-

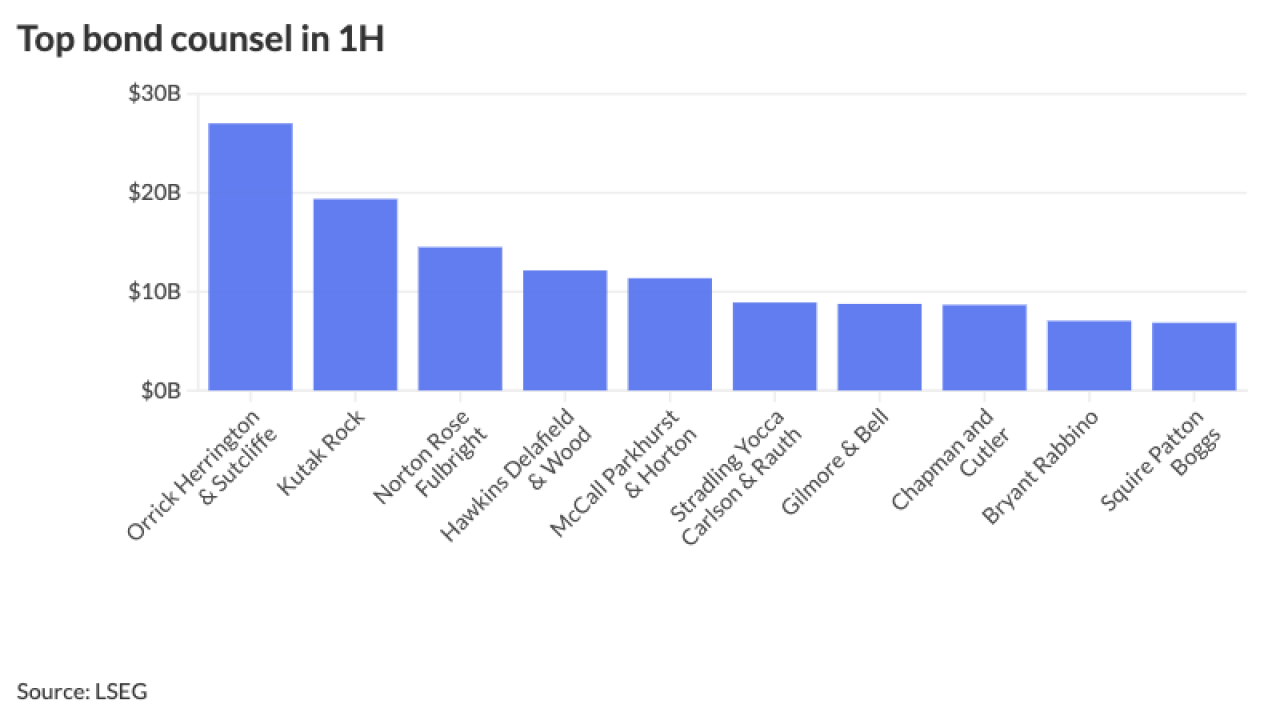

The top five featured in the ranking handled deals totalling more than $84 billion in par value.

July 25 -

The airport, also selling $412.8 million of new money, will join a bevy of issuers who have deployed a tender offer in the hope of realizing refunding savings.

July 25 -

Investors added $571.5 million from municipal bond mutual funds in the week ended Wednesday, following $224.6 million of outflows the prior week, according to LSEG Lipper data.

July 24 -

Port Freeport's decision to go property tax-free resulted in a revenue bond rating downgrade from S&P and raised disclosure questions.

July 24 -

The fund's sell-off in June shows the challenges of accurate pricing in the high-yield muni market.

July 24 -

Larger dealer networks lead to lower markups, but smaller networks show evidence of potential collusion and market manipulation, the paper said.

July 24 -

The toll revenue bonds, subject to federal alternative minimum tax, will be issued through the Wisconsin-based Public Finance Authority.

July 24 -

Longer-term munis have become more attractive, said Cooper Howard, a fixed income strategist at Charles Schwab.

July 23 -

An academic paper presented at the Brookings Institute's annual conference found that future wildfire risks are already having economically significant impacts on financial markets, municipal borrowing costs and vulnerable communities.

July 23 -

Why more issuers are opting for the tender offer. San Francisco PUC's Nikolai Sklaroff lays it out for Bond Buyer Senior Infrastructure Reporter Caitlin Devitt.

July 22