The new leadership at RBC Capital Markets is sticking with the winning formula and staff established by Chris Hamel, the former head of public finance.

It's been a little over a year since

Since Bob Spangler and Jim Tricolli have been tag-teaming as co-heads of the department, not much has changed internally. Coming into the role a year ago, they say, they recognized that RBC was in a strong position as a consistent top-four municipal player in negotiated underwritings and a top-three tax credit syndicator. They agreed the best path forward would be a continuation of the previous growth strategy, which is to maintain a strong regional practice along with a large issuer practice, while focusing growth in places and sectors where the firm was under-represented.

“We haven’t changed much since we took over, and we continue to gain market share,” Spangler said. “We have a select few states we focus on, 10 with a deep presence.”

Those 10 states are: Texas, Pennsylvania, California, Arizona, Colorado, Florida, Ohio, New York, New Jersey and Illinois.

To market participants, the transition has had little noticeable effect on RBC’s quality or quantity of products or services.

“For an institutional investor it’s your coverage, and ours has been seamless,” said John Mousseau, president and chief executive officer at Cumberland Advisors.

“We get good coverage, detailed knowledge of deals, and good bids. In this day and age, it’s hard to ask for more,” Mousseau said

“We are very close to where we envisioned we would be by this time, so we are pleased,” Spangler said. “Based on our metrics, we were fourth overall in negotiated deals only. As a firm, we gained 50 basis points and ended with a market share of 8.3%.”

Tricolli and Spangler agreed on what their greatest feat has been since taking over.

“We have retained close to 100% of our employees,” Tricolli said. “In our industry, employee turnover is common but we are proud to say we haven’t lost a single Managing Director in the past 12 months — while also adding some key senior hires in healthcare and charter school finance.”

In a municipal market where bankers tend to jump from firm to firm, Tricolli and Spangler have maintained a bench of professionals in 26 offices across 16 states.

“It was a natural transition for us, as we were being groomed to take over, and we were ready whenever that opportunity presented itself,” said Tricolli. The only change has been "stylistic," he said. "We have been pushing community service, for example.”

Spangler said you can’t make enough money in municipals just serving as an underwriter.“You need to be able to provide all aspects of financial advice that the client needs. We are in the client service business.”

The bank is coming off its strongest year ever and isn’t planning on stopping there.

“It was our highest-ever market share but we aren’t going to settle,” said Tricolli. “We believe we can reach 10% market share over the next few years; that’s a reasonable expectation if we simply continue to focus on our growth strategy.”

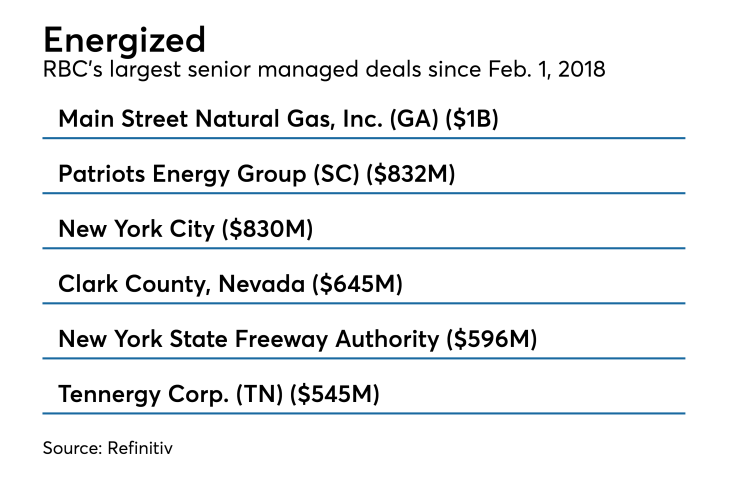

The firm enjoys a dominance in sectors including: pre-paid gas, housing, charter schools and student loans.

RBC plans to continue to focus on sectors like transportation and healthcare where it has made good strides. In 2018, for example, RBC strengthened its Healthcare Finance Group with five new hires that bolstered its national healthcare credentials.

RBC will also continue to focus on privatized student housing on a national basis, and K-12 education finance in its core markets. RBC is No. 2 ranked in K-12 and charter schools. The firm also has a core group of states where it is focused on being a top-three negotiated underwriter. Those are: Texas, Pennsylvania, California, Arizona, Colorado, Florida, Ohio, New York, Illinois and New Jersey.

“We want to finish what we started, for example there are likely to be more mergers in the not-for-profit acute care healthcare space and we want to be ready for when those mergers do happen. With the hires we made last year to strengthen our healthcare practice, we are ready,” said Tricolli.

“We are still big proponents of P3s, but the public-private partnership must mature in the U.S.,” Tricolli said. “We are in an excellent position of strength and opportunity currently across a lot of different sectors, we are firmed and staffed and ready to pounce on opportunities.”

In the affordable housing sector, RBC had a 23% market share last year. The firm focuses on low income housing, tax credits, and platform leverage nationally, RBC has managed 117 tax credit funds and 22 active direct investments with 951 properties and over 83,537 units of affordable housing under administration in 47 states, Washington, D.C., and Puerto Rico.

The firm has a 50% market share in the student loan group sector, a sector that is expected to continue to grow, creating vast opportunities. RBC has one of the most active specialty practices in the student loan finance industry. The firm collaborates with a broad range of nonprofit and state agency loan organizations to design and execute financing plans. Since the student loan industry began to emerge from the credit crisis in 2008, RBC has executed over $104 billion of student loan backed financings.

With that in mind, RBC is also active in the debt restructuring group. The group helps clients navigate economic challenges and uncertainty and provide creative solutions and insights that bridge borrower needs with financing sources. They are confident this group will gain traction in 2019.

Tricolli added that they are also focusing on balance sheet and a direct lending/purchasing program.

“We are spending a lot of time on this, we want to vet and make sure we are doing this effectively and efficiently,” he said.

The two co-heads have been trying to push community service, as another way to give back.

On Nov. 9, 2018, the Municipal Finance team held its first annual Municipal Finance Volunteer Day. Two hundred thirteen employees across 15 offices in 11 states signed up to volunteer their time and energy, raising $62,000 for charity.

John Hallacy and Christine Albano contributed to this report.