The primary municipal market saw fresh paper greeted by bond-craving investors who are looking to put money to work before the new year and new decade begin.

Amid the recent flurry of new issues, this week’s largest deal, $3.38 billion deal of exempt and taxable bonds for the Dormitory Authority of the State of New York came attractively priced to comparable offerings, according to a New York trader.

“A lot of the bonds are cheap to where the secondary market is, and it’s a big loan that had to come at some discounts to get it done,” the trader said.

He added that the structure included a 4% coupon bonds trading cheap to where a recent New York City Transitional Finance Authority deal came — yet tightened from the TFA’s original scale due to the heavy demand.

“I don’t see — at least right now with where Treasuries are and with this being the last big supply of the year — too many challenges to it not doing well,” he said of the DASNY deals.

Its standard structure included a 5% coupon out long — yet the trader said it consisted of $375 million of bonds, which he would be surprised if the deal isn't easily absorbed.

He also noted that the 3% bonds were largely in line with TFA bonds, which were trading at 2.90% Tuesday afternoon during the DASNY retail order period.

The 2044 maturity was trading at a "very attractive" plus 57 to the market, the trader said.

“[This deal] is nothing to sneeze at, but it’s all standard supply and all a reasonable amount of bonds, and with the way the market is right now versus the way the yields are positioning in the pre-sale, I think everyone’s perception is they are pretty attractive."

He added that the deal was lining up in a range before the bonds are priced.

"Overall the deal is entering into a market feeling strong with block buyers eager to find paper ahead of the typical upcoming holiday dry spell in the next two to three weeks," the trader said.

“It seems to be that there’s a predisposition for the market to be longer than shorter, and municipals have performed fairly well,” he said, noting that municipals have outperformed Treasuries in the last three weeks.

He said the market has a perception that municipals will continue to outperform through year end.

“The market will be watching percentages, which are on the tight end of the trading range at 90% in 30 years,” he said. “There is an awful lot of money and flows remain positive."

He added that deals have come and gone and there’s been a decent amount of supply that has been received very well.

“With the Treasury percentages and municipal outperformance — and now all of a sudden there are not too many bonds over the next two weeks — the market will manage to stay strong and stable,” he said. “Municipals will be be fine as long as Treasuries stay in a trading range. Municipals will incrementally perform well.”

Primary market

Morgan Stanley ran the books on the Dormitory Authority of the State of New York’s (Aa1/NR/AA+/NR) $1.986 billion of tax exempt general purpose personal income tax revenue bonds for retail investors on Tuesday.

Morgan Stanley also priced DASNY’s retail order period of (Aa1/NR/AA+/NR) $1.394 billion of 2019F federally taxable PITs.

"I will be surprised if there is not strong interest, given the holiday slowdown in supply, and continuing strong demand from funds etc," said another NYC trader. "I have a feeling they are going to go quickly, in the blink of an eye."

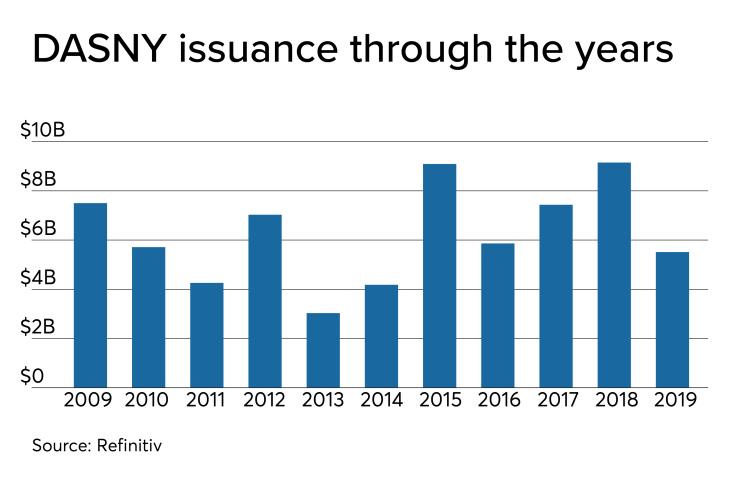

Since 2009 DASNY has sold roughly $72.15 billion of tax exempt bonds, with the highest year of issuance occurring in 2018 with $9.15 billion. The low issuance year was back in 2013 when they sold $3.03 billion.

