-

The $1 billion bi-state agreement includes building a wider bridge over the Potomac and adding tolled express lanes.

November 14 -

The legal teams for Baltimore and Philadelphia asked the court to reject the banks’ plausibility argument as well as their claim that the suit is barred by a four-year statute of limitations.

October 1 -

Texas officials say the attacks appear to be coming from a single source.

August 19 -

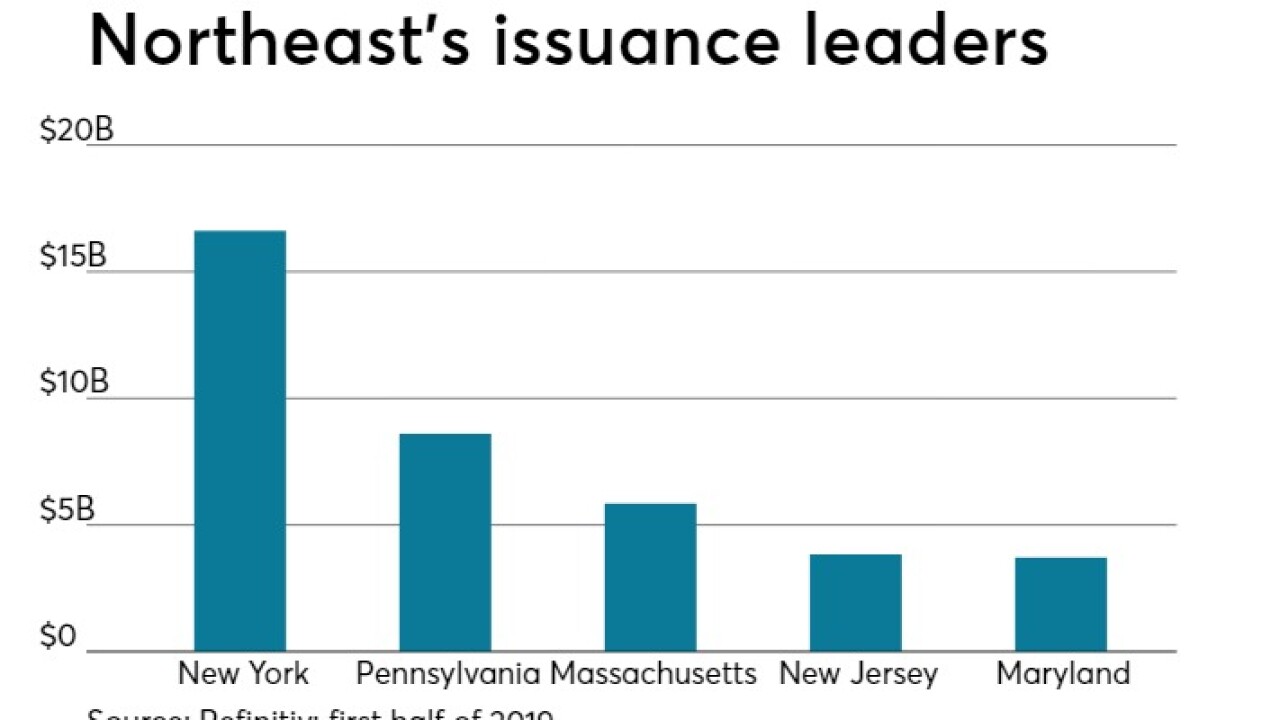

Municipal bond issuers in the Northeast sold $44.9 billion of municipal bonds in the first half of 2019, down 7% compared to the first half of 2018.

August 16 -

The law firm is bolstering its infrastructure project presence with the addition of an attorney who has helped advance some of the nation’s largest P3s.

August 13 -

The complaint filed by Philadelphia and Baltimore fails to rise to the level of specificity needed to prove conspiracy, Wall Street banks told a federal judge.

July 31 -

Strong government support fueled a two-notch upgrade for the Washington D.C.’s mass transit system despite drops in ridership.

June 20 -

The limit on the SALT deduction caused an estimated 10.88 million individual taxpayers to lose $323.1 billion in tax deductions for the 2018 tax year, the Treasury Inspector General for Tax Administration reported in February.

June 12 -

The amended lawsuit references inside sources who allegedly confirm that the banks worked together in violation of antitrust law.

June 3 -

Baltimore is locked out of many of its computer systems by online hijackers demanding more than $100,000 worth of bitcoins to restore them to the city.

