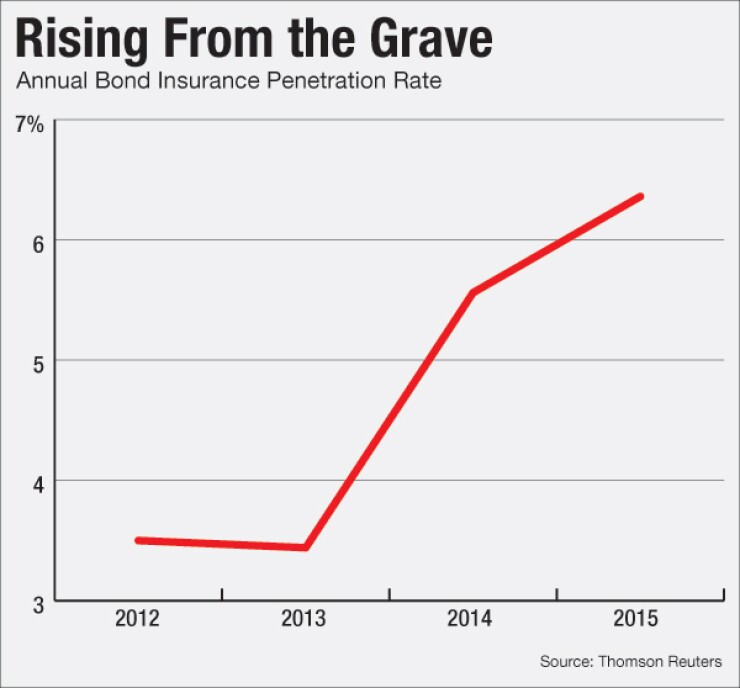

The municipal bond insurance industry took another step forward in their comeback, wrapping almost 36% more in par value in 2015 and increasing market share to the highest in five years.

Assured Guaranty led the charge again, as the par value of bonds wrapped and number of deals insured surged. Orrick Herrington & Sutcliffe maintained its position atop the bond counsel rankings.

Municipal bond insurers guaranteed $25.21 billion of bonds in 1,880 transactions, up from $18.54 billion in 1,403 transactions in 2014, according to data from Thomson Reuters.

The insurance penetration rate increased to 6.36% from 5.56% in 2014. This is the highest the rate has been since 2009 when it was 8.64%.

Assured improved on the par amount of deals wrapped, number of deals and market share, finishing the year with $15.14 billion in 1,009 transactions and 60.2% market share. In 2014, Assured has $10.74 billion, 697 transactions and 57.9%. The data includes Assured's subsidiary Municipal Assurance Corp.

"Demand for bond insurance grew in 2015, with primary-market par insured increasing 36%, far outpacing market growth of 20%," said Robert Tucker, managing director communications and investor relations at Assured. "We continue to see increased demand for our insurance in 2015. We led the market in terms of both par and the number of transactions insured during the year, capturing 60% of all insured new-issue par and 54% of the insured transactions. "

Tucker said Assured increased primary market transaction by 41% over 2014 and improved liquidity in its insured paper with the average trading volume exceeding $500 million per day.

"In 2015, we were the insurer of choice for smaller bond issues, bonds in amounts of $10 million or less, leading the industry with 662 transactions totaling $3.4 billion in par insured. Counting secondary market activity, our total 2015 US public finance par insured reached $16.1 billion," Tucker said.

Tucker also said for the fourth quarter of 2015, Assured Guaranty insured 203 new issues to produce an industry-leading par of over $3.2 billion.

"In the secondary market, we increased par insured by 16% and doubled the number of transactions we insured compared to the fourth quarter of 2014. Assured Guaranty's total par insured across both the primary and secondary municipal markets was $3.4 billion in the fourth quarter of 2015," Tucker said.

Build America Mutual insured $9.57 billion in 849 transactions, up from $7.47 billion in 705 transactions, though its market share dropped to 38% from 40.3% the previous year.

"We were pleased to see a strong increase in the use of insurance across the industry, and BAM's growth played an important role in driving that," said Bob Cochran, BAM's chairman. "Our gross par insured reached $23.5 billion by the close of 2015, up more than 80% over the year, and the number of municipal issuer members increased to more than 1,700. Importantly, those consistent results in the market allowed BAM to increase our claims-paying resources in every quarter of 2015."

Cochran said that BAM has now published 2,500 Obligor Disclosure Briefs on the insurer's website, and the number of downloads more than doubled in 2015.

"These credit summaries of every bond issue insured by BAM provide an important and easily accessible source of information for investors and other market participants who want to learn more about the small- and medium-sized issuers that make up BAM's core market," Cochran said.

National Public Finance Guarantee, the municipal arm of MBIA Inc., wrapped $496 million over 22 deals, up from $332 million in three deals during 2014. NPFG started writing new business in the third quarter of 2014. NPFG's market share stayed steady at 1.8% from last year.

