DALLAS – Kansas lawmakers are still looking for a way to cover a $900 million budget gap over the next two years after Gov. Sam Brownback on Tuesday promised to veto a bill that would raise $1.2 billion from higher taxes.

“Given that this tax package was assembled and passed just today, I hope to avoid any unnecessary delays by announcing that I will veto Senate Bill 30, allowing the legislature sufficient time to address its many deficiencies and harmful impacts on Kansas families,” Brownback said in a prepared statement after the state Senate’s post-midnight vote.

Calling the bill “the largest tax increase in state history,” Brownback said it would increase taxes $1.22 billion over two years, compared to $1.04 billion raised in House Bill 2178, which Brownback vetoed earlier.

“Earlier this year, I vetoed a tax increase that threatened to crush the Kansas economy, punishing individual Kansans and their families,” Brownback said. “Additionally, this tax increase is still retroactive and will affect individual families and small businesses in the 2017 tax year. Retroactively applying new taxes in the middle of the year is irresponsible and will harm families and individuals who are working to make ends meet.”

Brownback said the bill cuts the low-income exclusion in half, raises the bottom bracket by 14.8%, the middle bracket by 14.1% and the upper bracket by 23.9%.

The House and Senate would need two-thirds majorities to override Brownback’s veto. SB 30 passed with 69 votes in the House, far short of the 84 needed for an override, and 26 in the Senate, one short of the 27 needed for an override.

State budget director Shawn Sullivan said in a statement prepared before the votes Monday that failure to resolve the budget impasse would cause problems for state employees within two weeks.

“The FY 2018 for state payroll starts at 12:01 a.m. on June 18,” Sullivan said. “Without action by the legislature, we do not have the necessary authority to pay state workers, causing difficult decisions to be made regarding the continued operations of state government.”

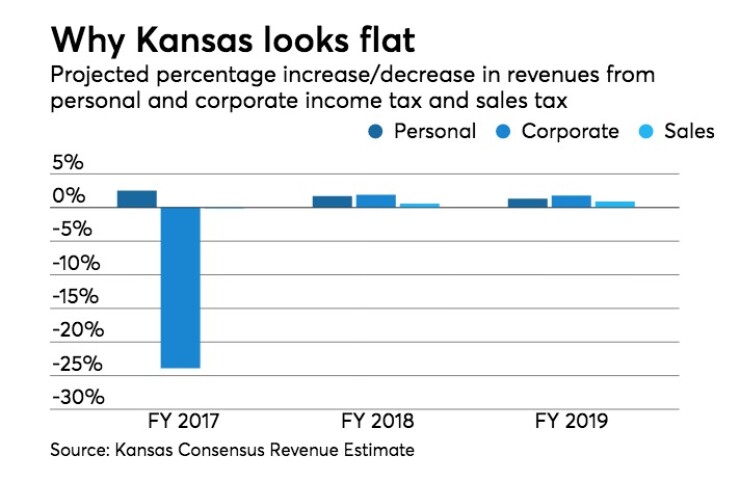

After meeting or exceeding expectations in the past two months, Kansas revenue numbers fell $2 million below estimates for the month of May, according to the state Department of Revenue.

The shortfall was largely driven by lower-than-expected individual income tax collections, officials said.

Sales tax and corporate income tax collections were both higher than expected. The state says the numbers are better than the first 11 months of last fiscal year.

Kansas still faces a nearly $900 million projected budget shortfall through June 2019.