-

The weirdness of this storm adds yet another layer of complexity to the vexing problem of coping with climate change.

September 3 -

July volume was $31.9 billion keeping the annual pace ahead of last year's record-breaking total. Issuance still lags demand by a large amount — $60 billion by many accounts for August alone — as redemptions coupon payments pile up.

July 30 -

Goldman Sachs is lead managet for the issuance, which includes tax-exempt and taxable bonds.

July 26 -

The agency must still pay the commonwealth due to 2007 legislation that went sideways.

July 21 -

Even with a 23.3% year-over-year drop in May, with five months now officially in the books, long-term muni volume stands at $169.45 billion, ahead of the $157.96 billion issued in 2020.

May 27 -

Incumbents Bill Peduto and Eric Papenfuse were unseated, the Allentown race is too close to call and constitutional amendments to curb a governor's emergency powers appear headed to victory.

May 19 -

Voters will decide on constitutional amendments regarding the length of time a governor can implement a disaster declaration without legislative consent.

May 14 -

Pennsylvania's competitive GO deal saw its yields fall further from recent trading while the North Texas Tollway Authority benefited from positive credit news on the transportation sector and repriced 25 basis points lower. ICI reported another round of $2-billion-plus inflows.

May 5 -

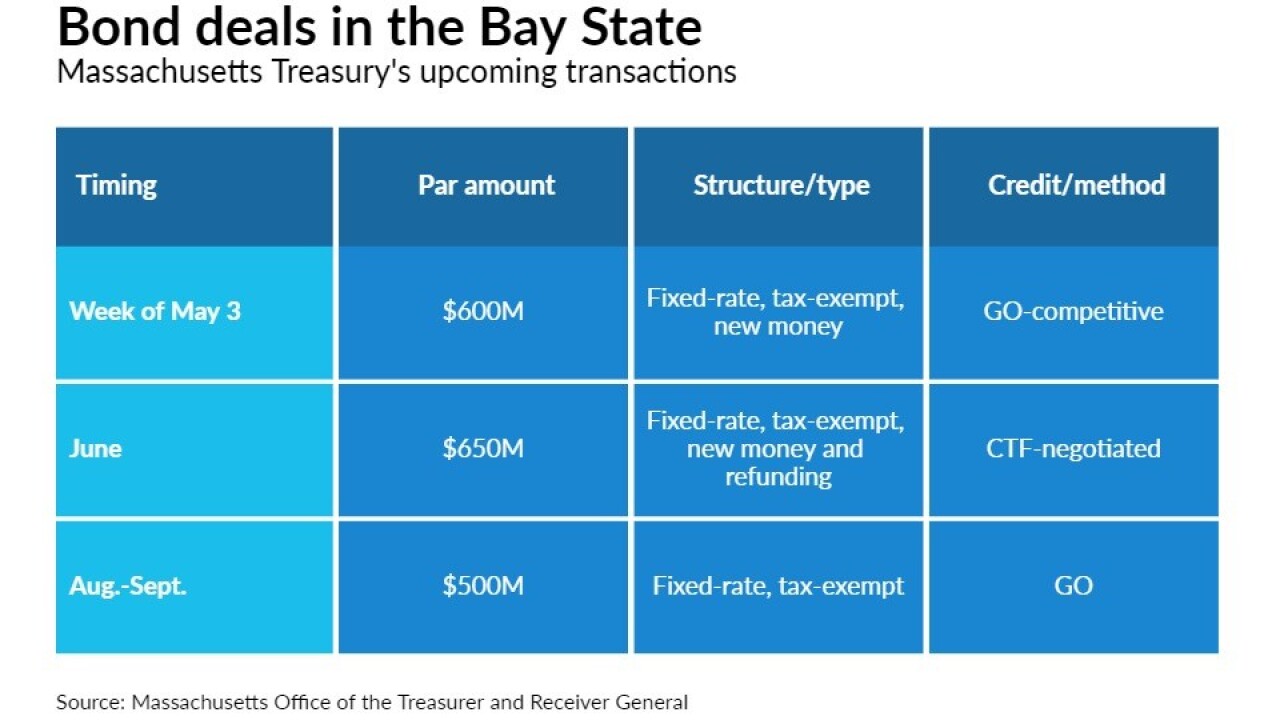

The states intend to come to market with $600 million and $1 billion, respectively, bringing state GO credits in an improving credit environment that has held yields down.

May 3 -

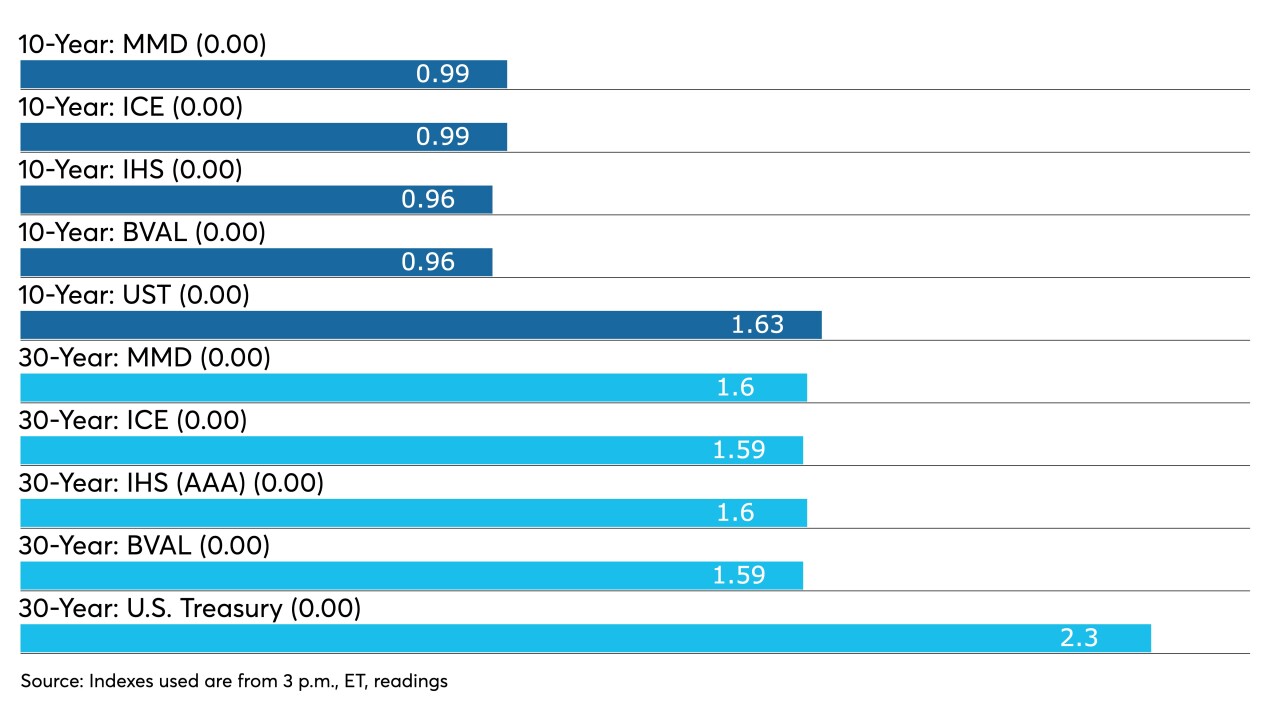

Rates, ratios and credit spreads have munis entering May on solid footing, though some pressures due to tax season and rising U.S. Treasuries remain.

April 30