LOS ANGELES — Courtroom sparks continue to fly nearly two years after California's highest court ruled in favor of dismantling redevelopment in the state.

The majority of the 181 redevelopment lawsuits — most filed in Superior Court in Sacramento County — stem from disagreements between the Department of Finance and a city or county over specific successor agency costs.

But seven lawsuits involve issues that could have a broader impact and involve billions of dollars.

Divergent rulings in those cases are enabling both sides to declare partial victory in what is largely a battle between localities and the state over the use of tax increment money.

Under redevelopment, a program designed to eradicate "blight," local governments created project areas that captured incremental property tax growth.

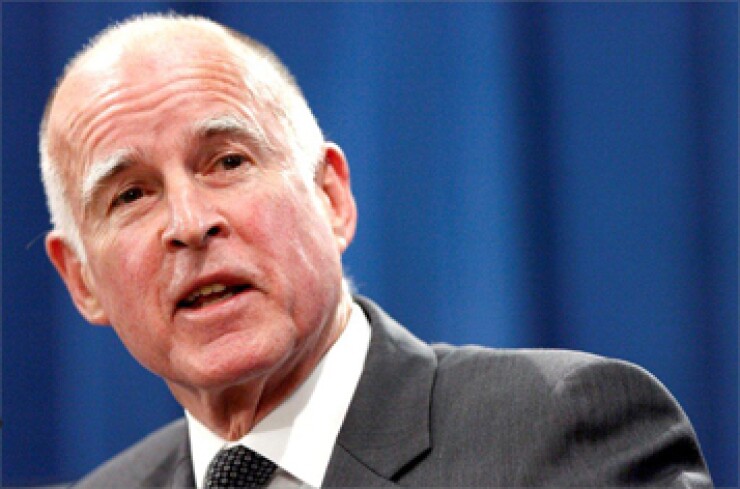

Critics, including Gov. Jerry Brown, thought the program had gotten out of hand; with redevelopment shut down, its former property tax revenue is supposed to flow to cities, counties, school districts and other local agencies.

Additional revenue that flows to schools benefits the state budget by reducing the amount of money it sends them to meet per-pupil spending minimums.

Department of Finance spokesman H.D. Palmer said that rulings have started to favor the state since Brown estimated the potential cost of the lawsuits at $3.4 billion in his budget released in early January.

The $3.4 billion was an estimate of the value of asset and other transfers from the RDAs to cities and counties from January 2011 through February 2012, he said.

"The governor delivered a balanced budget," Palmer said, "but included potential budgetary pressures."

Cited among those potential budgetary pressures was an amount equal to the maximum potential cost in the event of a final court ruling that Proposition 22 had been violated, he said.

On Dec. 6, Superior Court Judge Allen Sumner, in a case filed by Brentwood challenging a provision of the 2011 redevelopment dissolution law allowing the state to claw back money transferred between January 2011 and February 2012 to a sponsoring city or county by a redevelopment agency, found in a tentative ruling that the DOF's use of the clawback provision appeared to violate Proposition 22.

The measure, approved by voters in 2010, prevents the state from requiring redevelopment agencies to shift their funds to other localities such as school districts.

Brentwood's attorneys argued that the DOF is "violating Proposition 22 by ordering the return of funds the RDA expended for redevelopment projects before the RDA was dissolved."

In a similar tentative ruling, Sumner ruled on Dec. 13 the DOF's use of the clawback provision violated Proposition 22 in a Foster City case, but he added he wasn't asked to rule by the city on whether the legislation creating the clawback violated the proposition. Sumner asked the attorneys in the Brentwood case for supplemental briefings. A final ruling is expected by April.

While only $17 million is at stake for Brentwood, a ruling for the city could cost the state billions if applied to other jurisdictions. It is estimated that 150 jurisdictions made similar transfers totaling $3.4 billion. Others cities, many of whom have complied with the state transfer, could try to get their money back.

State officials said the clawback provision was designed to right a situation where cities and counties shifted RDA assets to their balance sheets during that 13-month period between the passage of the law and when it took effect.

Since the budget was presented, Palmer said, other rulings on the larger issues have come out that favor the state.

In cases brought by Watsonville, West Covina and Cuenca, three separate judges issued final rulings that clawback provisions, as applied to those cases, do not violate Proposition 22.

"If the tentative ruling upheld in Brentwood carries the day, it would not be good for our bottom line," Palmer said. "But we are heartened by the fact that after the budget was released, three final rulings came down in our favor."

Rulings are split in two cases challenging another broad issue.

The League of California Cities received a favorable ruling in a case where it sued the state over a provision in legislation to clean up the original dissolution law. The league challenged a provision that allows the state to withhold sales and use tax money and property tax revenue if cities and counties don't comply with requests to shift redevelopment money to schools and other local agencies.

The league argues that taking such action is unconstitutional under Proposition 1A, approved by voters to protect the state from taking money from localities to balance its budget, said Patrick Whitnell, general counsel for the league. The league also argued it violates Proposition 22, he said, under a provision of the initiative that protects city taxes for local services.

DOF had asked the state's board of equalization to withhold sales tax from the cities of Ontario, Pinole and Cerritos. After the League's ruling, Whitnell said, the DOF rescinded those orders.

"We accomplished our primary goal in the lawsuit, which was to get a determination that the sales and use clawbacks were unconstitutional," Whitnell said.

The state has filed notice it plans to appeal the judgment in that case.

In another case, a judge ruled against Bellflower, saying the state's ability to take the sales tax is constitutional.

That judge found "that the sales and use claw backs were in effect penalties and Proposition 22 did not specifically prevent the state legislature from imposing penalties in the form of withholding city sales and use tax," Whitnell said. The cities in the Bellflower case lodged an appeal.

If the state wins on the clawback issue it could be damaging to cities that would either risk the loss of sales tax revenue or need to come up with money from their existing general fund to cover the DOF demand, Whitnell said.

If, however, the league wins the appeal "it would have the binding effect — assuming the court publishes an opinion — that the legislature can't try and shift around sales and property tax in order to balance its budget when the budget process happens every year," said William Ihrke, a partner with Costa Mesa-based law firm Rutan &Tucker.

Ihrke represents Cerritos and at least a dozen other California cities in a lawsuit opposing the 2011 dissolution legislation. The lawsuit argues that the 2011 law should have required a two-thirds vote of the legislature because it reallocates property tax revenue.

He also is representing Twentynine Palms in a case challenging a state provision insisting that any proceeds from bonds issued after January 2011 for redevelopment projects be defeased, so the bonds can be paid back immediately.

The DOF has allowed bond proceeds issued in 2011 to be spent in some cases, but only when the agency had entered into a contract with a third-party that referenced the issuance of debt, Palmer said.

"The majority of the agencies didn't have executed contracts — just a list of future desires," Palmer said. "Statements of intent are not legally binding contracts."

State officials contend that the localities, which issued bonds after legislation was introduced in January 2011, were aware of the possibility RDAs could be dissolved. The market reflected that uncertainty by charging high interest rates to agencies that issued bonds at that point, officials said.

The DOF wants the agencies to defease the bonds as quickly as possible to pay off the bonds, so the tax increment currently used to make bond payments can be redistributed.

The state estimates that $600 million to $700 million in bonds were issued after January 2011.