College football powers are trying to salvage some revenue that supports more than $9.5 billion of debt after several conferences canceled or postponed their fall seasons.

The two largest conferences to cancel last week, the Big Ten and Pac-12, announced the postponement of fall college sports, most prominently football, amid a COVID-19 pandemic that has imperiled enrollment in higher education. The smaller Mid-America, Mountain West and Big Sky conferences also postponed or canceled their fall sports seasons.

The NCAA later canceled its playoffs for fall sports other than Division 1 Bowl Subdivision football, where the championship is decided through a bowl game series largely controlled by the "Power Five" conferences.

But even the Power Five have split over whether to play football in the fall.

The Southeast Conference said Sunday that it would continue its season within the conference only. The Big 12 also plans to continue with the season, with seating capacities to be determined by its members.

With more than $9.5 billion of debt outstanding on major college athletic facilities as of 2018, annual debt service and leases for the 10 largest conferences in Division 1 comes to nearly $1.5 billion, according to the

Moody’s Investors Service called the cancellations a “potential material shock.”

“In some cases, expense management will not be able to fully offset the revenue losses,” said Moody’s analyst Dennis Gephardt. “However, we expect university leadership to provide extraordinary support to continue paying debt service for athletic related facilities, given the strategic importance of sports to universities.”

Debt service has contributed to significant growth in college athletic expenses in recent years, Gephardt said. The fixed costs will affect universities' ability to adjust to the disruption.

“Budget difficulties at athletic departments will add to the financial strains facing universities, including a tuition revenue pinch, reduced state funding and incremental expenses to combat the coronavirus,” Gephardt said. “How the coronavirus spreads will affect universities' willingness and ability to conduct other intercollegiate competition during the 2020-21 academic year, including basketball, which is also a substantial revenue driver.”

The Pac-12's suspension of intercollegiate athletics runs through 2020, which takes out the first two months of the basketball season.

The Big Ten's Ohio State University will lose revenue supporting a $42 million expansion completed in 2019. The renovation is funded by the Department of Athletics using auxiliary funds, debt and private donations. The athletics department, which had about $205 million of debt outstanding in 2018, is completely self-supporting and shares stadium revenue with the university.

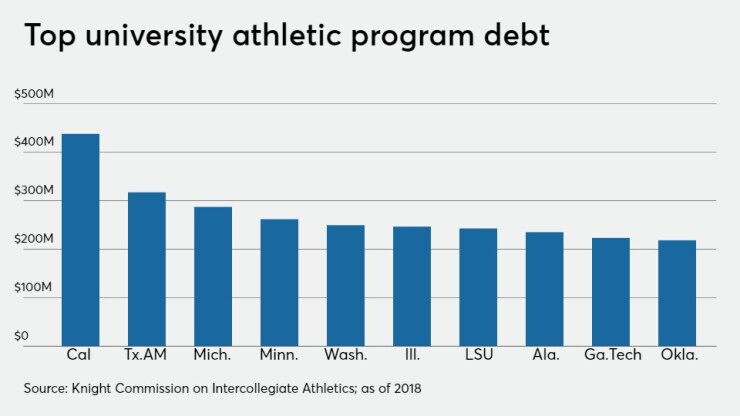

Big Ten rival Michigan spent $226 million on enhancements and expansions that were completed in 2010. Michigan has the third largest volume of outstanding debt at $287 million, behind California Berkeley’s $438 million and Texas A&M’s $317 million, according to the Knight Commission.

Texas A&M, which recently completed a $450 million expansion of its Kyle Field stadium, making it the largest in the Southeast Conference, topped the major colleges in annual athletic debt service at $23 million.

The University of Nebraska was in the process of raising $150 million for a football training facility when the COVID-19 pandemic hit. The financing was to include $50 million of bonds. University officials opposed the Big Ten's decision to call off fall competitions.

Colorado State University backs $239 million of bonds for construction of its on-campus Canvas Stadium with revenue from ticket sales. CSU announced plans to halt its football program earlier this month after reports that the athletic department had concealed the extent of the coronavirus contagion.

