-

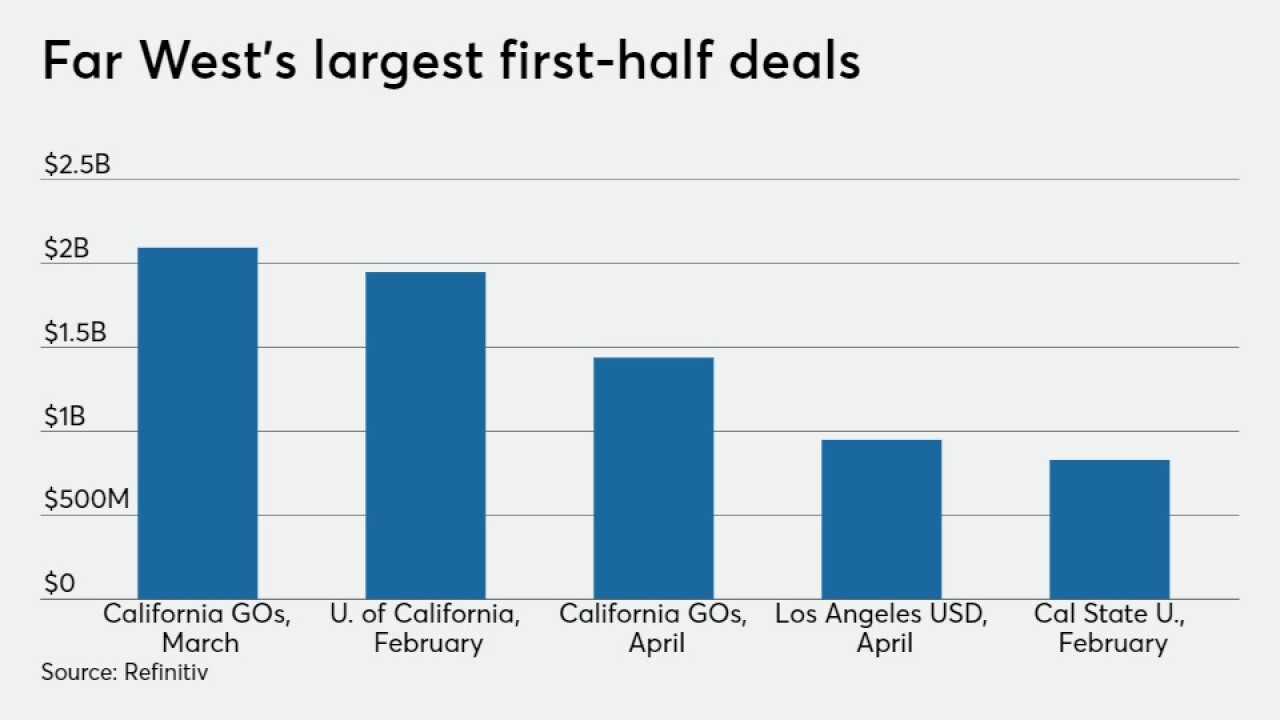

Municipal issuers in the Far West sold $38.7 billion in bonds during the first six months of 2020, 8.8% more than they did the year before.

August 27 -

Citing market turmoil from the pandemic, a California conduit issuer gave the Virgin Trains USA project a five-month extension to sell $3.25 billion of debt.

June 29 -

Moody's action on Aa1-rated Nevada follows a Fitch Ratings outlook cut to negative three weeks ago as the coronavirus hammers a tourism based state economy.

June 2 -

Fitch Ratings downgraded Las Vegas a notch to AA-minus

May 12 -

Nevada was one of the last states to recover from the Great Recession

April 24 -

AA-rated Las Vegas saw its outlook revised to negative by S&P Global Ratings with casinos shuttered and visitors absent.

March 30 -

Issuers in the Far West sold $85 billion of municipal bonds in 2019, a 23% increase from 2018.

February 27 -

Fitch Ratings raised the Las Vegas suburb to BBB-minus from BB, with a stable outlook.

January 31 -

The California Debt Limit Allocation Committee wants more information on the request for $600 million of private activity bond allocation.

January 16 -

S&P Global Ratings elevated Nevada's rating to AA-plus, two days after a Moody's upgrade.

November 11 -

Moody's Investors Service upgraded $1.2 billion of general obligation bonds to Aa1 from Aa2.

November 5 -

The California Infrastructure and Economic Development Bank agreed to issue $3.25 billion for the proposed line linking Vegas and Victorville, California.

October 25 -

The soccer league's drive for expansion pushed cities and owners to develop new stadiums to sweeten their bids.

September 26 -

Issuers in the nine-state Far West region sold $34.6 billion of municipal bonds in 2019's first six months.

August 22 -

The company behind the nation’s first privately owned intercity passenger railway in more than a century is seeking approval from California and Nevada to raise as much as $3.6 billion in tax-exempt bonds for a high-speed train linking southern California to Las Vegas.

July 26 -

Record inflows of cash to municipal-bond mutual funds coupled with the drop in tax-exempt yields has helped fuel the number of deals in more default prone sectors.

July 19 -

A city called the "double black diamond" of car driving is at the epicenter for autonomous-vehicle testing.

June 21 -

States struggle to reap the full benefits of the multibillion-dollar legal marijuana industry becuase of conflicts with federal law.

June 11 -

The highest-ranked states were mostly west of the Mississippi River, driven by expanding economies and population growth.

June 5 -

Utilities serving 40 million people and 5 million acres of irrigated farm land agreed to a federal plan to keep water flowing amid a two-decade drought.

April 25