Indianapolis and Marion County on Thursday will sell more than $623 million of tax-exempt debt that taps a new revenue pledge to fund a criminal justice complex billed as a cornerstone of reform plans.

The consolidated city-county government is pricing $610 million of bonds for the long-anticipated project, plus roughly $13 million of bonds to finance an assessment and intervention center.

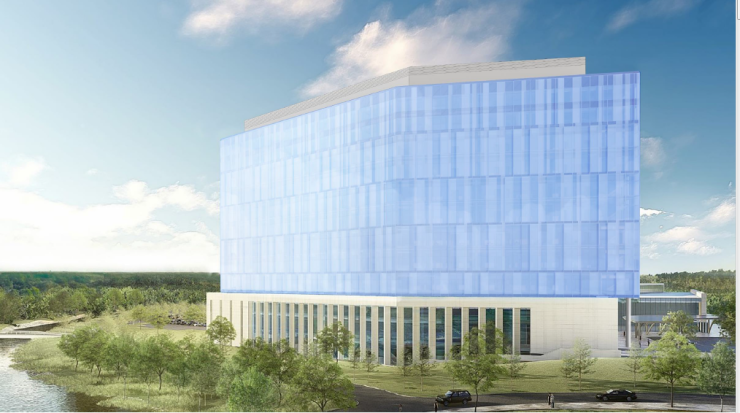

The three-building complex, which will house the county’s civil, criminal, juvenile and probate courts, jail and sheriff’s department, in addition to the assessment and intervention center, will repurpose a formerly vacant industrial site with the intent of revitalizing a long-underserved neighborhood on the Eastside.

Indianapolis has recognized the need for a new jail for more than a decade but previous efforts to build one have stalled. “Like other large metros the criminal justice infrastructure in Indianapolis is aging, inefficient and overcrowded,” Mayor Joe Hogsett said in an investor presentation.

Hogsett created a criminal justice reform task force three years ago to make recommendations. It found that nearly 30% of inmates suffer from mental illness and nearly 85% of inmates suffer from substance abuse or addiction. They recommended primary goal or reform should be to identify these non-violent inmates and send them to treatment rather than prison.

“With that in mind we are creating something new; a modern justice campus for entire community,” Hogsett said in the investor presentation.

The assessment and intervention center, run by the county‘s public health department, is designed to be a place where people can be diverted at the beginning of the process, assessed and offered the medical intervention needed rather than sending them to a jail bed, Sarah Riordan, executive director and general counsel of the Indianapolis Local Improvement Public Bond Bank, said in a phone interview. The bond bank will issue the debt.

“There is significant population of people in our jail facilities that are cycled in and out,” Riordan said. “They are not violent offenders but people who came into police interaction for whatever reason whose real problems are undiagnosed or untreated mental health issues or substance abuse.”

The building will be owned by the Indianapolis-Marion County Building Authority and will then be leased back to the city-county government.

The $610.5 million, 35-year, series A bonds will finance construction of the city county’s adult detention facility and local courthouse. The proceeds will also current refund $75 million of direct placement debt related to the project the city and county issued through the bond bank in 2017 and 2018. The first was for $20 million and was placed with PNC Bank. The second was for $55 million and was placed with Fifth Third Bank.

The new bonds are ultimately secured by lease rental payments, which are repaid with a local income tax. Local income tax is derived from an income tax with a flat rate structure imposed on state adjusted gross income of county taxpayers that is authorized by statute and available to all Indiana municipalities.

The deal marks the first time the city has pledged the revenue source to secure bond payments.

The $12.6 million, 20-year, series B bonds that finance the assessment and intervention center will be secured by lease rental payments backed by a property tax. The center will be operated by the Marion County Health and Hospital Corporation.

Bank of America Merrill Lynch and UBS Financial Services are co-senior managers. Faegre Baker Daniels LLP is bond counsel. Sycamore Advisors LLC is the financial advisor.

The bonds are scheduled to price on Thursday after a retail order period Wednesday.

“We have had positive meetings with some exiting bondholders and other investors,” Riordan said. “The reception has been good.”

Fitch Ratings has assigned the bonds its AAA rating and Moody’s Investors Service rates the bonds Aa1. Both Moody's and Fitch also affirmed the city's Aaa/AAA issuer ratings, with stable outlooks.

Moody’s rates the bonds one notch below the city/county rating “due to abatement risk if the facilities cannot be occupied,” the rating agency said.

“The dedicated tax revenue structure provides ample financial resilience in the event of a moderate economic downturn and incorporates strong legal protections to mitigate abatement risks,” Fitch said. “The city/county plans to capitalize interest on the bonds through the projected construction completion date. Additionally, the city/county will maintain two years of rental interruption insurance to mitigate abatement risks post completion.”

Andy Mallon, corporation counsel for Indianapolis, said in the investor presentation that relocating the justice functions to a single campus will generate significant operating and cost savings to make the project effectively budget neutral.

About $35 million in annual savings are expected from the expiring leases for those offices currently located in privately owned buildings.

“We determined for the 2019 budget what it costs to operate all of our criminal justice facilities and when those are no longer used we will apply that same amount of money to debt service,” Riordan said.

The assessment and intervention program is designed to improve people’s lives but may pay off financially.

“We are not banking on any type of savings to be generated from this in terms of our ability to pay back our bondholders but we predict there will be savings generated from fewer occupancies ultimately of the adult detention facility making it less expensive to run and also lower medical care costs,” Riordan said.

Mallon said that vacating the existing justice facilities would also create significant opportunity for private investments and jobs through the redevelopment of the real estate.

The local income tax-backed base is a new structure for Indianapolis. The city's pledged component of its LIT is 1.72% and the current all-in rate, which includes unpledged IndyGo LIT, is 1.97%. The maximum allowed all-in rate in the county is 2.75%.

The tax represents the second largest city revenue source with the city’s portion of the certified distribution a projected $336 million for fiscal 2019 up 41% from 2014, according to the presentation. The city and county have covenanted not to reduce the rate or otherwise impair LIT while the 2019 series A bonds are outstanding.

“The bonds have 3 times additional bonds test and nearly 8.7 times coverage, so we have a lot of LIT revenue and there is an irrevocable pledge of LIT revenue to service these bonds,” Riordan said. “There is a tremendous amount of capacity not only for these bonds but also for the city to raise revenues in the future should it decide to do that.”

For the series B bonds the city will continue using a levy that was instituted for healthcare-related projects. Riordan said there will be no new increase in the property tax rate or debt burden as a result of the financing.

The structure also provides safeguards to mitigate construction and abatement risks. The detention center and courthouse are expected to be completed by Dec. 31, 2021 and the assessment and intervention center has an earlier completion date of July 1, 2020. The facility will be constructed at the site of the former Citizens Energy coke plant.

The bonds benefit from additional security provisions to mitigate the risk of abatement if construction delays were to push the completion date back. The capitalized interest, funded with bond proceeds, is enough to cover debt service payments six months beyond estimated project completion date. There is also the revenue stabilization fund, which is equal to 25% of maximum annual debt service, that can be drawn on in first instance if rent is interrupted due to abatement or other causes. The debt service reserve fund will be funded equal 100% of maximum annual debt service or $38.7 million.

Riordan said the bonds also benefit from rental interruption insurance to cover two years' rental interruption to cover lease payments in event the property is unavailable for use or occupancy. Bonds will also have 100% coverage against physical loss or damage sufficient to fully repair property or call outstanding debt.