On heels of a successful GO deal on Wednesday, the market easily digested more Chicago paper on Thursday as the Chicago’s Sales Tax Securitization Corporation deal was as much as 40 times oversubscribed and bumped 30-35 basis points in repricing.

Primary market

Goldman Sachs priced Chicago’s Sales Tax Securitization Corp.’s (NR/AA-/AA-/AA+) $997.87 million of second lien refunding and taxable bonds.

The 2020A series of tax-exempt bonds for a par amount of $521.975 million came in at 60 basis points above the MMD scale on the 10-year, as it was priced as 5s to yield 1.91% after the repricing that bumped it by 22 basis points. The 10-year in the last tax-exempt STSC issue that sold in late 2018 settled at an 83 basis point spread to the AAA.

The long-bond on the deal (2040 maturity) came in at 65 basis points above MMD, as it was priced as 4s to yield 2.40%. The preliminary pricing came in at 100 basis points over on the long end, and the 10-year maturity was 82 points over. The 2039 maturity, which was uninsured with a 4% coupon, yielded 2.49% after a 35 basis point improvement in the repricing landing at a 77 basis point spread to the AAA.

Both the 2037 and 2040 maturities totaling $74.235 million are insured by Build America Mutual and have ratings of AA from S&P.

The 2020B series of taxable bonds for a par amount of 466.07 million were also priced by Goldman, but as of press time no pricing wire was available. The rates offered in the indications of interest wire Wednesday put the spread on an 11-year bond to comparable Treasuries at 120 basis points and a 15-year maturity at a 140 bp spread. The city’s last taxable deal in 2019 only offered term bonds in 2040 and 2048 and they landed at spreads of 156 basis points and 171 basis points, respectively.

“The tax-exempts do look cheap for the rating, but I don’t think everyone agrees with the rating,” one portfolio manager said. “The deal was well oversubscribed for, as many as 40 times over on the longer bonds with a 30 or 35 basis point bump. Even stronger demand than the Chicago GO."

One Chicago trader said that he was not surprised the STSC deal fared better, just from the simple fact that everyone is hunting for yield.

“There is a never-ending search for yield and that definitely played a part as to why the Chicago GO deal did so well,” he said. “The second lien was also hit with some headline risk, given the [Fitch] downgrade, but that clearly did not scare off buyers."

He also added that some buyers are hoping the city can perform a comeback with its credit, something similar to California.

“You look back at what Cal’s credit was 10 years ago versus where it is today and I would think some people are thinking a major city like Chicago can accomplish something similar but who knows how long that will take, if it even happens.”

The city is taking upfront for budget relief at least $210 million of the savings attached with the deal that refunds outstanding general obligation and motor fuel tax bonds and allows for the purchase of $370 million of high-yielding taxable bonds tendered by their owners at the city’s invitation. Demand for higher-yielding paper drove the appeal, multiple market participants said, eclipsing any worry over the city’s fiscal prospects as its grapples with rising pension, personnel and debt costs. The city has pledged to structurally balance the books by 2022.

"The municipal market has been on a tear and Chicago benefiting from a demand imbalance,” said Brian Battle, director of trading at Chicago-based Performance Trust Capital Partners. “It doesn’t portend that things are getting better and it’s not an endorsement” that Chicago finances have improved.

The demand also reflects the securitization features that are stronger than typical revenue bonds that have taken a reputational hit due to Puerto Rico bankruptcy rulings and that Chicago’s GO credit is stable in the near-term so investors are willing to give the city breathing room to work toward a structural fix, Battle said.

Citi priced the Connecticut Health and Educational Facilities Authority's (A2/A/A+) $292.92 million of revenue bonds for Hartford Healthcare.

Citi also priced Virginia Small Business Financing Authority’s (Aa2/AA/ ) $187.27 million of healthcare facilities refunding revenue bonds for Sentara Healthcare.

Morgan Stanley priced the Dormitory Authority of the State of New York’s (A2/A/) $145.19 million of revenue bonds for Fordham University.

Bank of America Securities priced Durham Capital Financing Corporation, N.C.'s (Aa1/AA+/) $100.260 of taxable refunding limited obligation bonds.

Secondary market

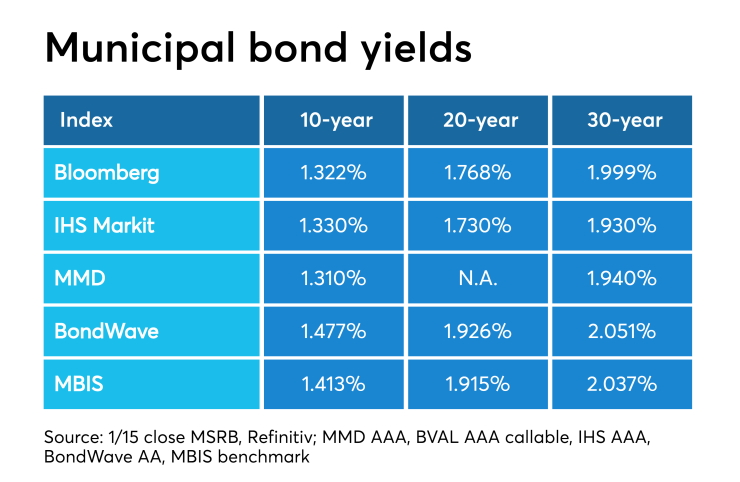

Munis were mixed on the MBIS benchmark scale, with yields falling by four basis points in the 10-year maturity and rising by four basis points in the 30-year maturity. High-grades were stronger with yields on MBIS AAA scale falling five basis point in the 10-year maturity and by less than a basis point in the 30-year maturity.

