-

One-time spending, rainy-day funds and fare hikes are forming a rickety bridge for crossing the transit funding ravine.

July 22 -

In a year characterized by a rise in mega deals, the agency looks to address an advancing financial "cliff."

July 8 -

In the first half of 2024, winding-down federal aid, a resurgence of Build America Bond refundings and election uncertainty have contributed to the surge in issuance, said James Welch, a portfolio manager at Principal Asset Management.

June 28 -

April's volume stood at $40.456 billion in 653 issues, up 21.2% from $33.377 billion in 666 issues in 2023.

May 1 -

"Just like the ATM became an additional transaction channel in the banking industry, I believe distributed ledger technology will provide municipal issuers with a similarly valued tool to sell their bonds," said Rick Coscia, Quincy's Strategic Asset Manager.

April 25 -

Boston is more dependent on property taxes from commercial real estate, and property taxes in general, than most of its large-city peers.

March 4 -

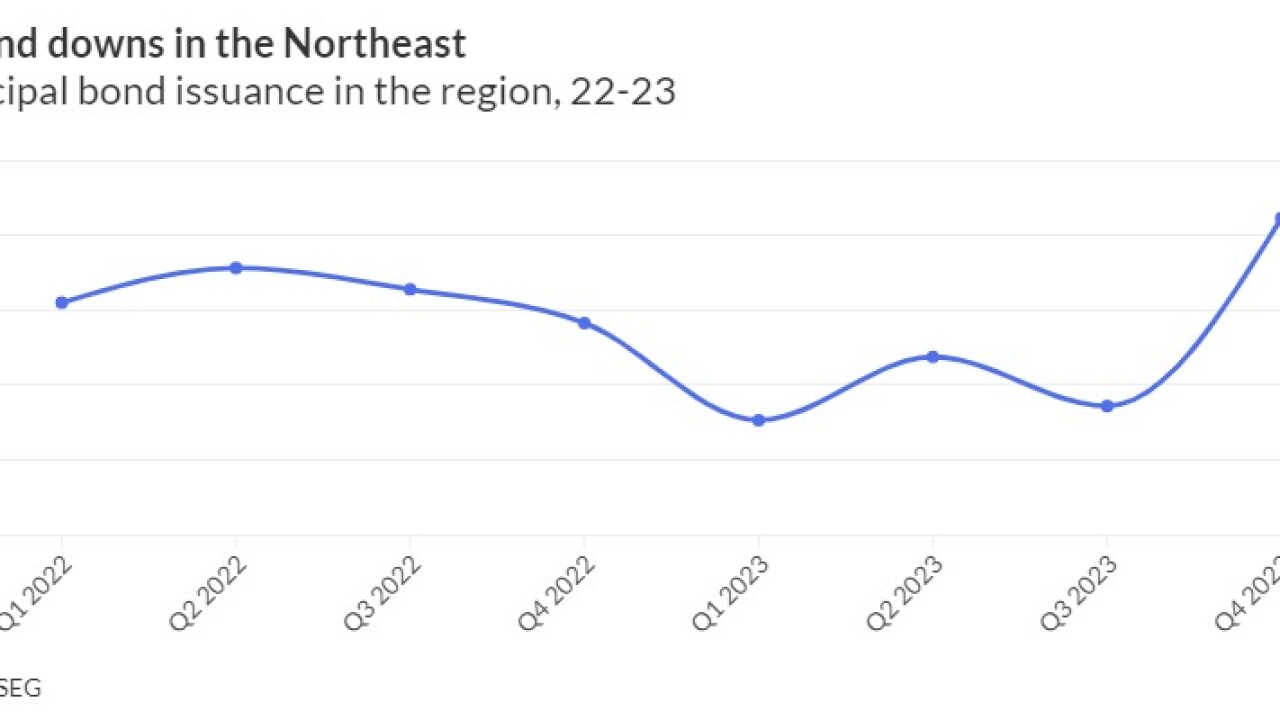

High rates and high inflation, coupled with rich reserves, pushed off or delayed issuers coming to market in 2023, noted James Pruskowski, chief investment officer at 16Rock Asset Management.

March 1 -

An off year from municipal bond issuers in the Northeast in 2023 pulled the national volume numbers into negative territory.

February 26 -

The top five bond financings have an average dollar volume of nearly $1.5 billion.

February 21 -

Maura Healey's budget plan for fiscal 2025 features more money for the Commonwealth Transportation Fund, which would increase its bond capacity by $1.1 billion.

February 13 -

The SIFMA Swap Index fell to 3.24% Wednesday, down 50 basis points from 3.74% from the week prior, and 131 basis points from 4.55% it hit on Jan. 24 as swings continued in the VRDO market. Tax-exempt money market funds reversed course to see inflows of almost $4 billion.

February 7 -

Issuance for the month is slightly above the $27.666 billion 10-year average, according to LSEG Refinitiv data.

January 31 -

Mr. Laverty spent most of his life living and working in New York City as a municipal bond underwriter for several Wall Street firms.

January 19 -

The one-year was cut up to eight basis points, depending on the scale.

January 10 -

The Massachusetts Municipal Wholesale Electric Company deal, self-designated as green, will finance a soon-to-open 6.9 megawatt, 35-acre solar power project.

January 10 -

Since November, 10-year munis have fallen 130 basis points, according to Refinitiv MMD. This has pushed ratios to near-record lows, said Jason Wong, vice president of municipals at AmeriVet Securities.

January 8 -

After this week's sale, the state intends to issue another series of refunding bonds in February in connection with a potential tender offer for taxable GOs and a current refunding of some tax-exempt GOs.

January 8 -

Despite the outperformance this week, and while the asset class had "a stellar December, which rounded out a very solid year," Barclays PLC strategists said the high-grade muni market has become "quite rich."

January 5 -

The muni market saw $379.992 billion of debt issued in 2023, only $11.076 billion less than the lackluster $391.068 billion seen in 2022.

December 29 -

The top five bond financings have an average dollar volume of more than $1 billion.

December 11