Its Mountain West conference

Colorado State also hired an outside law firm to investigate allegations of racist communications.

CSU’s bonds for the stadium that opened in 2017 were supported by $8.1 million in debt payments for 2018-19, according to the university. The pledged revenue grows to $12.2 million in 2021.

CSU expected $16 million or 30% of its $154 million athletic budget to come from the 2020 football season. Most Division I conferences said they are hoping to play traditional fall seasons to spring, but that scenario presents conflicts with other sports and uncertain revenue, along with doubt about whether the pandemic will be any better then than now

“Athletics is more capital intensive than higher education generally,” Gephardt said. “For public higher education overall, the median debt to operating revenue was 58%. For schools competing at the NCAA Division I Football Bowl Subdivision level with debt, the ratio of athletics debt to athletics revenue was 66% in 2018.”

Facilities expenses, including debt service, across Division I public universities drove the greatest dollar increase between 2013 and 2018 with a 54% increase and growth to $2.3 billion in 2018, per the Moody’s report.

“The strategic importance of college sports to universities over the long term will prompt them to deploy financial reserves to close coronavirus-induced athletic budget gaps,” Gephardt said.

“The response is especially resonant among universities with the largest athletic debt exposure," he said. "Given the revenue shocks, many athletic departments will not be able to cover debt service with net revenue from recurring operations, prompting the need to fill the gap from appropriate auxiliary and/or other reserves.”

The Pac-12 is planning to organize up to$1 billion of loans to help its members cope with the lost season, according to the

“I would be leery of investments tied to these loans because there is so much doubt surrounding the future business model of college athletics and the scope and size of the revenue potential of college sports,” Darin White, executive director for Samford University's Center for Sports Analytics, told The Bond Buyer. “One thing is for sure, the financial structure of college athletics will be significantly different than in the past.”

The University of California, Berkeley, a Pac 12 member, backs its stadium bonds with a system pledge, Gephardt said. The revenue streams backing bonds vary from state to state.

“Some of the limited-pledge athletic bonds will fail to meet covenanted debt service coverage requirements from pledged revenues in fiscal 2021, with the university's response determining impact on credit quality,” Gephardt wrote. “Failure to meet debt service coverage covenants may be an event of technical default, and could require use of consultants, but is not a payment default.

“Also, while some of the limited-pledge bonds have debt service reserve funds that could be used to pay debt service, we expect universities will avoid tapping such funds and instead find other ways to support debt service,” Gephardt wrote. “A draw on a debt service reserve fund would likely have negative credit ramifications unless the university took immediate offsetting action to replenish.”

By continuing the season, even with partially filled stadiums, the Southeast and Big 12 conferences would at least preserve broadcast revenue.

Facilities expenses, including debt service, across Division I public universities drove the greatest dollar amount increase between 2013 and 2018 with a 54% increase across the period and growth to $2.3 billion in 2018.

Of Division I public universities, 37% reported expenses greater than revenues, with a median operating deficit of 3%, according to Moody’s.

“The revenue shocks will curb universities' operating performance and compound an already difficult expense environment on many campuses tied to challenges with tuition and auxiliary revenue as well as state funding,” Gephardt said.

“The events of 2020 have created a radically changing business landscape for college athletics that will have implications on the business of college sports for many years to come,” White said. “The college athletic department of the future will be much leaner, run by business savvy athletic directors with strong backgrounds in business strategy rather than coaching success.”

The 65 universities that are part of the Power Five Conferences each has on average about $77 million in annual revenue tied directly to football, White said. If college football is not played during the 2020/2021 academic year, Power Five schools stand to lose more than $5 billion in revenue.

"This represents well over half of the total athletic revenue generated in a typical year," he said. "There will also be major negative economic impact on college towns.”

Moreover, higher education is seeing "the threat to multiple revenue streams, most importantly tuition," Gephardt said.