Rising interest rates and falling investment returns

The Arizona State Retirement System rolled out a state-authorized

Pinal County, located between Phoenix and Tucson, has a nearly $110 million pledged revenue obligations deal pending to raise money for its contribution.

"ASRS expects other employers to use either excess and typically one-time employer cash, or various funding opportunities to participate in this prepayment program," Paul Matson, the system's executive director, said in a statement.

The program could be a trendsetter, making pension obligation bond issuance related to pension funds structured like the ASRS more feasible, according to an October S&P Global Ratings report.

"For public entities participating in a cost-sharing multiple-employer pension plan, all assets are combined in one trust," Todd Kanaster, S&P's director of municipal pensions, told The Bond Buyer. "That means deposits from a POB would barely benefit the issuer since proceeds would be spread across all participating employers."

Under the ASRS program, a local entity's prepaid funds, including bond proceeds, are kept in a separate account and the entity has the ability to apply that money to their pension obligations or payments at its discretion, according to Steve Murray, a Fitch Ratings analyst.

A majority of public pension funds in the National Association of State Retirement Administrators' database are structured as multi-employer, cost-sharing plans like the Arizona State Retirement System versus multi-employer agent or single-employer plans.

Matson said employers in ASRS maintain flexibility over when they use the prepayments to offset future actuarially required contributions.

"Essentially, the prepayments will earn the ASRS total fund rate of return, and this balance can then be utilized at some future date when the employer may encounter more difficult financial circumstances," he said. "In the meantime, the employer will continue to make their actuarially determined contribution payments."

The system, which has 664 state, county, municipal, school district, university, and community college participating employers, had a market value of $50 billion at the end of fiscal 2021.

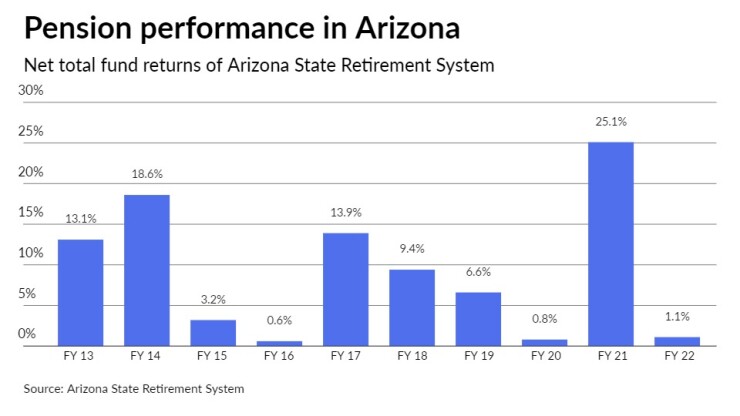

ASRS' fiscal 2022 net total fund returns dropped to 1.1% from 25.1% in fiscal 2021. But

The ability to prefund contributions from surplus money "is probably an overall positive," according to Lisa Washburn, a managing director at Municipal Market Analytics.

"It gives these entities in a multi-employer/cost sharing plan the ability to use money to lower their future contributions with excess cash and the pension plan gets a little benefit from it too via a small reduction in the unfunded liability," she said.

This "arguably good idea goes south" if the governmental entity uses borrowed funds in an arbitrage play, increasing the debt load amid the risk of paying more if investments underperform, Washburn added.

Issuers of taxable POBs seek to lower their unfunded pension liabilities with the expectation that investment returns generated from the proceeds will be higher than the interest rates on the debt. Citing "a considerable investment risk," the Government Finance Officers Association

Kanaster said the risks are generally similar for all POBs.

"Particularly the risk that we note as typically the biggest: market returns right after issuance," he said. "If the market takes a dive not long after issuance, then the issuer will be hard pressed to make up for that loss in the future."

A combination of the Federal Reserve ratcheting up interest rates to battle inflation and stocks and other assets tumbling in value could make POBs even riskier.

The nation's largest public defined pension plans estimated investment returns ranged from negative 9.6% to negative 3.3% in September,

S&P reported last month it expects higher interest rates to suppress POB issuance and that debt sold in the past five years is unlikely to have met investment return expectations.

"Whether or not investment return benchmarks can be realized in the long term, and issuances become profitable, it's important to note that a restructured contribution schedule might still be beneficial to the issuer even if expectations are not fully met," the report said.

With 25 POB deals totaling just over $880 million rated between January and the end of September, S&P said that pace would result in a projected 33 rated deals totaling nearly $1.2 billion this year.

"This would be a 60% reduction in POB issuances and an 85% par reduction from the 78 POB issuances, totaling $7.5 billion, that we rated in calendar 2021," it said.

Pinal County's deal, which is structured with serial maturities from 2023 to 2042 and insured by Assured Guaranty, is pricing through Stifel, which was also the sole underwriter for the Coconino County issue. The debt is backed by a first lien on revenue from the county's general excise and vehicle license taxes, as well as its state shared revenue.

In an emailed response to questions, Pinal County acknowledged interest rates have risen significantly and said it believes ASRS is well-managed and well-positioned to meet its investment targets over the long term.

"We are also taking a conservative approach to the transaction: we will use level debt service, include a par call redemption provision allowing us to take advantage of potential rate declines in the future, and we will only move forward with pricing if borrowing rates meet our targets," the county said.

Pinal County reported an unfunded liability of $117.4 million at the end of fiscal 2021, according to the preliminary official statement. The county said its share of ASRS liability represents the most expensive liability on its balance sheet.

"Prepaying allows us to prospectively reduce the cost of the liability to the rate of our debt while providing a lot of flexibility by virtue of how we can adjust our usage of our prepayment balance over time," the county said.

In September, Coconino County's pledged revenue obligations, rated AA by both Fitch and S&P, were priced with yields on serial maturities ranging from 4.073% in 2023 to 5.508% in 2037. Term bonds fetched yields of 5.494% in 2040 and 5.594% in 2043.

Bondholders have a first lien on the county's revenue from general excise and vehicle license taxes, state shared revenue, and payments in lieu of taxes – a federal program that compensates local governments for property tax base reductions and services associated with the presence of federally owned land.

The county, which also answered questions via email, said it looked at the past 45 years of ASRS's investment returns on a rolling 25-year basis as part of its risk assessment.

"In each period, ASRS returns exceeded the actuarial rate," the county said. "While we recognize this does not predict the future, even during the worst period which included numerous recessions and shocks, the 25-year average rate of return was 7.25%."

It added the anticipated present value savings will depend on how it chooses to take offsets against the contributions, noting the county "is planning to defer taking offsets initially to maximize investment return, and our current (present value) savings estimate is $10.3 million and over 19% of par."

In 2021, Coconino County sold $18.16 million of debt and Pinal County sold $89 million of debt in 2020 to make additional contributions to the Arizona Public Safety Personnel Retirement System, which as a multi-employer agent plan is structured differently than ASRS with each employer having its own plan cost.