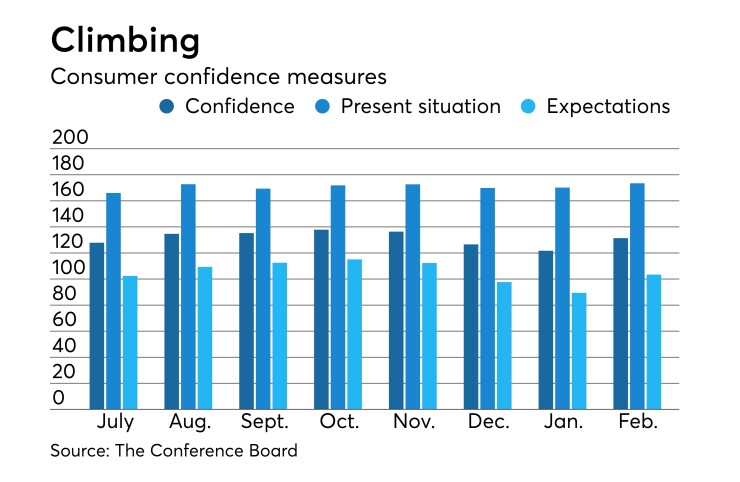

The consumer confidence index increased to 131.4 in February from an upwardly revised 121.7 last month, originally reported as 120.2, The Conference Board reported Thursday.

IFR Markets predicted a 125.0 reading for the index.

The present situation index rose to 173.5 from an upwardly revised 170.2, first reported as 169.6, while the expectations index soared to 103.4 from an upwardly revised 89.4, first reported as 87.3.

“Consumer Confidence rebounded in February, following three months of consecutive declines,” said Lynn Franco, director of economic indicators for The Conference Board. “The Present Situation Index improved, as consumers continue to view both business and labor market conditions favorably. Expectations, which had been negatively impacted in recent months by financial market volatility and the government shutdown, recovered in February. Looking ahead, consumers expect the economy to continue expanding. However, according to The Conference Board’s economic forecasts, the pace of expansion is expected to moderate in 2019.”

Business conditions were called “good” by 41.2% of respondents in February, up from 36.4% of respondents in January. Those saying conditions are “bad” held at 10.8%.

The percentage of consumers expecting a pickup in business conditions in the next half year gained to 19.7% from 16.3%, while 8.9% said they expect conditions to worsen, down from 13.8% in the prior month.

On the jobs front, those who believe jobs are “plentiful” dipped to 46.1% from 46.7% in last month, while the number saying jobs are “hard to get” fell to 11.8% from 12.6%. The respondents who see fewer jobs becoming available in a half year, rose to 8.5% from 6.8%. Those expecting more jobs to become available rose to 18.5% from 15.3%, The Conference Board reported.

The consumer confidence survey is based on a probability design random sample by the Nielsen Company.