-

LSEG Lipper reported fund inflows of $63.8 million for the week ending Wednesday following $300.5 million of inflows the prior week. High-yield saw its 11th consecutive week of inflows at $180.4 million, down from $278.6 million the week prior.

March 21 -

The New York MTA has not sold fixed-rate transportation revenue bonds since February 2021. The first maturity of that deal (4% 11/15/44) priced at +81 and was evaluated at +78 as of Wednesday by BVAL, according to CreditSights strategists. The same maturity but with a 5% coupon was priced at +59 to BVAL.

March 18 -

Municipal bond buyers looking for yield need look no further than the OTB's non-rated tax-exempt revenue bond deal that's set to be priced this week.

March 18 -

"While rate volatility returned this week, should the market return to range-bound levels for a protracted period of time, investors might want to add exposure to sectors that provide the most value and have underperformed thus far," Barclays said.

March 15 -

"This upgrade from Fitch reflects the continued growth of confidence in the MTA's sustainable financial strength, bringing tangible benefits when we look to finance critical transit projects," said MTA Chair and CEO Janno Lieber.

March 7 -

The New York Metropolitan Transportation Authority and the Triborough Bridge and Tunnel Authority are planning several note and bond sales this month as well as several remarketings, the MTA said.

March 6 -

The city has again proven to have a resilient economy, with better than budgeted revenues, said Howard Cure, a partner and director of municipal bond research at Evercore Wealth Management LLC.

March 5 -

The city and its related issuers picked financial advisors to work on upcoming bond deals, including GO issuances, TFA deals and water authority sales.

March 4 -

Mr. Fish worked at Bankers Trust Co., Donaldson, Lufkin, & Jenrette and ABN Amro and had served as a chair of the Municipal Analysts Group of New York and been a president of the Society of Municipal Analysts.

March 4 -

High rates and high inflation, coupled with rich reserves, pushed off or delayed issuers coming to market in 2023, noted James Pruskowski, chief investment officer at 16Rock Asset Management.

March 1 -

Legal challenges to congestion pricing tolls may delay much-needed repairs to the city's transit system, the Metropolitan Transportation Authority said.

February 28 -

Public finance lawyers Alison Radecki and Helen Pennock, who come to the firm from Orrick, Herrington & Sutcliffe, will work of of the New York City office.

February 28 -

Based in New York City, Ted Hynes has almost 40 years of experience in the fixed-income markets, the last 15 at Raymond James.

February 26 -

The bonds are rated Aa2 by Moody's Investors Service, AA by S&P Global Ratings and Fitch Ratings and AA-plus by Kroll Bond Rating Agency. All four rating agencies have a stable outlook on the credit.

February 26 -

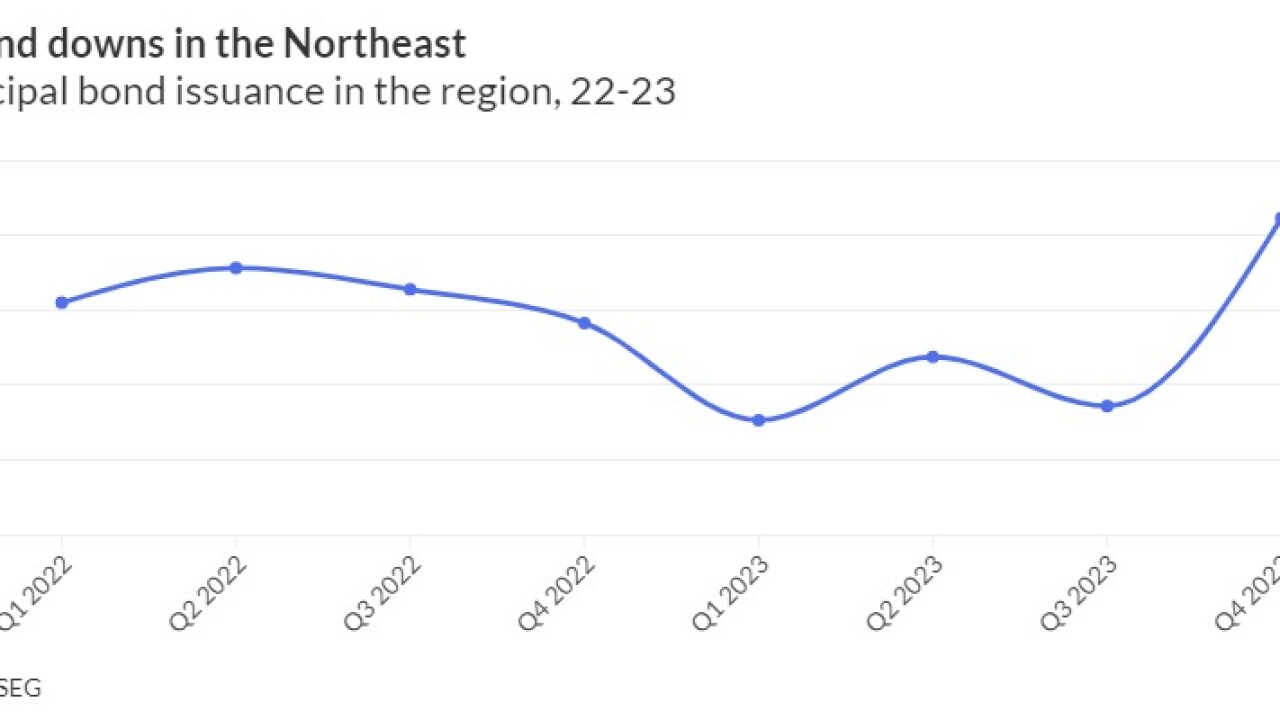

An off year from municipal bond issuers in the Northeast in 2023 pulled the national volume numbers into negative territory.

February 26 -

Robert Poole, a leading expert in the U.S. public-private partnership transportation sector, joins infrastructure reporter Caitlin Devitt to talk about upcoming deals including toll lanes and bridges in the Southeast and high speed rail in the West as well as states that are advancing P3s and action on the federal front. (37 minutes)

February 20 -

Meanwhile in New York, the state doubles down on climate investments and restricts investments in some big oil and gas companies as the city blasts several big banks as they pull out from the Climate Action 100+ initiative.

February 16 -

The value of the fund rose from the $246.3 billion reported in the second quarter while returns improved to 6.18% in the third quarter from negative 1.59% in the prior period.

February 13 -

Jackie Wells, a former FINRA enforcement director, is the second leader from the industry's self-regulating body to join the firm in recent months.

February 7 -

Thomas DiNapoli criticised the agency for failing to include projected costs associated with needed system repairs in its 2023 20-Year Needs Assessment.

February 5