A California healthcare issuer came to market with a multi-billion dollar offering on Tuesday as municipal bonds weakened in secondary trading.

Primary market

Goldman Sachs priced and repriced the California Health Facilities Financing Authority’s $2.12 billion of Series 2017A revenue bonds for Kaiser Permanente.

Traders and analysts said the deal attracted much attention.

"Pricing was good for Kaiser, " said Alan Schankel, municipal analyst at Janney Capital Markets. "I suspect demand was strong due to [its] unique structure within the tax-free space,"

The $408.74 million of Subseries 2017A-1 green bonds were priced as 5s to yield 2.55% in 2027.

The $1.33 billion of Subseries 2017A-2 fixed-rate bonds were priced as 4s to yield 3.83% in 2038, as 4s to yield 3.95% in 2044, as 5s to yield 3% in 2047 and as 4s to yield 4.03% in 2051.

The $75.39 million of Series 2017B mandatory put bonds were priced as 5s to yield 1.85% in 2029 with mandatory put in 2022.

The $175.76 million of Series 2017C mandatory put bonds were priced as 5s to yield 1.85% in 2031 with mandatory put in 2022.

The $128.32 million of Series 2017D mandatory put bonds were priced as 5s to yield 1.85% in 2032 with mandatory put in 2022.

“The deal was very cheap [in my opinion]," said one New York trader. "They bumped it between seven to 10 basis points on the longer end.”

The deal is rated AA-minus by S&P Global Ratings and A-plus by Fitch Ratings.

Schankel said there are some unique aspects to the deal and to the issuer.

"Despite 38 hospitals, [Kaiser] is more of an insurance program, which offers investors diversification not easy to find in the tax-free space," he said. "Kaiser has less exposure to the uncertainty from potential federal cutbacks in some future 'repeal and replace' effort or other potential federal budget reductions."

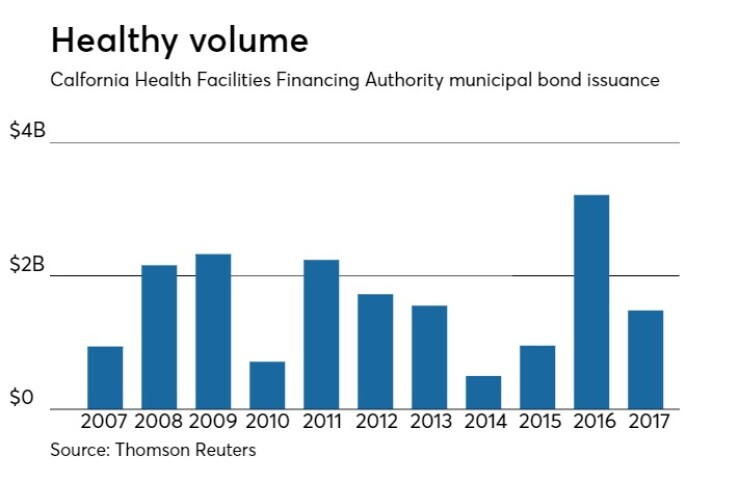

Since 2007, the California HFFA has sold more than $18 billion of securitie,s with the largest issuance occurring last year when it came with $3.21 billion. The authority has only issued less than $1 billion four times, with the lowest year of issuance in the period in 2014.

Wells Fargo Securities priced the Port Authority of New York and New Jersey’s $694.74 million of tax-exempt consolidated bonds on Tuesday for retail investors ahead of the institutional pricing on Wednesday.

The $250 million of 200th Series bonds not subject to the alternative minimum tax were priced for retail as 5s to yield 2.38% in 2027, 2.50% in 2028, 2.70% in 2030 and to yield from 2.98% in 2034 to 3.11% in 2037, 3.23% in 2042, and 3.30% in 2047. No retail orders were taken in the 2057 maturity.

The $444.74 million of 202nd Series bonds subject to the AMT were priced for retail as 5s to yield 1.43% in 2020 to 3.43% in 2037. The 2017 and 2018 maturities were offered as sealed bids. No retail orders were taken in the 2024 maturity, or split halves of the 2029 and 2030 maturities, or in the 2031, 2032 maturities.

The deal is rated Aa3 by Moody’s Investors Service and AA-minus by S&P and Fitch.

Siebert Cisneros Shank priced and repriced Atlanta’s $226.82 million of Series 2017A water and wastewater revenue refunding bonds.

The issue was repriced to yield from 1.27% with a 5% coupon in 2020 to 1.96% with a 5% coupon in 2024 and from 2.56% with a 5% coupon in 2028 to 3.61% with a 3.50% coupon in 2039.

The deal is rated Aa2 by Moody’s, AA-minus by S&P and A-plus by Fitch.

In the competitive arena on Tuesday, Rhode Island sold $158.95 million of general obligation bonds. Bank of America Merrill Lynch won the bonds with a true interest cost of 2.94%.

The $91 million of Series A consolidated capital development loan of 2017 bonds were priced to yield from 1% with a 5% coupon in 2018 to 3.31% with a 5% coupon in 2037.

The $67.95 million of Series B consolidated capital development loan of 2017 refunding bonds were priced as 5s to yield 1.93% in 2024 and from 2.27% in 2026 to 2.72% in 2031.

The deal is rated Aa2 by Moody’s and AA by S&P and Fitch.

The Hayward Unified School District, Calif., competitively sold $134 million of Series 2017 election of 2014 GOs. BAML won the bonds with a TIC of 3.71%.

The issue was priced to yield from 0.90% with a 3% coupon in 2018 to 3.43% with a 4% coupon in 2034; a 2037 maturity was priced as 3 1/2s to yield 3.66%, a 2039 maturity was priced as 4s to yield 3.66% and a 2042 maturity was priced as 4s to yield 3.70%.

The deal is rated A-plus by S&P and AAA by Fitch. The deal was insured by Assured Guaranty Municipal.

Secondary market

The yield on the 10-year benchmark muni general obligation rose four basis points to 2.13% from 2.09% on Monday, while the 30-year GO yield gained five basis points to 3.00% from 2.95%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were weaker on Tuesday. The yield on the two-year Treasury rose to 1.27% from 1.23% on Monday, while the 10-year Treasury yield gained to 2.33% from 2.27%, and the yield on the 30-year Treasury bond increased to 2.98% from 2.92%.

The 10-year muni to Treasury ratio was calculated at 91.5% on Tuesday, compared with 91.9% on Monday, while the 30-year muni to Treasury ratio stood at 100.6%, versus 100.7%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 38,130 trades on Monday on volume of $8.64 billion.