Although the volume for the primary market will fall toward a more normal level in the coming week, demand isn't expected to waver.

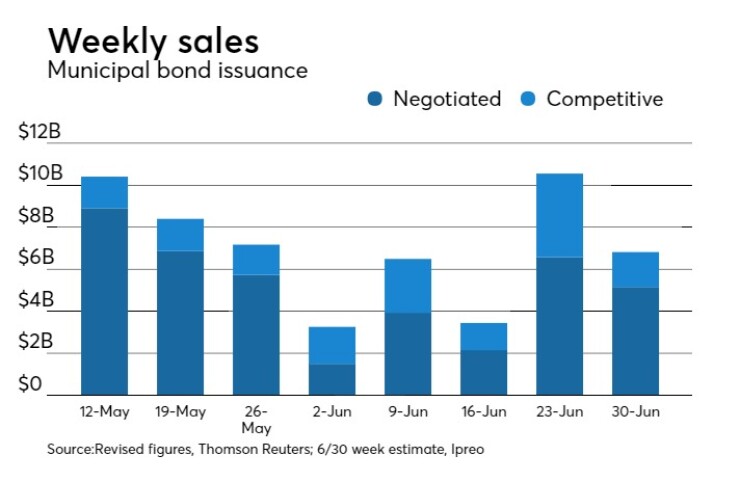

Ipreo estimates volume will drop down to $6.82 billion, after a revised total of $10.59 billion sold in the past week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $5.16 billion of negotiated deals and $1.66 billion of competitive sales.

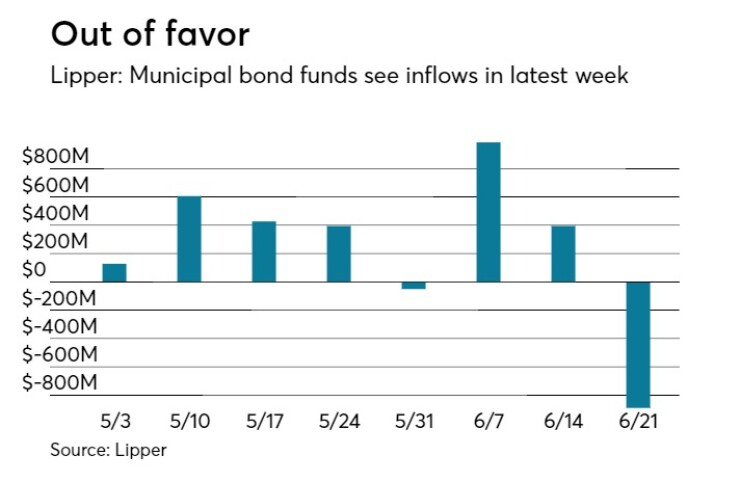

“The [Lipper] outflows we saw this past week are an anomaly; there has been strong demand across the board and I don’t think there will be any lessening of that going forward,” said Jim Grabovac, senior portfolio manager at McDonnell Investment Management. Investors pulled $890.590 million from muni funds in the week ended June 21, the first outflow in three weeks, according to Lipper data released Thursday.

After one of the biggest issuance weeks of the year, volume will get back closer to the weekly average. There are only 10 deals scheduled that are $100 million or larger, with three of those being competitive deals.

“It looks like a typical summer week with moderate volume, but I expect the market to keep doing what it’s been doing,” he said. “I’m expecting the deals to get done easily in this environment.”

Morgan Stanley is expected to price the largest deal of the week, the Dormitory Authority of the State of New York’s $1.72 billion of state personal income tax revenue general purpose bonds on Wednesday, following a one-day retail order period. The deal is rated Aa1 by Moody’s Investors Service and triple-A by S&P Global Ratings.

Citi is scheduled to price the New York Metropolitan Transportation Authority’s $500 million of revenue climate bonds on Thursday, following a one-day retail order period. The certified green bonds are rated A1 by Moody’s and AA-minus by S&P and Fitch Ratings.