May 30 -

Baltimore's $85 million general obligation bond deal is expected to sail into the municipal bond market without fallout from the resignation of the mayor.

May 3 -

The lawsuit filed in federal court is now the second national suit alleging fraud in the variable-rate debt market.

March 27 -

With extreme weather more frequent, investors and rating agencies are scrutinizing the effects of resiliency measures on municipal budgets and reserve levels.

February 1 -

As the federal government shutdown draws close to a month in length, the District of Columbia is coping fairly well.

January 14 -

The three states are in the bottom of a ranking of state fiscal conditions by the Mercatus Center at George Mason University.

October 10 -

Wilshire Consulting said the aggregate funded ratio for U.S. state pension plans remained unchanged between and first and second quarters of 2018 at 70.8%, up 0.7 percentage points from the previous 12 months.

August 27 -

The proposed Treasury rules would limit states' use of charitable deductions as workarounds for the $10,000 cap on the federal deduction for state and local taxes.

August 23 -

A report on cyber-related risks released Wednesday by S&P Global warned that “a successful attack on an entity with limited resources could have a credit impact.”

August 22 -

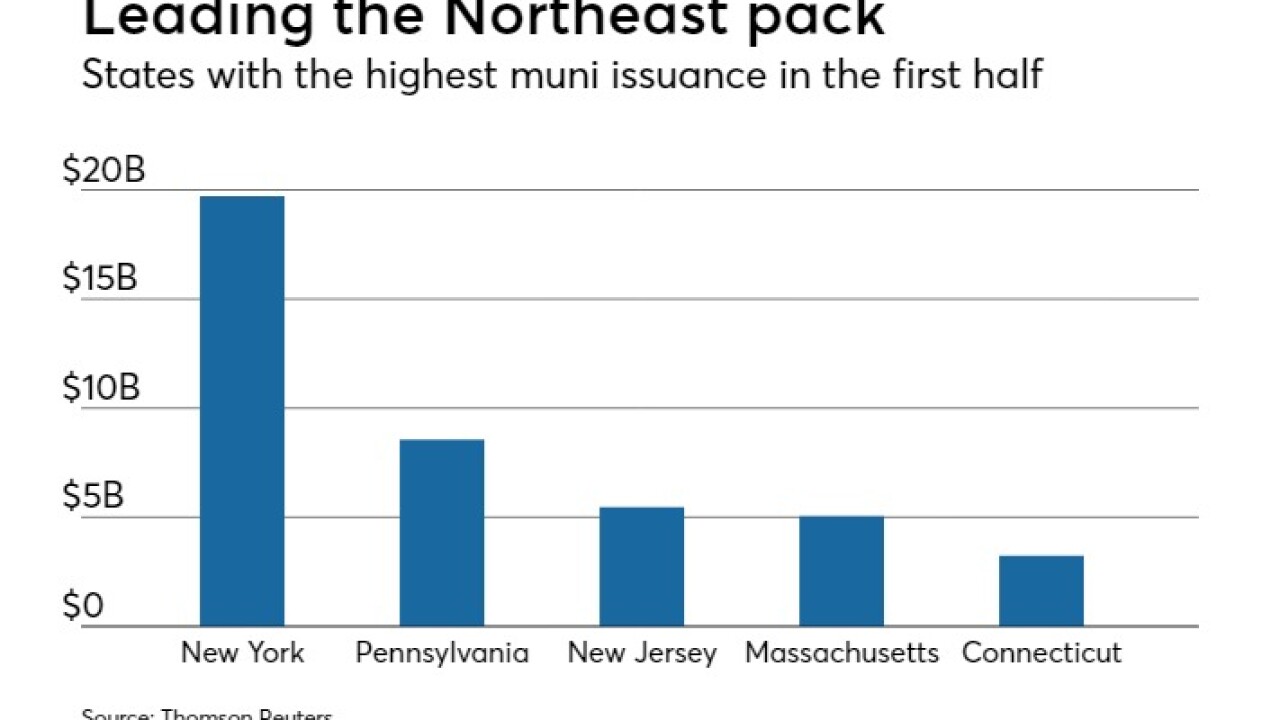

Northeast municipal bond issuance sank 11.7% in the first half of 2018 compared to a year earlier, reflecting a national trend driven by federal tax changes.

August 17 -

The Trump administration’s effort to publish a proposed rule comes just over two months after the IRS announced May 23 it was working on the regulations to enforce the $10,000 cap on what previously was an unlimited personal deduction of state and local taxes, also known as SALT.

August 6