LOS ANGELES — Changes are afoot at Kansas City-based Columbia Capital Management with the acquisition of a California financial advisory firm and a leadership shift.

Columbia, a municipal and investment advisory firm founded 22 years ago, will acquire C.M. de Crinis & Co., Inc. a 28-year-old independent municipal advisory firm based in Glendale, California, effective December 31.

“Their depth of experience in and knowledge of the California and Hawaii public finance markets will allow us to better serve clients in these states,” said Courtney Shea, a Columbia principal. "Instead of building from the ground up, we decided to combine with a firm whose business strategy was similar to our own."

The new year will also bring a change in management at Columbia as current president and founder Dennis Lloyd will become an associate serving his existing clients on Jan. 1. Principals Shea and Jeff White will take over management of the day-to-day operations.

C.M. de Crinis has worked with government issuers and special districts in California and Hawaii.

Columbia is based in Kansas City with offices in Chicago and St. Louis. It has focused on Midwest clients, but also serves in the municipal advisory pools for California issuers including the state government, Los Angeles County and San Diego.

De Crinis counts among its clients many southern California local governments including Riverside County and the cities of Aguora Hills and Colton. Maui County in Hawaii has been a client of de Crinis' for nearly a decade.

The addition of Curt de Crinis and Mike Williams, principals at C.M. de Crinis & Co., and their two colleagues, gives Columbia “boots on the ground in the work we have already been doing in California for the state and local governments," said Shea, who

The combined firm will have 12 employees including eleven municipal advisors.

The California firm’s approach to developing long-term relationships with clients, rather than bidding for one-offs on individual bond sales matches Columbia’s approach, Shea said.

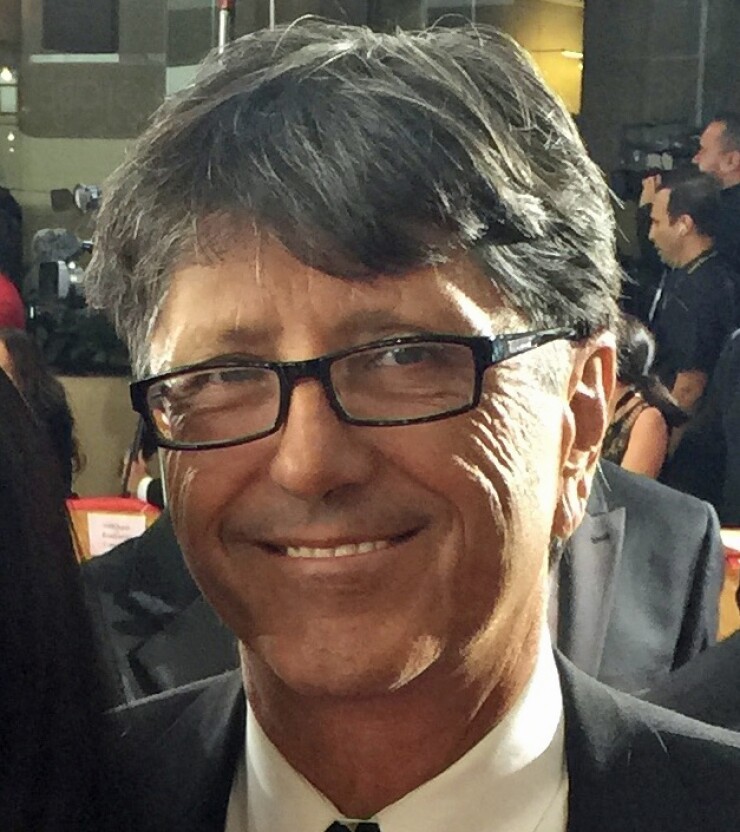

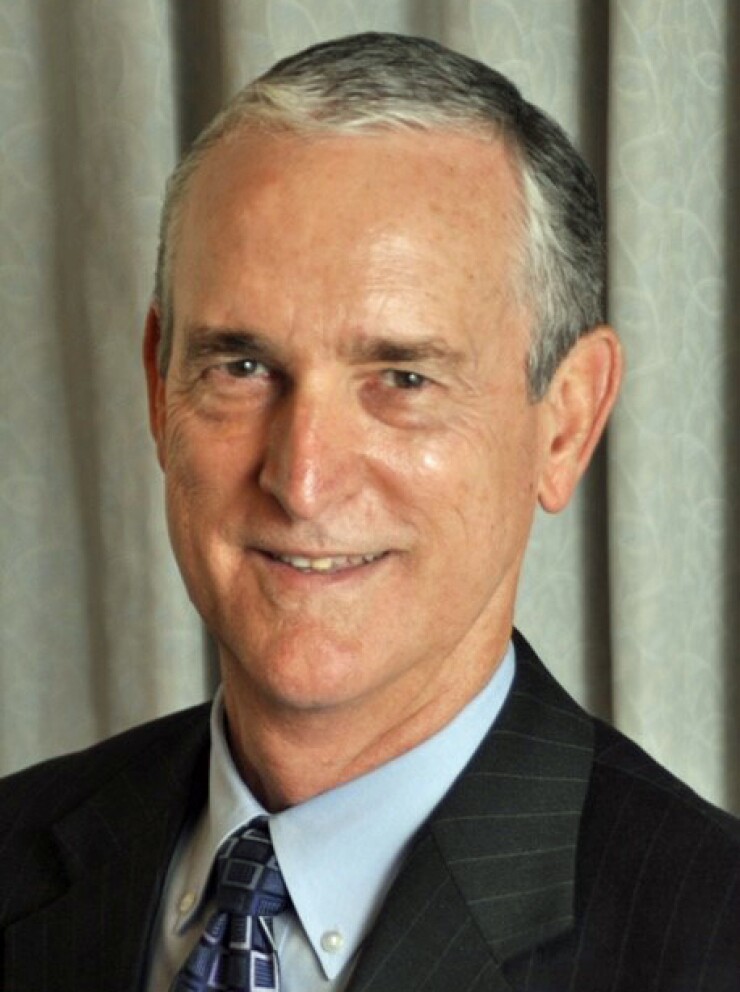

Curt de Crinis formed C.M. de Crinis in 1990 after working as a public finance investment banker. Both he and Williams worked as finance officers for local California governments early in their careers. Williams has been with the firm nearly since its inception, joining in 1991. Richard Kriss, an investment banker, worked with Piper Jaffray for decades before joining the California financial advisory firm. The fourth de Crinis employee is Sarah Smith, an associate.

De Crinis will come on as a principal. It has not been decided if his and Williams' titles will be managing director.

For de Crinis, the acquisition means added resources for serving its clients.

“Columbia Capital brings top notch analytics, a deep resume of work with mid- and large-sized issuers and a breadth of experience across the municipal market. Our existing clients will benefit,” de Crinis said.

Shea, who is among the founders of Women in Public Finance, said her connections in WIP have helped in efforts to expand in California, where many women have leadership roles among issuers.

"I don't want to say it's all me, but I am sure in competing in pools such as San Diego, it helped that I was associated with the firm," Shea said. "So many issuers in California are run by strong women, which is unique for California and is not so much true in other places."