-

Justices appeared open to narrowing the scope of federal environmental impact reviews during oral arguments on a bond-financed Utah railway to move crude oil.

December 17 -

As investors start shutting down for the year, there may be some mixed sessions ahead "especially for any accounts that find themselves as forced sellers," Birch Creek Capital said.

December 16 -

Overall state and local government credit conditions will remain neutral, Fitch Ratings says, though some storm clouds may be on the horizon.

December 16 -

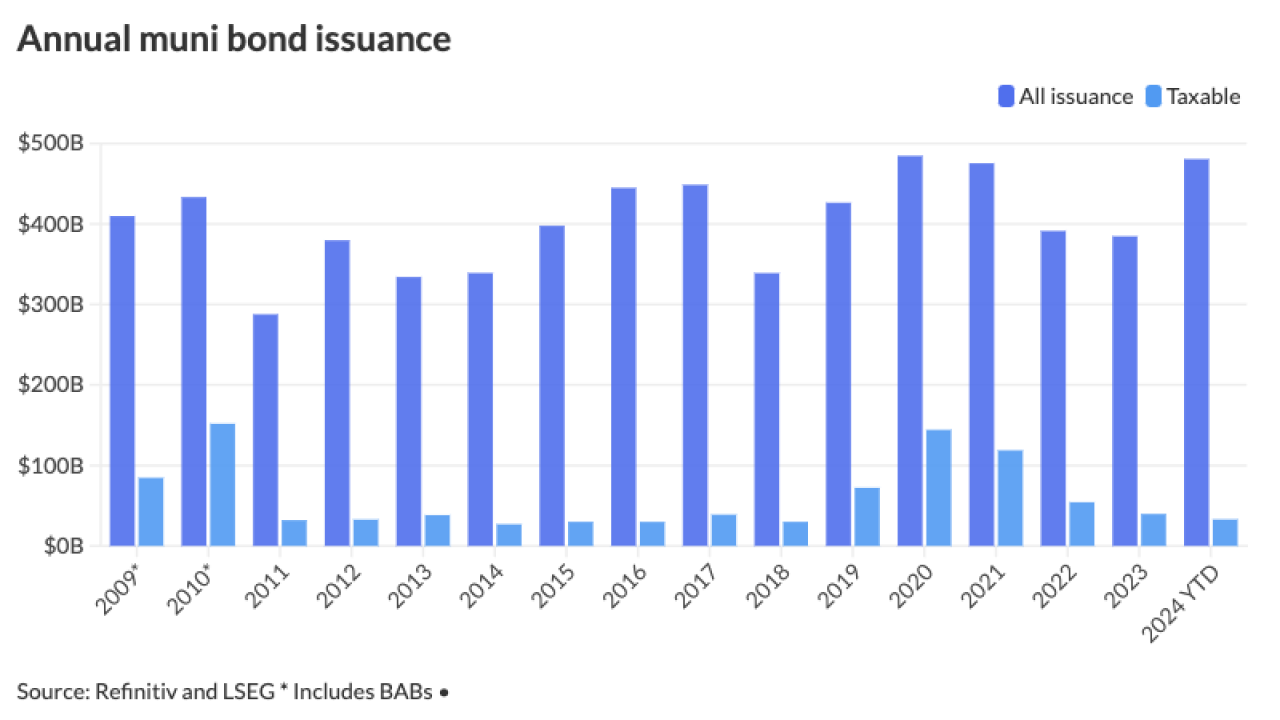

Supply falls ahead of the final Federal Open Market Committee meeting of 2024 and the holidays but issuance still breaks records. The lighter calendar should provide support for the secondary market in the final weeks of the year.

December 13 -

The face amount of munis outstanding rose to $4.171 trillion, a 0.8% increase from Q2 2024 and 2.9% from Q3 2023, according to the latest Fed data.

December 13 -

Something less than $400 million of the bonds will be taxable bonds.

December 12 -

Muni mutual funds saw outflows after 23 weeks of inflows as LSEG Lipper reported investors pulled $316.2 million for the week ending Dec. 11. High-yield municipal bond funds, though, saw inflows of $192.3 million.

December 12 -

Most on the Street expect issuance to come in around $500 billion, but a few think volume will be much higher, primarily because of potential changes to the tax exemption. Most firms expect refunding volumes to also grow in 2025.

December 12 -

Municipal investors are more focused on the final new-issues coming down the pike and repositioning books as 2024 heads to a close. ICI reported another week of inflows into municipal bond mutual funds.

December 11 -

Wednesday marks the 10-year anniversary of Detroit's exit from bankruptcy. Its Chapter 9 declaration in 2013 was the largest municipal bankruptcy in the U.S.

December 11