Goldman Sachs is slated to price the Department of Water and Power of the City of Los Angeles’ $375 million of power system revenue bonds on Wednesday. The deal is rated Aa2 by Moody’s and AA-minus by S&P and Fitch.

The largest competitive offering will come from the Commonwealth of Virginia Transportation Board, as it will auction off $255.405 million of transportation capital projects revenue bonds on Wednesday. The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Secondary market

Top-shelf municipal bonds finished flat on Friday. The yield on the 10-year benchmark muni general obligation was unchanged from 1.86% on Thursday, while the 30-year GO yield was steady from 2.69%, according to the final read of Municipal Market Data's triple-A scale.

Treasuries were mixed on Friday. The yield on the two-year Treasury was flat from 1.34% on Thursday, the 10-year Treasury yield dipped to 2.14% from 2.15% and the yield on the 30-year Treasury bond decreased to 2.71% from 2.72%.

The 10-year muni to Treasury ratio was calculated at 86.8% on Friday, compared with 86.6% on Thursday, while the 30-year muni to Treasury ratio stood at 99.2% versus 98.9%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 41,782 trades on Thursday on volume of $14.37 billion.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended June 23 were from New York and California issuers, according to

In the GO bond sector, the Los Angeles 5s of 2018 were traded 106 times. In the revenue bond sector, the New York MTA 2s of 2018 were traded 79 times. And in the taxable bond sector, the California Housing Finance Agency 3.656s of 2029 were traded 32 times.

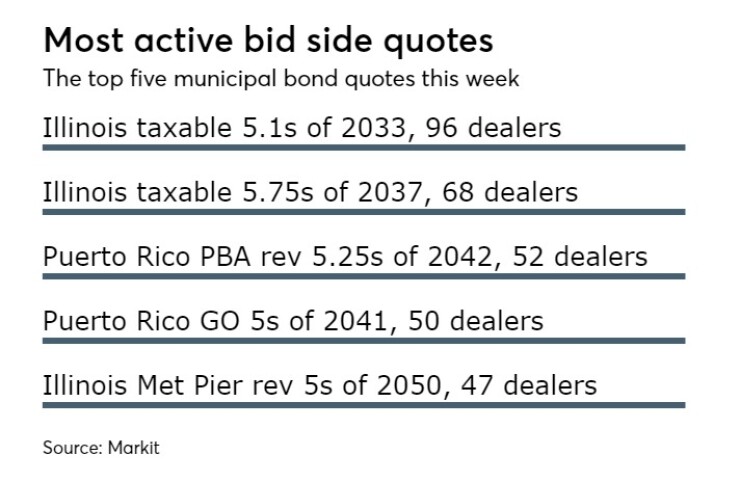

Week's actively quoted issues

Illinois and Florida names were among the most actively quoted bonds in the week ended June 23, according to Markit.

On the bid side, the Illinois taxable 5.1s of 2033 were quoted by 96 unique dealers. On the ask side, the Florida State Board Administration Finance Corp. taxable 2.638s of 2021 were quoted by 108 unique dealers. And among two-sided quotes, the Illinois taxable 6.725s of 2035 were quoted by 28 unique dealers.

Lipper: Muni bond funds see outflows

Investors in municipal bond funds pulled cash out of the funds in the latest week, according to Lipper data.

The weekly reporters saw $890.590 million of outflows in the week ended June 21, after inflows of $394.878 million in the previous week.

The four-week moving average was positive at $109.636 million, after being in the green at $430.908 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had outflows of $1.078 billion in the latest week after inflows of $326.028 million in the previous week. Intermediate-term funds had inflows of $92.321 million after inflows of $70.283 million in the prior week.

National funds had outflows of $904.896 million after inflows of $394.948 million in the previous week. High-yield muni funds reported inflows of $231.470 million in the latest reporting week, after inflows of $235.860 million the previous week.

Exchange traded funds saw inflows of $56.529 million, after inflows of $85.244 million in the previous week.