California-based underwriter De La Rosa & Co. is filling a strategic seat on its team with the addition of municipal veteran Bradford Thiel, who is slated to join its sales and trading desk this month.

Thiel brings 27 years of underwriting experience to his new role, including 12 at Citi where he served as a managing director and headed sales and underwriting for West Coast operations.

The Los Angeles-based trader, who begins his new role Aug. 16, said he was pleased to join a firm with such potential in the region.

“It’s got a tremendous amount of growth behind them and a tremendous amount of growth in the future,” Thiel said Monday of De La Rosa. “They are a solid, mainline firm.”

De La Rosa is a minority-owned underwriter with a sole focus on the Golden State. It was founded in 1989.

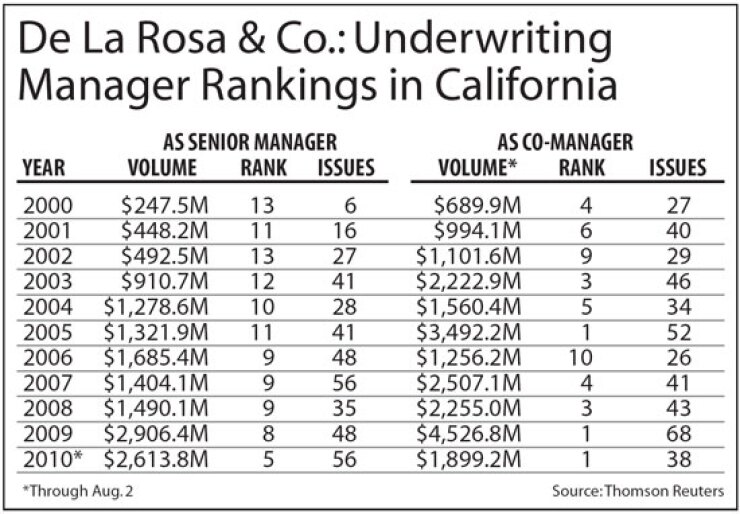

The firm has experienced rapid growth in recent years, senior managing 56 deals with a total value of $2.6 billion in the first seven months of 2010. It ranks fifth in California among underwriting firms, with a 7.8% market share, and is the 16th largest nationally, according to Thomson Reuters.

Back in 2007, De La Rosa led $1.4 billion worth of deals — good for a 2.1% share of the California market — and was ranked 35th nationally.

Benjamin Stern, who heads the firm’s underwriting operations, said Thiel will help manage underwriting business as it continues to grow. The new hire will work alongside Chris Tota, who joined De La Rosa in 2008 as head of sales and trading.

“Brad adds another senior presence to the underwritings we manage,” Stern said in a company statement. “We have assembled a desk that can outperform any other firm in selling, trading and underwriting California bonds.”

Thiel has spent the last year running the underwriting desk at Los Angeles-based Wedbush Morgan Securities. He previously worked 12 years at Citi and 10 years at Lehman Brothers. Thiel is now in his seventh year on the board of the California Public Securities Association.

Thiel, who has competed against Stern and been a friend of Tota’s for years, said he spent the past decade watching De La Rosa evolve from a small team into an established presence in the regional market.

“Their footprint has really grown dramatically, especially over the last 10 years,” Thiel said. “They’ve leap-frogged over a lot of the smaller firms in California.”

He said there is a real opportunity for smaller firms to pick up business if they are aggressive and nimble, as De La Rosa has been.

“As the larger firms continue to move up market and look at their business model as real whale hunters, it leaves so much business in the hands of the smaller firms,” he said, estimating that the smaller deals they leave behind can be worth $10 million to $250 million.

Thiel left Wedbush in mid-July. Like De La Rosa, Wedbush has experienced quick growth in recent years by focusing almost exclusively on the regional market.

Wedbush senior managed 15 deals in California worth $403.5 million to date this year, ranking it the 13th largest underwriter in the state. In 2007, it ranked 23rd with just 12 deals totaling $145 million.

“We saw a tremendous amount of growth over last year and I see that continuing,” Thiel said of his former firm. “They’ve got a good group of bankers.”