On the MMD benchmark scale, the yield on the 10-year GO dropped two basis points to 1.29% as the 30-year declined remained steady at 1.94%.

The 10-year muni-to-Treasury ratio was calculated at 70.1% while the 30-year muni-to-Treasury ratio stood at 85.2%, according to MMD.

Stocks all hit new highs as the record rally rolls on, while Treasury yields mostly moved higher.

The Dow Jones Industrial Average was up about 0.64%, the S&P 500 Index gained around 0.57% and the Nasdaq rose about 0.76%.

The Treasury three-month was yielding 1.559%, the two-year was yielding 1.568%, the five-year was yielding 1.623%, the 10-year was yielding 1.808% and the 30-year was yielding 2.261%.

Muni money market funds see small inflow

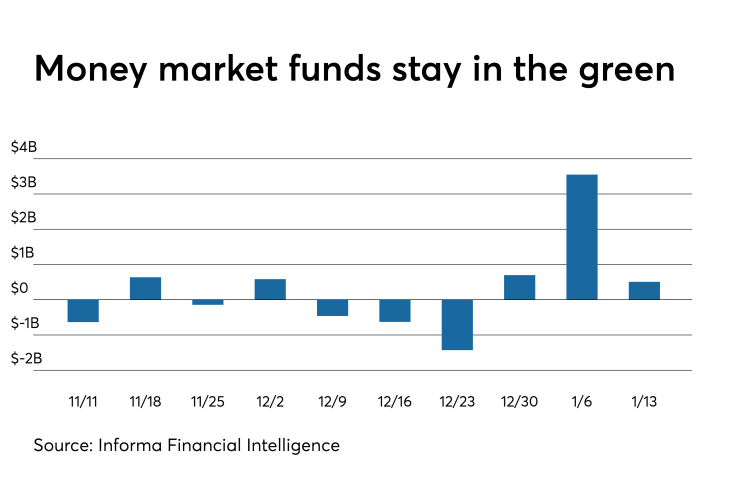

Tax-exempt municipal money market fund assets increased by $508.4 million, raising their total net assets to $141.17 billion in the week ended Jan. 13, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds dropped to 0.60% from 0.94% in the previous week.

Taxable money-fund assets gained $155.8 million in the week ended Jan. 14, bringing total net assets to $3.450 trillion. The average, seven-day simple yield for the 801 taxable reporting funds slipped to 1.27% from 1.28% the prior week.

Overall, the combined total net assets of the 988 reporting money funds increased slightly by $664.2 million to $3.591 trillion in the week ended Jan. 14.

Bond Buyer indexes dip

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, was lower to 3.58% from 3.59% the week before.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields dropped seven basis points to 2.56% from 2.63% the week before.

The 11-bond GO Index of higher-grade 11-year GOs fell seven basis points to 2.09% from 2.16% the prior week.

The Bond Buyer's Revenue Bond Index was down four basis points to 3.06% from 3.10% the previous week.

The yield on the U.S. Treasury's 10-year note was slightly lower to 1.81% from 1.85% the week before, while the yield on the 30-year Treasury slipped to 2.26% from 2.32%.

Previous session's activity

The MSRB reported 34,248 trades Wednesday on volume of $13.61 billion. The 30-day average trade summary showed on a par amount basis of $11.14 million that customers bought $5.77 million, customers sold $3.44 million and interdealer trades totaled $1.93 million.

New York, Texas and California were most traded, with the Empire State taking 13.507% of the market, the Lone Star State taking 13.354% and the Golden State taking 13.185%.

The most actively traded security was the New Hampshire Health and Educational Facilities revenue 5s of 2059, which traded 29 times on volume of $51.410 million.

Treasury auctions bills

The Treasury Department Thursday auctioned $35 billion of four-week bills at a 1.505% high yield, a price of 99.882944.

The coupon equivalent was 1.532%. The bid-to-cover ratio was 3.21.

Tenders at the high rate were allotted 5.13%. The median rate was 1.480%. The low rate was 1.460%.

Treasury also auctioned $35 billion of eight-week bills at a 1.530% high yield, a price of 99.762000.

The coupon equivalent was 1.559%. The bid-to-cover ratio was 3.20.

Tenders at the high rate were allotted 14.02%. The median rate was 1.500%. The low rate was 1.480%.

Treasury bill announcement

The Treasury Department said Thursday it will auction $42 billion 91-day bills and $36 billion 182-day discount bills Tuesday.

The 91s settle Jan. 23, and are due April 23, and the 182s settle Jan. 23, and are due July 23.

Currently, there are $68.001 billion 91-days outstanding and $25.997 billion 182s.

Treasury also announced it will auction $14 billion 10-year TIPS on Jan. 23.

The TIPs are dated Jan. 15 and due Jan. 15, 2030.

Yvette Shields and Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.