Bank of America Securities priced the Maine Governmental Facilities Authority’s (Aa3/AA-/ / ) $171 million of lease rental revenue bonds.

Barclays priced the Massachusetts Development Finance Agency’s (Aaa/AAA/NR/NR) $137 million of revenue bonds for MIT.

Secondary market

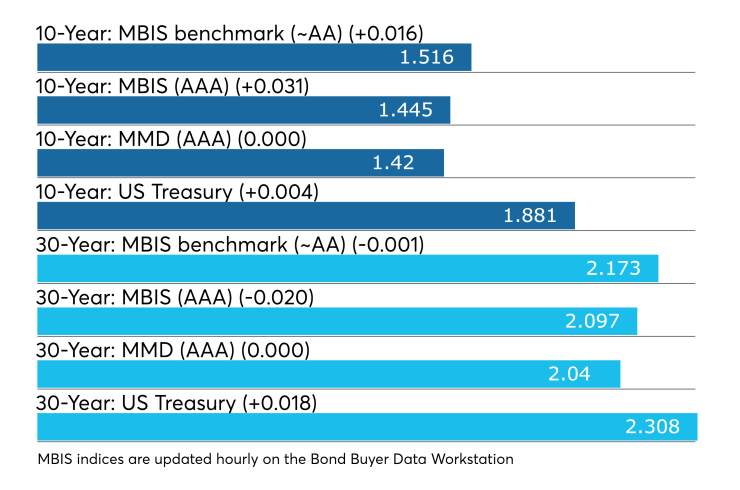

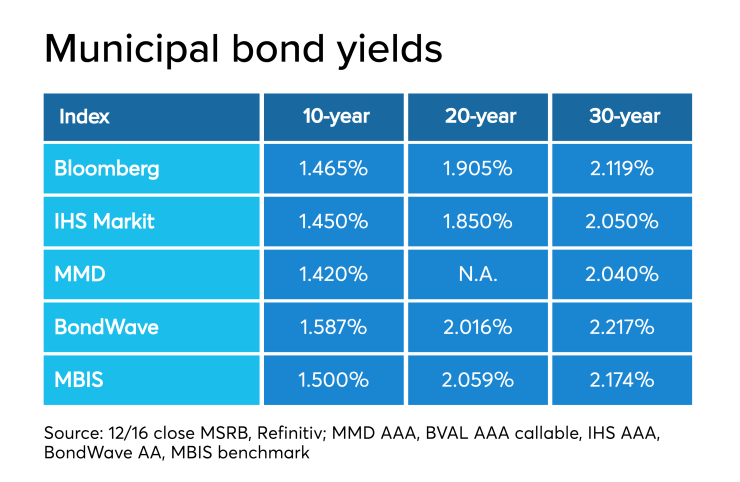

Munis were mixed on the MBIS benchmark scale, with yields rising by no more than two basis points in the 10-year maturity and falling by less than a basis point in the 30-year. High-grades were also mixed, with yields on MBIS AAA scale increasing by three basis points on the 10-year and decreasing by two basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the both 10- and 30-year were steady at 1.42% and 2.04%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 75.2% while the 30-year muni-to-Treasury ratio stood at 88.0%, according to MMD.

Treasuries were on the rise and stocks were in the green.

The Dow Jones Industrial Average was up about 0.11% as the S&P 500 Index rose 0.06% while the Nasdaq gained 0.10%.

The Treasury three-month was yielding 1.546%, the two-year was yielding 1.631%, the five-year was yielding 1.708%, the 10-year was yielding 1.881% and the 30-year was yielding 2.308%.

Previous session's activity

The MSRB reported 33,344 trades Monday on volume of $9.47 billion. The 30-day average trade summary showed on a par amount basis of $11.69 billion that customers bought $6.36 billion, customers sold $3.27 billion and interdealer trades totaled $2.06 billion.

California, Texas and New York were most traded, with the Golden State taking 14.29% of the market, the Lone Star State taking 13.402% and the Empire State taking 12.954%.

The most actively traded security was the City and County of San Francisco Public Utility Commission ’s Series 2019A taxable revenue refunding green bonds, 3.303s of 2039, which traded 18 times on volume of $37.25 million.

Treasury to sell $35B 4-week bills

The Treasury Department said it will sell $35 billion of four-week discount bills Thursday. There are currently $40.010 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.