"For our growth, we are also diversifying our base. In addition to new deals, there have also been a number of secondary market transactions that we have done," said Tom Weyl, managing director, head of new business development at National. "We are expanding that area, as well. We also did some competitive deals recently. There have been 2 or 3 transactions that were awarded to us, that had little to no spread compared to our competitors. We are positioning ourselves for growth, we are building a base. It's been slow-going, but we'll be well-positioned when interest rates become more favorable."

Weyl said National expects refunding activity to continue even as short term rates go up, as the volume of 2006 and 2007 muni debt with 10-year call dates is significant. He said the company's new business production depends more on longer term rates, which rely on factors beyond Fed rate hikes.

"We ended 2015 with the same basic story. We are building our new business team and expanding our market knowledge. As interest rates raise and we get into a more normal interest rate environment, then bond insurance will have a better chance to compete. In the meanwhile, we have been staffing up and we are now seeing and winning more transactions," Weyl said.

Orrick Again Tops Bond Counsel Rankings

Law firms benefited from last year's growth in the municipal bond industry, as all top 15 firms posted improved par amounts from the prior year. The top firms posted a par amount of $374.53 billion in 12,009 transactions in 2015, compared to $314.22 billion in 10,115 transactions in 2014.

Orrick had a par amount of $37.55 billion in 391 deals, which accounts for 10% of market share. This is an improvement upon the firm's 2014 numbers of $30.38 billion in 321 deals and 9.7% market share.

"We are, of course, pleased to be ranked number one as bond counsel and number one as disclosure counsel, as we have each year for well over a decade," said Roger Davis, chair of Orrick's public finance department. "We attribute our consistent standing at the top of the league tables to the quality of our bond and tax lawyers, the supportive and creative services they provide to our clients, which has led many of those clients to turn to us, repeatedly, for their public finance needs, which is more important to us than the rankings."

Hawkins Delafield & Wood LLP remained in second place from a year ago with $23.08 billion in par amount in 396 issues and 6.2% market share, up from $16.45 billion in 321 issues and 5.2% market share.

"We once again had the most bond volume of any law firm as underwriters' counsel," said Howard Zucker, managing partner at Hawkins. "We are fortunate to have many very loyal clients across the nation; but by 'fortunate', I do not mean 'lucky.' We know that we cannot rest on our laurels; we understand that we have to come to work each and every day to earn and deserve the trust and confidence of our clients. "

Hawkins was the top underwriters' counsel with $17.37 billion in 147 deals, according to Thomson Reuters.

Zucker also mentioned that the trend for many years has been for greater specialization in the bond legal practice. This is a reflection of the increased complexity of municipal bond issues, the highly extensive regime of federal tax regulations, as well as the heightened disclosure expectations of the market and of the SEC.

"Today law firms that want to be active in this field have to be truly dedicated, and have to commit significant resources to have the depth and breadth of expertise in order to be able to advise issuers and others in the navigation of the matrix of issues across the full range of sectors of public finance," Zucker said.

Zucker said Hawkins is now in its 162nd year and has over 135 years acting as bond counsel.

"Three months ago we opened an office in Michigan, our ninth office, and as of Jan. 1, we added three new partners to our ranks. We look forward with excitement and great expectations to 2016 and beyond," he said.

McCall Parkhurst & Horton LLP came in third place with $14.50 billion in 436 deals or 3.9% to remain in third place.

Norton Rose Fulbright jumped to fourth place from seventh, finishing the year with $13.40 billion or 3.6% market share, improving upon 2014's numbers of $8.14 billion and 2.6% market share.

Bob Dransfield, Norton's U.S. head of finance said that he attributes the firms good year to its commitment to client service as well as the favorable interest rate environment that was present in 2015, which enabled Norton to assist its' clients in achieving substantial savings through refundings and restructurings, as well as raising capital for new projects at attractive interest rates.

"We listen to the needs and goals of our clients and work collaboratively with them to help them reach those goals," said Dransfield. "We work hard to understand the business of our clients which enables us to help them evaluate their options in light of their business goals and we work to make sure they understand the alternatives that may be available with any particular financing structure so that their business decisions are based on a complete understanding of the issues."

Kutak Rock LLP rounds out the top five, with $13.33 billion, also a 3.6% market share.

Gilmore & Bell PC, Ballard Spahr LLP, Sidley Austin LLP, Chapman and Cutler LLP, Squire Patton Boggs, Stradling Yocca Carlson & Rauth, Greenberg Traurig LLP, Bracewell & Giuliani LLP, Mintz Levin Cohn Ferris Glovsky & Popeo PC and Chiesa Shahinian & Giantomasi PC round out the top 15.

Davis said that Orrick expects 2016 to be somewhat more challenging, as market activity has been slowing for several months, refundings are becoming fewer, rates are rising, municipal revenues are improving, but slowly and offset by rising pension and OPEB liabilities. He also said that regulation and enforcement are rapidly increasing and changing a market that until recently has been characterized by being largely unregulated and lightly enforced, and this election year, which is always distracting.

"On the other hand, we see activity increasing in specific sectors, like multifamily housing, student housing, health care, charter schools, cultural facilities, public private partnerships, PACE and other alternative energy programs," Davis said. "We are starting 2016 busy and expect that to continue."