WASHINGTON — The District of Columbia’s $11.3 billion fiscal 2013 budget proposal is balanced and its plans to issue nearly $900 million of bonds will not exceed its mandatory 12% debt cap, according to chief financial officer Natwar Gandhi.

The operating budget proposed by Gray would leave the city with a $700 million operating margin, the CFO said.

The proposal would raise the additional revenues needed primarily from increased tax- and traffic-violation enforcement. The increased revenue would offset higher expenditures stemming from inflation, according to Gandhi’s analysis.

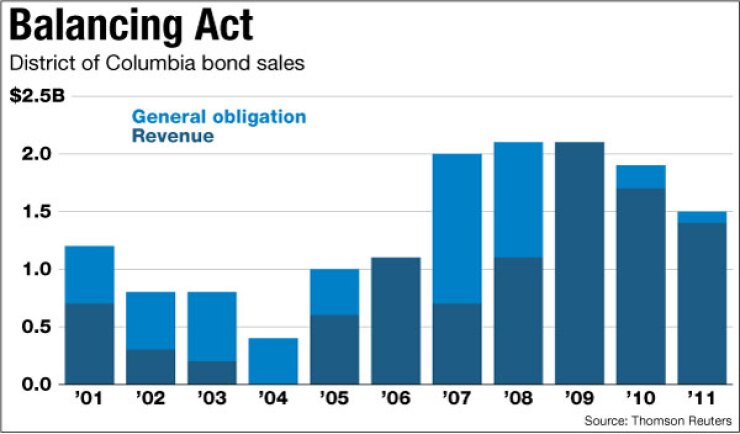

His letter also lays out the district’s debt financing program for fiscal 2013, including nearly $900 million of bonds to pay for infrastructure improvements under the city’s ongoing capital improvements program. The CIP is a 10-year, $3.8 billion effort to upgrade existing facilities and a wide range of infrastructure needs. Earlier this month, the District of Columbia Water and Sewer Authority priced $445 million of tax-exempt bonds to support upgrades to a major wastewater treatment plant, in addition to refunding previously issued debt.

The fiscal 2013 program calls for $816.1 million of new general obligation bonds and income tax-secured bonds, as well as $50 million of grant anticipation revenue bonds backed by allocations from the troubled federal Highway Trust Fund. The district is legally mandated to stay within a 12% debt cap, meaning that outstanding bonds cannot exceed 12% of revenues.

Gandhi concluded that Gray’s proposed budget would meet this requirement, but nevertheless noted the cap can restrict the city’s ability to issue GO and income-tax bonds and stressed the need to make those dollars stretch as far as they can.

“Taken together, these factors place a premium on developing a sound CIP to make the best use of limited resources,” the CFO said in his letter.

The letter makes clear Gandhi concern that pressure on federal lawmakers to reduce national spending, as well as the global downturn, could pose a significant risk to the district’s economic recovery.

“Despite a brightening of economic and fiscal prospects over the past year,” Gandhi wrote, “a high degree of uncertainty marks the future course of both the national and local economies. The possibility of cutbacks in federal spending as part of the legislative requirement to reduce federal deficits now poses the greatest risk to the district’s economic and fiscal outlook. Additionally, financial ripple effects from the ongoing European debt crisis, disruptions to oil supplies from the Middle East, or a downturn in the still-fragile national economy could all derail the nascent district economic recovery.”

The budget must win approval from the District Council, which will spend much of the next two months debating it before a vote June 5, according to the council’s legislative schedule.