Alabama’s goal to replace the old and overcrowded state prisons at the center of a long-running legal battle will get a financial boost from an $850 million public-private partnership bond deal this week.

The Public Finance Authority of Wisconsin will serve as the conduit issuer for the Alabama Department of Corrections’ project to build two prisons for male inmates. The jails will be owned by a private company and provide almost 7,000 new beds.

The deal tentatively consists of about $635 million of Series 2021A taxables to be sold in a public issuance in compliance with Rule 144a of the Securities Act to qualified institutional buyers and around $215 million of Series 2021B taxables that are going into the private placement market with institutional investors, in compliance with Section 4(a)(2) of the Securities Act.

Barclays Capital is lead manager on the Series 2021A senior secured taxable private-activity revenue bonds and is expected to price the deal on Thursday. KeyBank Capital Markets and Stifel are co-managers.

ADOC will lease the jails and the state will provide funds to pay off the loan on the prisons, which will be owned by CoreCivic Inc., the project’s sponsor on two of the three jails to be built. Under the lease agreements with the state, ADOC is responsible for the day-to-day operations of the prisons, including security and managing the inmates and employees.

The developers will buy the land and design, build, finance and maintain the correctional facilities that ADOC will lease and staff. They will also provide infrastructure maintenance and facility life-cycle replacement over the 30-year term of the leases on sites in Elmore, Escambia and Bibb counties. The construction will replace 11 facilities, most of which are over 30 years old, and ADOC is expected to refurbish up to four more existing prisons.

This week’s deal will help finance the two prisons that CoreCivic will own in Elmore and Escambia counties.

The third jail will be built in Bibb County with about 3,000 new beds and the state is in talks with another developer, Alabama Prison Transformation Partners, about that site. When that is completed, it will boost the total of new spaces for inmates to 10,000.

ADOC operates about 15 correctional facilities across the state that hold around 20,000 inmates in seriously overcrowded conditions. These new prisons will allow for the closure of about half of those crumbling facilities and alleviate some of the problems that have been facing the system as well as provide new programs and services.

“The project will materially improve the quality of life for inmates with improved mental health, physical health, education, rehabilitation programs and religious services as well as improved efficiency, resiliency and sustainability of the prison facilities,” according to the investor roadshow.

The Series 2021A fixed-rate taxables are tentatively structured as serial bonds running from 2025 to 2036 with term bonds in 2041 and 2054.

ADOC is the lessee. Government Real Estate Solutions of Alabama Holdings LLC is the borrower, Government Real Estate Solutions of Central Alabama LLC is the Elsmore County lessor and Government Real Estate Solutions of South Alabama LLC is the Escambia County lessor. UMB Bank NA is trustee and KeyBank NA is the collateral agent.

The issuer’s counsel is von Briesen & Roper s.c., Ballard Spahr LLP is bond counsel. Chapman and Cutler LLP is the initial purchasers’ counsel, Maynard, Cooper & Gayle PC is counsel to ADOC, Butler Snow LLP is the borrower’s local counsel, BTY US LLC is the lenders technical advisor and Logino Public Finance LLC is the trustee’s counsel.

The bonds are rated A3 by Moody's Investors Service and A-minus by S&P Global Ratings. Both agencies have stable outlooks on the credit.

ADOC is a department of the state of Alabama and not a separate legal entity and its debt is an obligation of the state. ADOC’s revenues are provided by annual state appropriations. Alabama's general obligation bonds are rated Aa1 by Moody's, AA by S&P and AA-plus by Fitch Ratings. All three assign stable outlooks on the GOs. As of Sept. 30, 2019, the state had about $723 million of outstanding GOs.

The state is facing two class-action lawsuits and two U.S. Department of Justice finding letters for poor conditions at the prisons, according to the preliminary official statement.

In early 2019, U.S. District Judge Myron H. Thompson ruled ADOC had indeed violated the Eighth Amendment. Later that year, the Department of Justice notified the governor that its attorneys had reason to believe that Alabama’s prisons routinely violated the rights of prisoners and said the suspected violations were exacerbated by “serious deficiencies in staffing and supervision and overcrowding.”

In 2020, DOJ said there was reasonable cause to believe conditions at the state’s prisons violated the Eighth Amendment of the Constitution because male prisoners were subjected to excessive force by prison staff. DOJ then gave ADOC written notice of its allegations and the minimum remedial measures it said were needed to address them.

“As evidence of the seriousness with which we have taken the DOJ’s allegations, the state is undertaking efforts to construct three new men’s facilities that we believe, and the DOJ has conceded, will have a significant positive impact on many of the areas of concern that the DOJ has identified,” Alabama Attorney General Steve Marshall said at the time.

Moody’s said its A3 rating reflects the project's standard P3 framework and project structure. It noted, however, that the highly supportive termination plan with full debt repayment in all scenarios was much better than standard. Moody’s said the risks of political sensitivity, future consolidation of inmates away from the facilities or closure of the facilities were mitigated by the favorable termination payment regime.

“The rating acknowledges the project's essentiality in the state's effort to reduce prison overcrowding comply with U.S. constitutional (Eighth Amendment) requirements and remedy violations alleged by the U.S. Department of Justice. At completion, the two prison facilities will represent about 40-50% of the state's rated bed capacity.”

S&P said the A-minus rating was based on its view “the project's insolvency risk during construction is shifted from the project to the Alabama Department of Corrections through the use of a unique prepayment mechanism. It also reflects our view that the project's responsibilities to maintain the facilities are simple and consistent with other building-type social accommodation projects.”

The project is also using environmental, social and governance criteria to create a safe and secure environment for the inmates, provide better health care services and improve the working conditions for the staff while improving the physical infrastructure of the facilities, according to the POS.

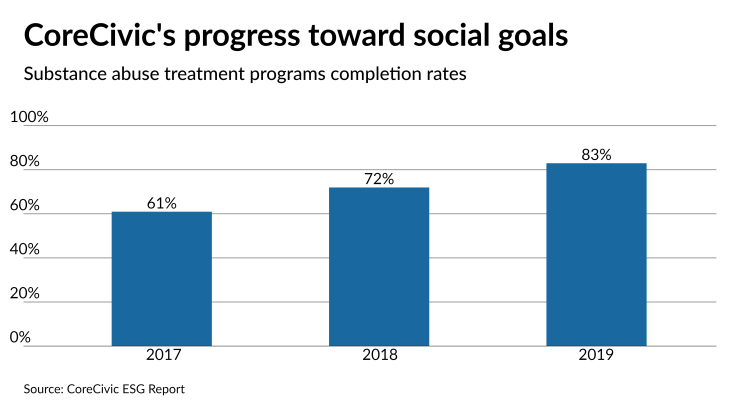

CoreCivic, independent of the project, plans several programs at the jails to lower recidivism among the prisoners, such as substance abuse and disorder treatment, job training and education programs.