CHICAGO — The board of Cook County, Ill. Friday approved a $2.9 billion fiscal 2013 budget as the county prepares to enter the market with up to $300 million of refunding bonds by the end of the month.

The county's finance team had planned to price the bonds the week of Nov. 12, but opted to delay it to give the board of commissioners time to approve a final spending plan, according to county Chief Financial Officer Tariq Malhance.

"It doesn't look nice if we issue the POS and within a week there are some budget changes," Malhance said in a telephone interview Thursday.

The transaction is now set for the week of Nov. 26.

The deal is expected to generate more than 10% net present value savings. It will not extend any maturities but will smooth out debt service through 2016, Malhance said.

"We are trying to create some room for new money," he said, adding that the county does not expect to issue new money until the end of 2014.

Cook, which includes Chicago and is the second-largest county in the U.S., has a $700 million capital plan through 2016. Just under $300 million of it will be financed with bonds.

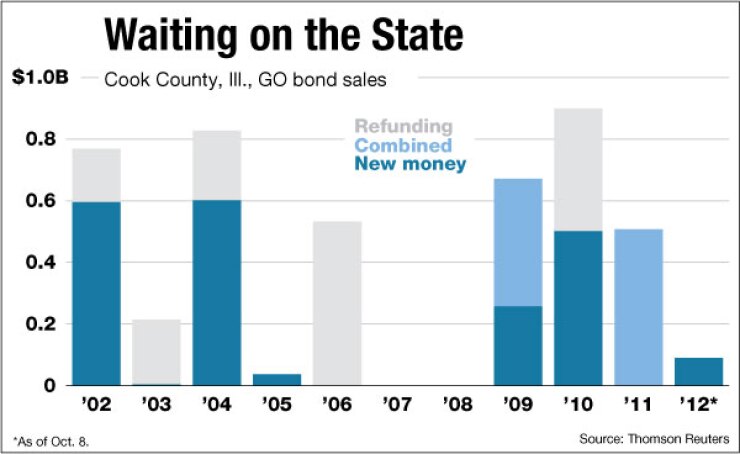

The upcoming deal will refund general obligation bonds originally issued in 2002 and 2004, and possibly 2003. Malhance said the county has the authority to refund up to $500 million, but the deal will likely be $300 million or less. The 2004 bonds will be an advance refunding.

Citi is the lead manager. Morgan Stanley, William Blair & Co., Cabrera Capital Markets LLC, Loop Capital Markets LLC, and Siebert Brandford Shank & Co. LLC round out the underwriting team.

Financial advisors are Public Financial Management Inc. and Acacia Financial Group Inc. It's the first time that President Toni Preckwinkle's administration, which took office two years ago, has used PFM.

Chapman and Cutler LLP and Pugh, Hones, Johnson & Quandt PC are co-bond counsel.

Two of the three major ratings agencies – Moody's Investors Service and Fitch Ratings – have a negative outlook on the county, but all three affirmed their ratings ahead of the deal. Moody's rates the county's general obligation bonds Aa3. Fitch rates the county AA-minus and Standard & Poor's AA with a stable outlook.

The negative outlooks are due in part to the county's large and growing unfunded pension liability, estimated at $4.7 billion. Like Chicago, the county is waiting legislative action from Springfield before tackling the problem, Malhance said. "We are waiting on the state," he said. "A lot of us are concerned. In fact, the majority of the country is concerned."

The 17-member board Friday approved a final $2.9 billion spending plan that largely adheres to Preckwinkle's blueprint. The budget closes a $287 million deficit by relying on $99 million in federal funding from waiver that allows the county's hospital system to expand its Medicaid program a year ahead of the formal implementation of the new federal health care law. New revenues include taxes on cigarettes, guns, and gambling machines.

It eliminates the last 0.25% of a wildly unpopular 1% sales tax increase implemented by Preckwinkle's predecessor, Todd Stroger. Preckwinkle campaigned on a promise to eliminate the tax, and has gradually cut it by since taking office. The final phase-out means the loss of around $90 million in fiscal 2013.

"This is fiscally responsible budget that reflects the values and priorities of my administration," Preckwinkle said in a statement Friday morning.