-

Issuance year-to-date is at $505.245, just shy of 2024's record of $507.585 billion, with $11.109 billion of supply on the calendar for the week of Nov. 17.

November 14 -

The Fargo-Moorhead Metropolitan Area Flood Risk Management Project had a deadline Friday for bondholder consent to a settlement resolving construction disputes.

November 14 -

Negative rating and outlook revisions for U.S. K-12 public school districts rose markedly from 2024 to 2025, according to S&P Global Ratings.

November 14 -

For munis, the end of the shutdown helps steady the backdrop, said James Pruskowski, an investor and market strategist.

November 13 -

Rural providers face $137 billion in federal Medicaid cuts from the One Big Beautiful Bill Act.

November 13 -

Multi-layered state oversight, strict fiscal safeguards and durable revenue pledges support New York City GO and TFA bonds even as investors brace for policy shifts under mayor-elect Zohran Mamdani.

November 13 The Bond Buyer

The Bond Buyer -

The Florida county is in the midst of executing a $9 billion capital improvement plan.

November 13 -

"Continuing yield stability ... suggests a comfortable market that, even with the shutdown apparently close to ending, may resist/lag potential price/yield changes in taxables," said Matt Fabian, president of Municipal Market Analytics.

November 12 -

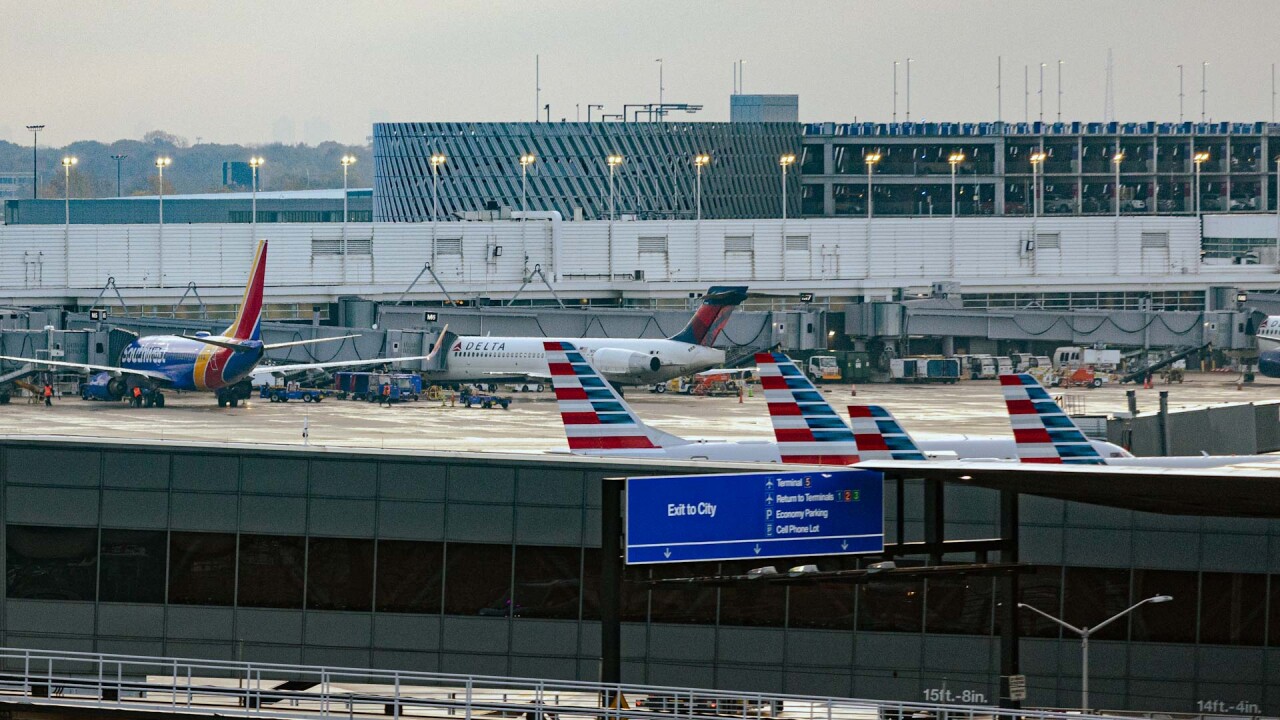

The airport's sprawling capital improvement program is expected to total $11.5 billion over the next decade, $9 billion of it bond funded.

November 12 -

Some of the most active sectors have been education (+29%), GOs (+17%) and healthcare (+17%), said Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

November 10