-

Still, Moody's on Tuesday revised its outlook on the New York MTA's primary transportation revenue bond credit to stable from negative while affirming its A3 rating.

April 6 -

S&P raised CPS' junk rating by one notch, saying federal funds will boost an "already positive financial trajectory."

April 5 -

Transportation fare and tax revenues lost to the coronavirus can be countered with federal relief funding, says the Illinois Economic Policy Institute.

March 30 -

Moody’s followed S&P in lifting Illinois’ outlook to stable, where it stood before the COVID-19 pandemic, but a lot more needs to happen for an upgrade.

March 26 -

Moody's is the second rating agency this month to bring its outlook on Illinois to stable, though all ratings remain at the lowest investment grade.

March 25 -

Illinois Supreme Court justices offered little indication of how they lean in the case seeking to invalidate more than $14 billion of outstanding bonds.

March 18 -

Illinois rode the tailwinds of market demand for higher-yielding paper and its rosier fiscal picture, sending its primary market spreads to their lowest since 2014.

March 17 -

A repricing of Illinois GOs saw the bonds bumped by 12 to 20 basis points from Tuesday's preliminary pricing wires and 17 to 25 basis points from Monday's price talk.

March 16 -

A bill backed by the Municipal Employees’ Annuity and Benefit Fund underscores the fiscal strains created by Chicago's pension underfunding.

March 16 -

A reversal of fund flows and the arrival of the economic aid for states and local governments helped boost the market's morale ahead of $10 billion in new-issues supply this week.

March 15 -

Municipals largely ignored the moves to higher yields in U.S. Treasuries as participants await the largest new-issue calendar of 2021 and big-name deals out of New York and Illinois.

March 12 -

The junk-rated school district won an upgrade and saw its secondary bond market spreads narrow as it expects to pocket about $1.8 billion in new aid.

March 12 -

S&P moved Illinois' outlook to stable from negative amid revenue numbers that beat pandemic-driven low expectations. The rating remains the lowest among states.

March 9 -

The Illinois attorney general and the head of conservative policy group lay out their positions next week in a case seeking to void $14 billion of state debt.

March 9 -

From the use of taxables to forward deliveries, refunding deals drove an overall 15.8% hike in Midwest bond volume that exceeded the national average.

March 2 -

S&P said the proposed budget represents a step in the right direction but it will weigh the final budget and other developments before acting on its BBB-minus rating.

February 25 -

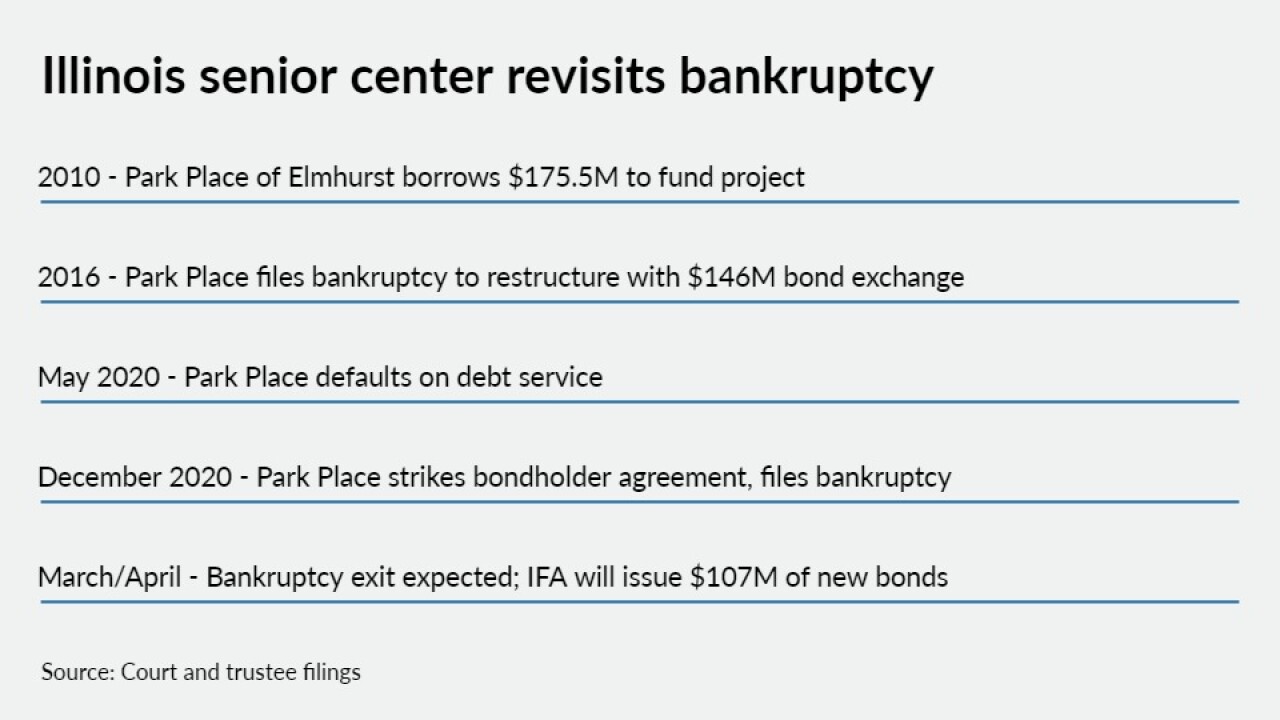

The facility and a majority of bondholders agreed to a restructuring that aims to ease repayment problems not solved by the previous bankruptcy in 2016.

February 24 -

Gov. J.B. Pritzker is still mulling action on legislation Mayor Lori Lightfoot says will add to the city's considerable fiscal burdens.

February 22 -

Illinois Gov. J.B. Pritzker's budget proposal, rosier revenue estimates and the prospects of more federal aid are only short-term salve for the state's long-term fiscal strains.

February 19 -

Gov. J.B. Pritzker's says potential federal funding relief would go first to pay down short-term debts likes its Federal Reserve borrowing and the state's bill backlog.

February 17