-

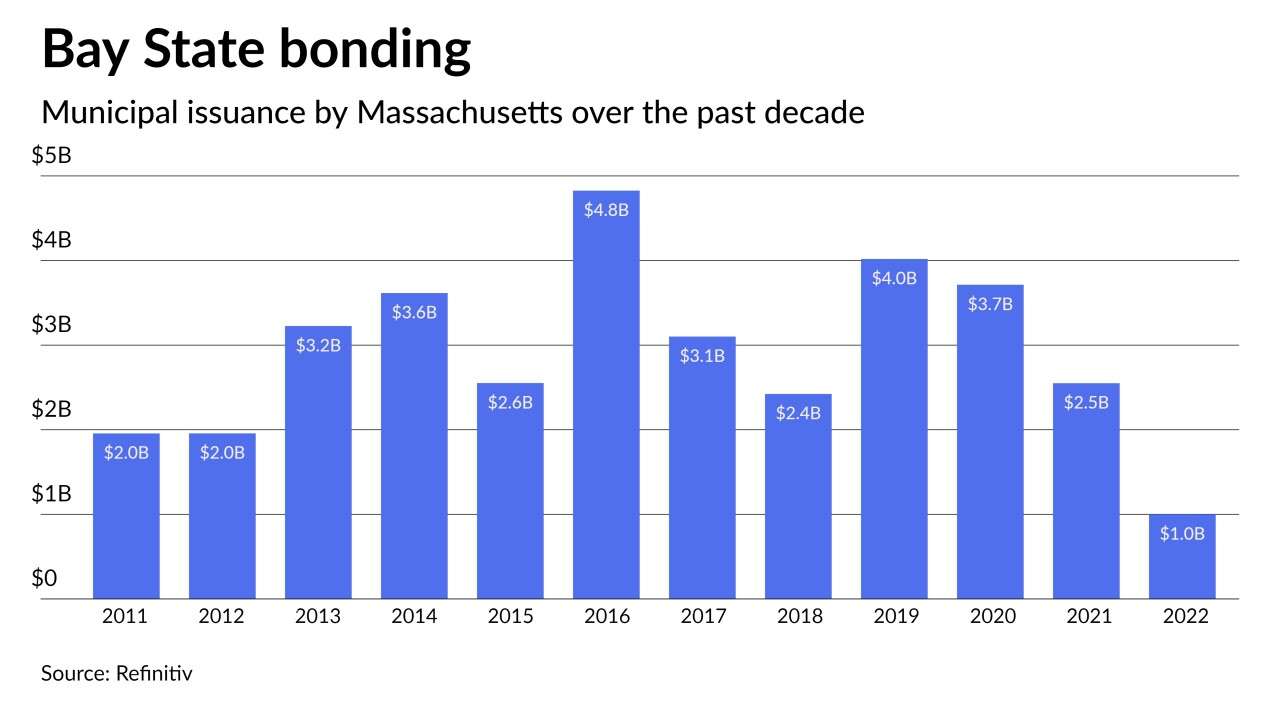

Massachusetts delayed the sale of $2.7 billion of taxable special obligation revenue bonds as state lawmakers consider a bill for their unemployment trust fund.

July 15 -

Proceeds of the taxable business-tax backed special obligation revenue bonds will pay down federal debt the state accrued during the COVID-19 pandemic for unemployment insurance costs.

July 8 -

Hosting a World Cup game brings a variety of economic benefits to cities and counties, from increased spending by fans and tourists from around the world to burnishing a region's reputation.

June 17 -

The legislation proposed by Gov. Charlie Baker includes more than $1.3 billion in capital bond authorizations.

April 22 -

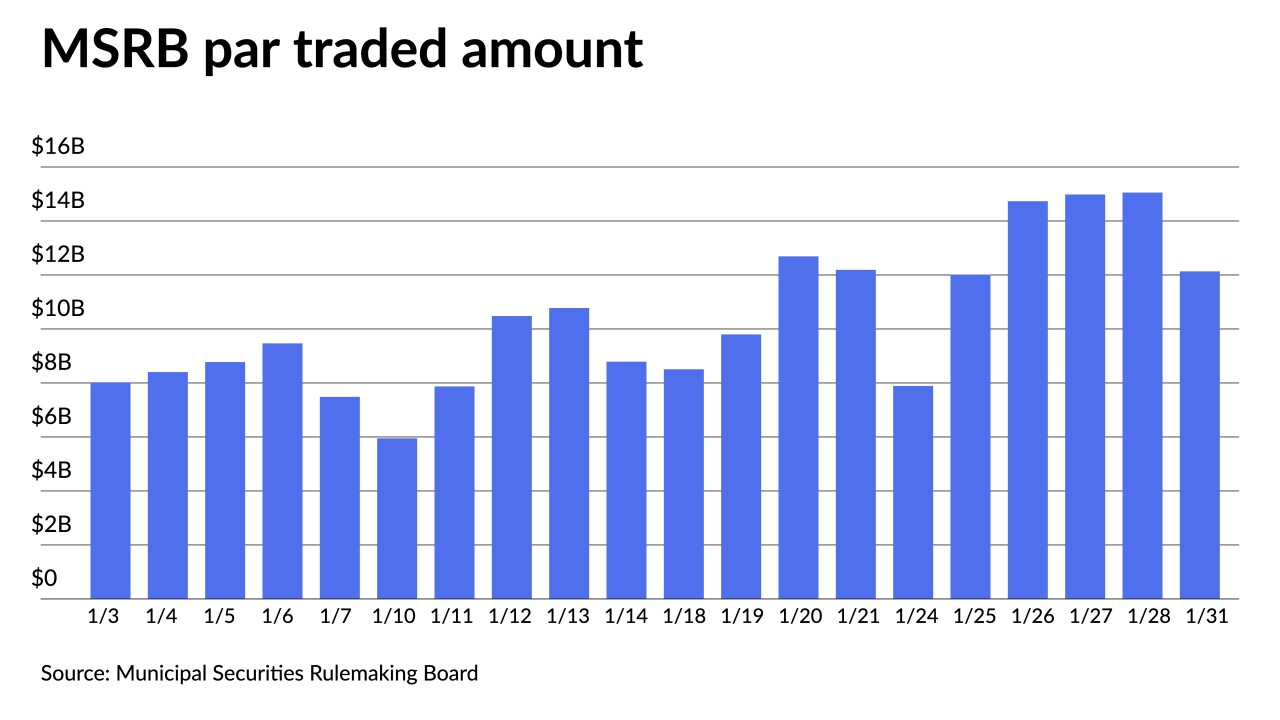

Triple-A benchmark curves were bumped two to five basis points outside of five years as markets calmed to start February.

February 1 -

Katherine Craven, chief administrative and financial officer at Babson College, discusses the school's business niche, its bond-rating upgrades amid negative outlooks for higher education overall, and the outlook for the sector in the face of the pandemic. Paul Burton hosts. (Recorded on Dec. 23, 2021 and is 25 minutes long.)

January 11 -

The pandemic, and now the spreading of the omicron variant, exposed nationwide disparities in Internet access with the transition to remote work and learning.

December 23 -

Quincy officials say they are getting out front of a state directive for full local funding by 2037.

December 10 -

The sale is Babson’s first since 2017. The business-and-entrepreneurial themed private college, which opened in 1919, has about $150 million of outstanding bonds, according to its presentation to Moody’s.

December 6 -

The weaker-than-expected employment report sent U.S. Treasury yields lower and equities sold off. Munis did what they've been doing — mostly ignored it.

December 3