-

July's total volume was $25.939 billion in 542 issues, down from $28.258 billion in 619 issues a year earlier, the smallest percentage drop in monthly issuance year-over-year in 2023, according to Refinitiv data.

July 31 -

Her prolific coverage and willingness to share knowledge with local reporters brought transparency and accountability to Midwest public finance.

July 25 -

In addition to her professionalism there was a more important aspect that defined Yvette. She was simply a nice person. Always upbeat, helpful and kind.

July 21 Consultant

Consultant -

The proposed exchange — which extends the final maturity date by two decades but offers features like a tax levy with a direct intercept and trust estate — is the cornerstone of the consent agreement the city struck with a group of 2007 bondholders

July 12 -

Most top 10 issuers for 1H are from New York and California, with three from New York and three from California.

July 10 -

Chasse Rehwinkel most recently has held the position of director of banking for the Illinois Department of Financial and Professional Regulation.

July 5 -

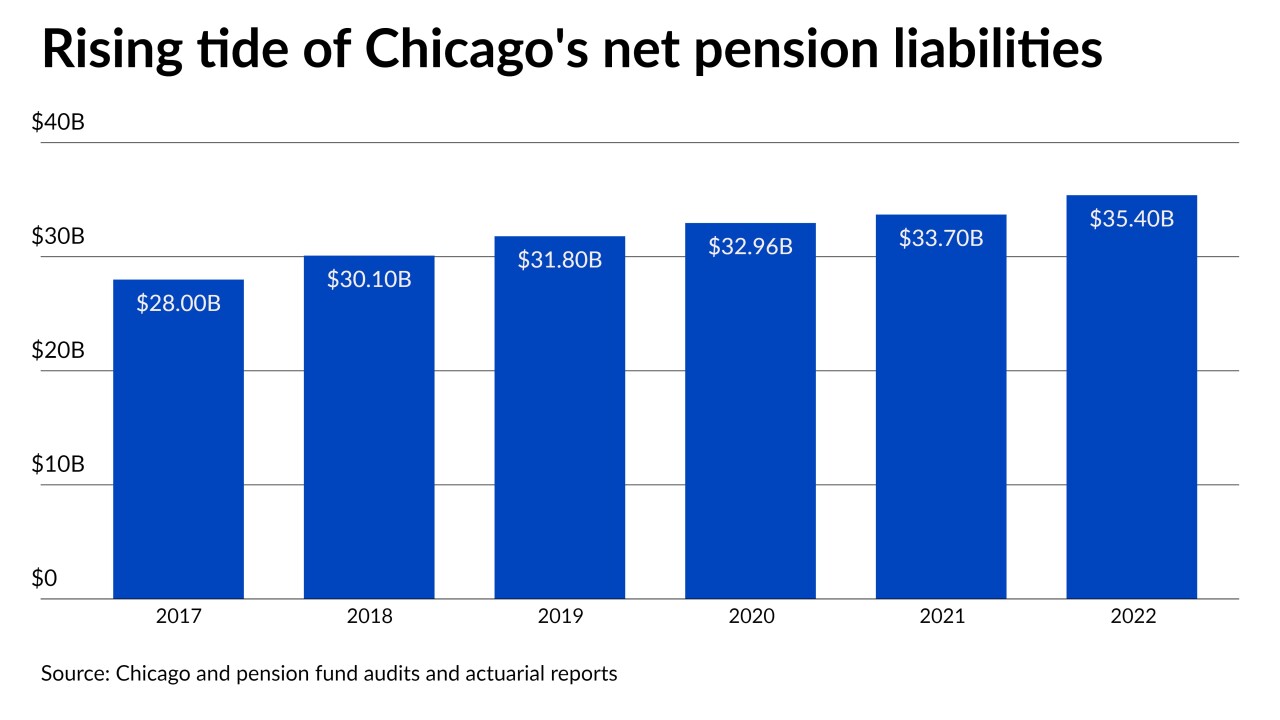

While all four of Chicago's weakly funded pension funds hit a milestone by posting modest increases in their funded ratios in 2021, they lost ground in 2022 due to investment losses driving up the city's pension burden to $35.4 billion

July 5 -

Illinois Comptroller Susana Mendoza will highlight the state's progress on key fiscal metrics during upcoming meetings with the rating agencies and has updated the fiscal 2023 interim audit as the full audited results have not yet been published.

July 3 -

The Board of Education approved a fiscal 2024 budget amid warnings about the need for more state help to manage a gap of up to $700 million in fiscal 2026.

June 29 -

David Fields, Rob Whitlock and Naomi O'Dell have been hired from RBC Capital Markets and will work out of the firm's Philadelphia and Chicago offices.

June 28