s 30-year bond dropped 13 basis points this week, to 2.87%. It is now at its lowest level since Dec. 6, 2012 (19 weeks ago), when it was 2.77%.