A Biden administration is likely to be favorable to a wider use of private activity bonds just as its federal cap for surface transportation is practically at full capacity.

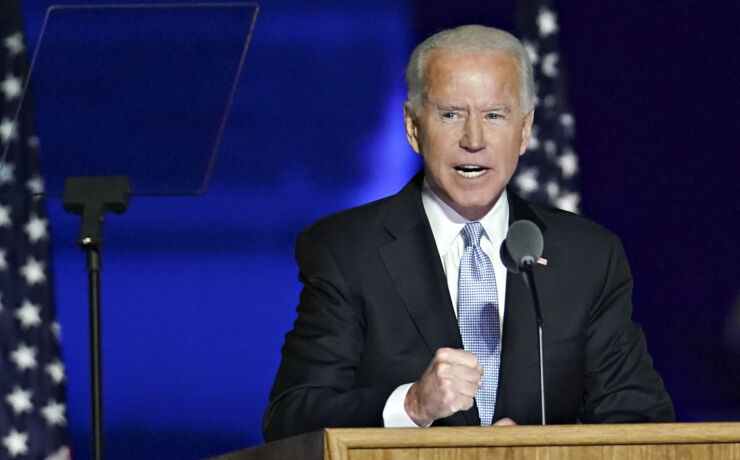

Combined with bipartisan support of PABs and a robust laundry list of infrastructure goals in President-elect Joe Biden’s Build Back Better plan — an increase of the federal $15 billion dollar PAB allotment is plausible. Biden’s published infrastructure plan, a part of his Build Back Better economic plan, includes building out robust transit systems, reducing greenhouse gas emissions and building more resilient infrastructure.

“I believe that private activity bonds as a tool for helping to address our significant infrastructure needs will be a part of a Biden plan and part of a Biden plan that should have enough bipartisan support to make it through a Republican Senate,” said Robert Labes, a partner at Squire Patton Boggs.

The current volume cap on PABs for surface transportation projects is $15 billion and $14.7 billion of it has already been allocated and issued, according to the Build America Bureau within the Transportation Department. That cap was established under the Safe, Accountable, Flexible, Efficient Transportation Equity Act: A Legacy for Users or SAFETEA-LU in 2015 and is separated from the individual state volume caps.

An increase in the PAB cap is most likely to be included in an infrastructure bill, sources believe. Labes said Biden’s past relationships with lawmakers will prove helpful. PABs allow government entities to borrow on behalf of private parties for certain projects, while maintaining the bonds’ tax exempt status. Bonds issued under the DOT's PAB program have supported high-occupancy tolled lanes and bridges, among other things.

Control of the Senate is not yet decided, awaiting two Georgia runoffs in January. Democrats would need to win both of those races to get control of the chamber.

“A Biden Harris administration will be very good for private activity bonds and I believe that is going to be the case even if Republicans win one or both of the Senate runoff races in Georgia in January,” Labes said.

Labes said compared to President Donald Trump, Biden will maintain focus on getting an infrastructure bill passed.

“A Biden presidency is going to get back to the basics of governing and infrastructure has been overlooked for too long, so there will be continued follow-through by the administration and a continued push for infrastructure,” Labes said.

Biden’s follow-through on increasing the PAB cap will depend on who leads the Department of Transportation, which hasn’t yet been announced. During the Obama administration, DOT officials supported expanding PAB issuance and proposed Qualified Public Infrastructure Bonds, said Marc Scribner, senior transportation policy analyst at the right-leaning Reason Foundation. QPIBs would have expanded PABs use to airports, ports, sewer and water among others.

“His very mass transit heavy review team isn’t giving me a ton of confidence that this is high on the list for team Biden priorities, but if he does put qualified people in the agencies, which is possible, there is a reason then to think that something like the QPIB proposal being revived,” Scribner said.

Phillip Washington, formerly CEO of the Los Angeles County Metropolitan Transportation Authority is leading Biden’s transportation transition team.

Washington was a supporter of P3 projects and oversaw a $2.2 billion transit P3 in Denver, as CEO of Denver's Regional Transportation District.

However, Scribner said he wanted to see more people from the private sector on Biden’s transition team.

Ultimately raising the PAB cap or expanding the use of PABs will be up to Congress, where there is bipartisan support. A group of bipartisan lawmakers

An identical bill is in the Senate introduced by Sens. John Cornyn, R-Texas and Mark Warner D-Va.

House Democrats’ infrastructure bill, the Moving Forward Act, would also raise the volume cap for PABs to $18.75 billion from $15 billion.

Given Biden’s robust infrastructure agenda, an increase of the federal PAB cap would be needed to get projects going as states and local governments are struggling financially to weather the pandemic, Scribner said.

“If you want to build even a fraction of the kinds of infrastructure to meet the Build Back Better goals, you would open up the toolbox wide, especially right now given the fiscal situations of state and local governments,” Scribner said. “They would want to shift some of that risk off of taxpayers to private investors. You’d think that that would be something that they would be seriously looking at. We haven’t seen an indication that they are, but we really haven’t seen details on any of this.”

The Trump administration initially appeared to support expanding PABs, but that fizzled out, so time will tell in a Biden administration.

“Both the outgoing Trump Administration and the incoming Biden Administration have expressed support for creative, transformative infrastructure initiatives,” said Michael Decker, senior vice president of policy and research at Bond Dealers of America.

The future of an increased PAB cap will depend on who takes the lead in Biden's administration, Decker added.