-

Both 10-year transportation funding plans proposed by Minnesota Gov. Mark Dayton include $2 billion of road bonds.

May 17 -

Despite House Republican threats of criminal prosecution, the District of Columbia Council will hold the first of two votes Tuesday that would give the district budget autonomy and the ability to spend its local tax and fee revenues without annual congressional appropriation.

May 16 -

Merrill Lynch, Pierce, Fenner & Smith, a subsidiary of Bank of America, was ordered to pay $422,708 in fines and restitution by the Financial Industry Regulatory Authority for charging customers excessive markups and markdowns on municipal securities.

May 16 -

Minnesota Gov. Mark Dayton will propose a compromise transportation funding bill to resolve a legislative deadlock.

May 16 -

The next president and new Congress have an opportunity to reverse the ongoing decline in the nation's aging infrastructure.

May 16 -

Facing new federal constraints on tax-exempt debt for projects with a private revenue stream, El Paso County, Texas, refunded tax-exempts with taxable bonds and still achieved interest rate savings.

May 13 -

The Indianapolis Airport Authority said this week that it has agreed to settle a dispute with the Internal Revenue Service over rebate liability in connection with $347 million of tax-exempt bonds, even though it disagrees with the IRS' position on the bonds.

May 11 -

A California authority and a high school district said this week that they are prepared to file a protest and appeal of an expected Internal Revenue Service proposed adverse determination that $25.4 million of tax-exempt variable rate demand bonds are taxable.

May 10 -

With the House Natural Resources Committee planning to release a new Puerto Rico bill on Wednesday and vote on it a week later, Treasury Secretary Jack Lew traveled to the commonwealth to hold meetings to drum up support for a legislative solution.

May 9 -

Colorado Senate has approved a $3.5 billion road note package that could go to voters in November.

May 6 -

Municipal industry experts on Thursday urged analysts to continue focusing on how the presence of statutory liens can change the treatment of debt in bankruptcy proceedings and ratings analyses.

May 6 -

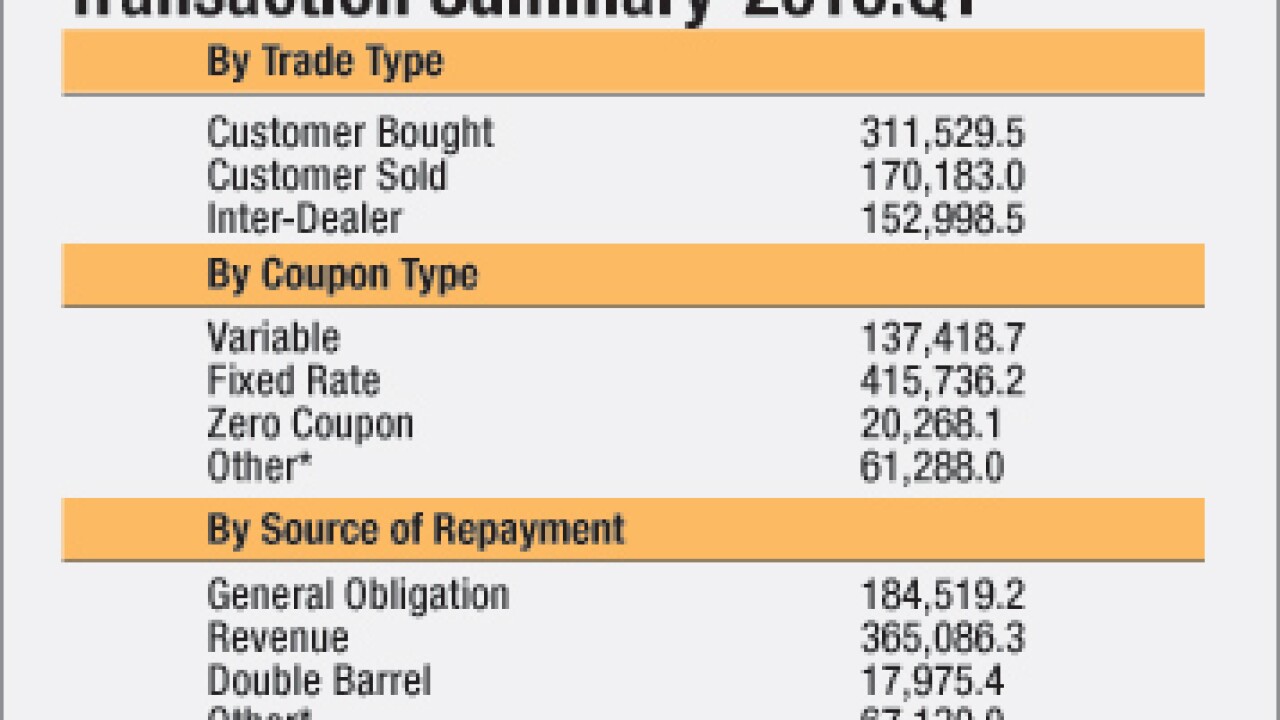

The par amount and number of municipal securities trades rose in the first quarter of this year, compared to both the previous and same quarters last year, according to Municipal Securities Rulemaking Board statistics posted Thursday. But the number of continuing disclosure documents received dropped to 46,623 in the first quarter of this year from 47,934 during the same period last year.

May 5 -

A regulatory official and market participants sparred over the merits of the Securities and Exchange Commission's voluntary continuing disclosure enforcement initiative during a panel here on Wednesday while acknowledging the need to improve municipal disclosure.

May 5 -

U.S. Treasury Secretary Jack Lew said concern for the people of Puerto Rico is the primary reason he wants lawmakers to adopt restructuring legislation for the commonwealth.

May 4 -

Dustin McDonald, the current director of the Government Finance Officers Associations federal liaison center, is leaving GFOA on Friday to lead the marijuana technology company Weedmaps government relations practice.

April 28 -

In a near unanimous vote, the Senate Environment and Public Works Committee on Thursday passed a bill that includes $1.4 billion in federal funding for Flint, Mich. as well as any other community facing a water crisis.

April 28 -

After having been withdrawn from the energy bill in the Senate, controversial legislation to provide federal funds to Flint, Mich., and any other community facing a water crisis, has been included in a major water bill introduced in the chamber this week.

April 27 - Washington

Standard & Poors Ratings Services this week revised its outlook to negative from stable on both the District of Columbias bonds outstanding issued for National Public Radio (NPR) and on its issuer credit rating for the media organization.

April 22 -

The Internal Revenue Service is preliminarily challenging the tax-exempt status of bonds issued by the District of Columbia as part of a much lauded public-private partnership to build a new elementary school.

April 20 -

A recent Superior Court ruling, a pending district lawsuit and a renewed push for statehood have all set the stage for a budget showdown in the nations capital this fall.

April 20