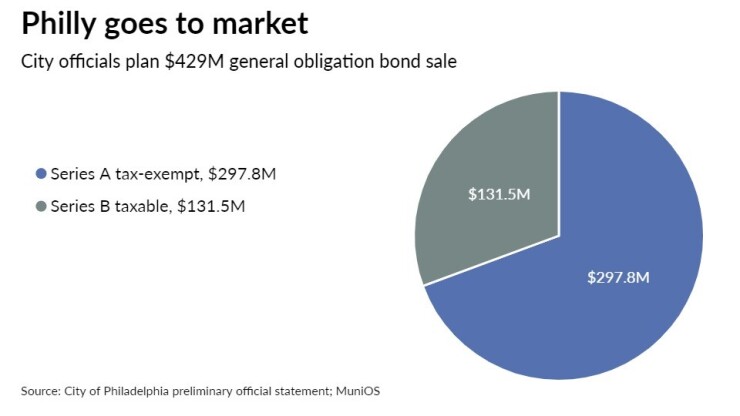

Armed with a revised outlook to stable from Fitch Ratings, Philadelphia plans to issue roughly $429 million of Series 2021 general obligation bonds on Tuesday.

Goldman, Sachs & Co. is the senior manager.

The negotiated sale will feature $297.8 million of Series A tax-exempt bonds for the city’s capital program, and $131.5 million of Series B taxables, with a portion to refund a Series 2014A issuance.

Maturities will run through 2042 and 2038 for Series a and B, respectively.

Fitch, which rates Philadelphia GOs A-minus, said its revision from negative reflects reduced exposure to short-term fiscal disruption from COVID-19. The city’s $1.4 billion, or about 30% of its general fund revenue, through the federal American Rescue Plan Act, “affords the city time to achieve revenue recovery and/or rebalance spending to weaker revenue levels without depleting reserves,” Fitch said.

The city received half its ARPA allocation in May and will get the balance in May 2022.

All three major bond rating agencies have Philadelphia at stable. S&P Global Ratings and Moody’s Investors Service rate the city A and A2, respectively.

Philadelphia has roughly $3.5 billion of debt outstanding and expects to amortize 71% of its debt within 10 years. Nearly 96% of its debt is fixed-rate.

“It is a good sign to see Fitch revised the city's outlook and increase it to stable,” said David Fiorenza, a Villanova School of Business professor.

“Philadelphia is dependent on a large majority of its wage taxes from workers who reside outside the city limits. As more workers are staying home to work, this will have an impact on tax revenues, lease agreements, and all businesses that depend on city workers.”

Restaurants and bars will eventually need to adjust their hours and staffing, Fiorenza added, and city services may need adjusting to reflect the reductions in tax collections.

Philadelphia, the sixth-largest U.S. city, estimates that workers outside the city, including New Jersey, generate 40% of wages and 13% of general fund revenues. It expects that 15% of commuters will continue to work remotely post-pandemic.

Federal money helped fill gaps in the just-passed $5.3 billion fiscal 2022 budget, up 7% over the previous year. Employee benefits include a full annual pension contribution and a reallocation of pension costs among funds. Targeted restorations include mental health and police.

Philadelphia budgeted $575 million of its ARPA funds for fiscal 2022. According to Fitch, the city plans to use the funds to fill gaps until revenues fully recover from the pandemic, and expects to reach structural balance by December 2024, when it must use up its ARPA funds.

The city between 2011 and 2019, leading up to the pandemic, boosted its reserves from $92,000 to $439 million, or 9% of expenses.

PFM and Phoenix Capital Partners are the financial advisors for the sale.