-

The Midwest Economy Index declined to 0.51 in May from 0.72 in April, the Federal Reserve Bank of Chicago said Friday.

June 30 -

FORT MADISON, Iowa -- Voters rejected a $27 million school bond issuance Tuesday that would have been used to build, furnish and equip a new elementary school and a softball and baseball field.

June 28 -

Iowa’s weaker-than-projected revenue collections are so far manageable, Moody’s said.

June 26 -

IOWA CITY, Iowa -- As the mother and grandmother of children with special needs, Heather Young has never voted against a school bond issue.

June 26 -

Moody's Investors Service places Mercy Hospital's (IA) Baa2 rating under review for downgrade, affecting approximately $74 million of rated debt.

May 26 -

WATERLOO, Iowa -- The city's plans to borrow $20.9 million next week will be among its largest annual bond issues ever.

May 9 -

CORALVILLE, iowa -- Meg Moreland, a 17-year-old student at West High School in Iowa City, has missed more school days this year because of excessive heat than snow.

May 3 -

WATERLOO, Iowa -- A national bond ratings firm gave Black Hawk County's government high marks for fiscal management.

April 28 -

FORT MADISON, Iowa -- The Fort Madison School Board is putting a $27 million general obligation bond issuance that will pay for the construction of a new elementary school and softball and baseball fields to vote June 27.

April 20 -

Lee County voters soon will take to the polls for the first time this year to vote on the fate of the county health department building.

April 12 -

During its regular meeting Monday night, the Newton, Iowa, Community School Board of Education took another step forward in funding the new Berg Middle School.

March 30 - Michigan

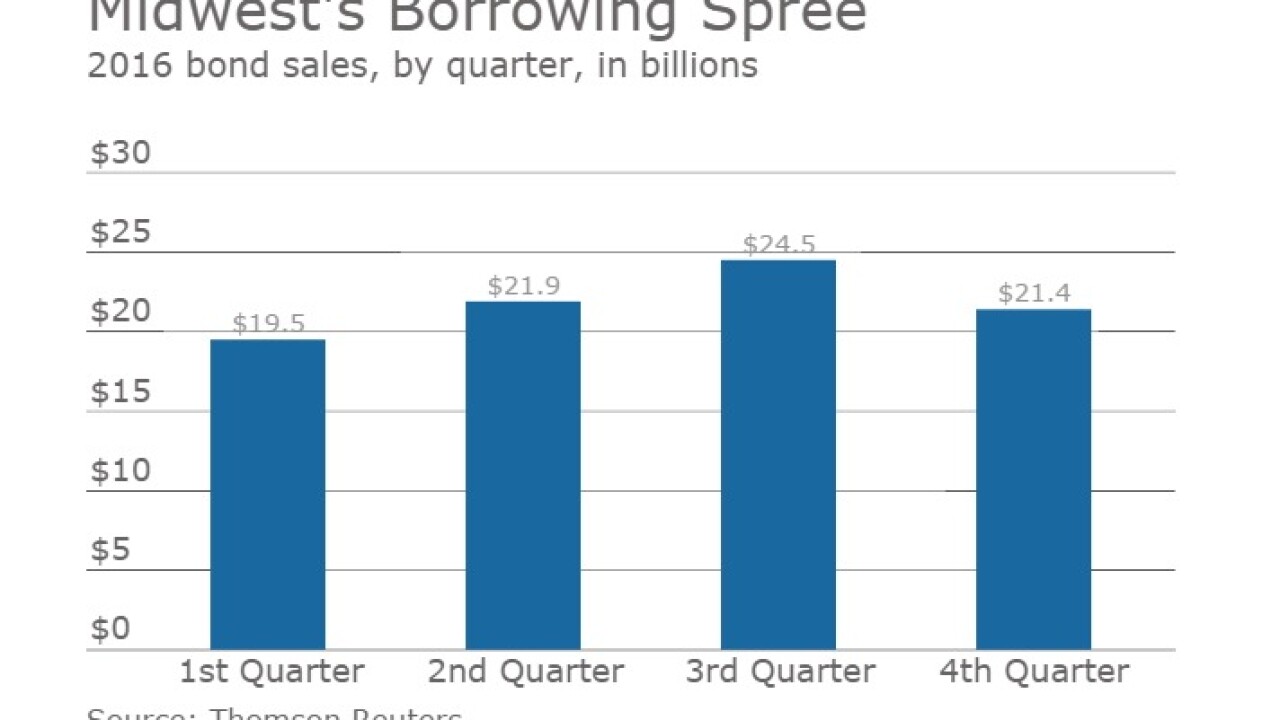

Issuers in the Midwest sold $87.2 billion of municipal bonds in 2016, a 23.4% year-over-year increase that was the biggest of any region.

February 14 - Iowa

Iowa s Xenia Rural Water District brought its long financial struggles to a happy ending as it formally shed remaining bonds from its troubled 2006 issue, ending a saga that began with an ambitious expansion that led to default and concerns over the districts solvency.

December 6 - Iowa

The Iowa Fertilizer Co. LLCs successful receipt of bondholder waivers and completion of a tender exchange for $150 million of the original nearly $1.2 billion deal eases pressures on the struggling project without eliminating them.

December 5 -

The Iowa Fertilizer Co. LLCs construction and cash flow troubles led Fitch Ratings to downgrade deeper into junk almost $1.2 billion of project bonds that are now under an Internal Revenue Service cloud.

November 21 - Missouri

The issuers of the Midwest sold $41 billion of municipal bonds in the first half of 2016, spurred by increased new money issuance, according to Thomson Reuters data.

August 23 -

An Iowa casino and racetrack is challenging the proposed loss of its tax-exempt status by the Internal Revenue Service, claiming it lessens the burdens of government and is a legitimate 501(c)(4) social welfare organization.

June 21 - Iowa

Iowa will return to the market twice this month after a six-year absence to snag refunding savings.

June 20 -

The Conroe Industrial Development Corporation in Texas has paid a penalty and agreed to redeem bonds under the Internal Revenue Services voluntary closing agreement program (VCAP) to settle a tax violation relating to bonds it issued in 2008 and refunded in 2012.

April 11 - Iowa

Coralville, Iowas general obligation bond rating moved closer to speculative grade amid balance sheet struggles due in part to its investment in recreational enterprises.

December 10