WASHINGTON — Garvee bond ratings are at risk from the increasingly unpredictable budget and policy process in Washington, Standard & Poor’s warned in a report released Friday.

The agency said it retained a stable outlook on all of the Garvees it rates. But in its report, it said, “We believe there are several potential risks that if realized alone or in combination, might cause us to reevaluate the ratings on some or all of our Garvee bonds.”

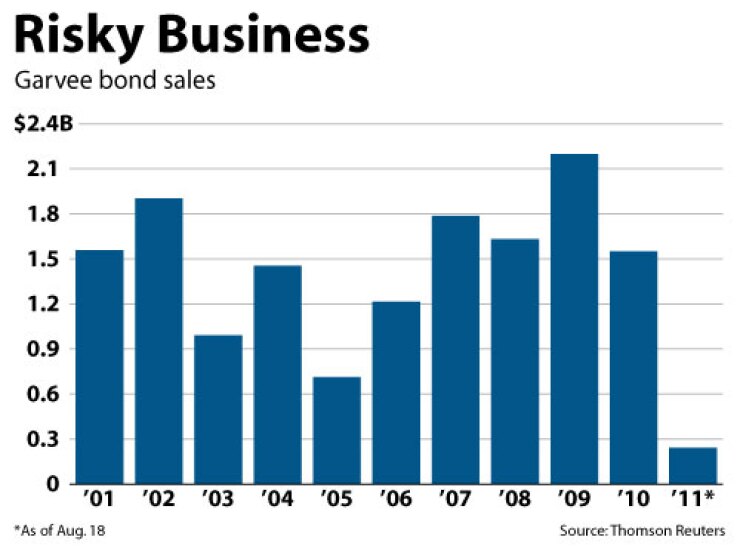

Grant anticipation revenue vehicle bonds are backed with the allotted portion of federal highway funds that each state gets every year, and are used to finance transportation infrastructure. Questions arose last week about whether Standard & Poor’s downgrade of the federal government’s debt would have the domino effect of downgrades to Garvees.

One reason for the report, the agency said, is to make clear “ratings on bonds backed in whole or on part by direct federal payments for state and local highway and transit programs” won’t be automatically downgraded.

“We’re saying, look, we did not take any action in direct correlation to the sovereign,” said Geoffrey Buswick, a managing director in public finance. “We just wanted to highlight the fact that there are three prominent risks that will likely be coming to a head over the next month or two.” The three risks are budget cuts, a delay in extending the gasoline tax, and stalemate over a new transportation bill.

Standard & Poor’s first risk stems from potential deficit reduction legislation.

“We expect that program rules changes, constrained funding sources, and federal budget pressures might lead to lower authorization and appropriation levels for grant programs in the Garvee sector,” the rating agency said. “Any lowering of authorizations and appropriation levels could affect our opinion about what we generally view to be very strong coverage levels for most of our rated Garvee bonds.”

However, Buswick said, “cuts don’t necessarily mean credit actions.” Less money available for grants doesn’t have a uniform effect and analysts would be evaluating each Garvee. “So if there’s a cut to the overall funding — what does it mean looking forward? It’s very hard to determine at this point,” he said.

The second risk in the report “is a delay in extending or in identifying a sustainable, long-term supplement to the diminishing federal gas tax.” Authorization for the 18.4-cent-per-gallon federal tax expires Sept. 30. The gas tax accumulates in the federal Highway Trust Fund.

“Since the HTF is the source of funding for the federal component of Garvee bonds,” Standard & Poor’s said, “any delay or reduction in this funding source could have credit ramifications.”

The third risk is a delay in an extension of, “or an interruption in, adopting a multiyear successor authorization to the Safe, Accountable, Flexible, Efficient Transportation Equity Act: A Legacy for Users (SAFETEA-LU).” That is the last multi-year bill to authorize spending on federal surface transportation programs. It expired in 2009 and the the 20th extension expires Sept. 30.

The new House and Senate bills are drastically different and can’t be reconciled and passed before then. That makes the 21st extension necessary to keep highway programs running.

The concern follows the recent Federal Aviation Administration shutdown and rancorous debt-ceiling debate. “The effectiveness, stability, and predictability of American policymaking and political institutions have weakened,” and highway funding could be similarly affected, according to Standard & Poor’s.

“This is one of the reasons we’re putting this piece out,” Buswick said. “We think there are risks out there, there are many questions, and yet the answers could come in so many different forms.”