-

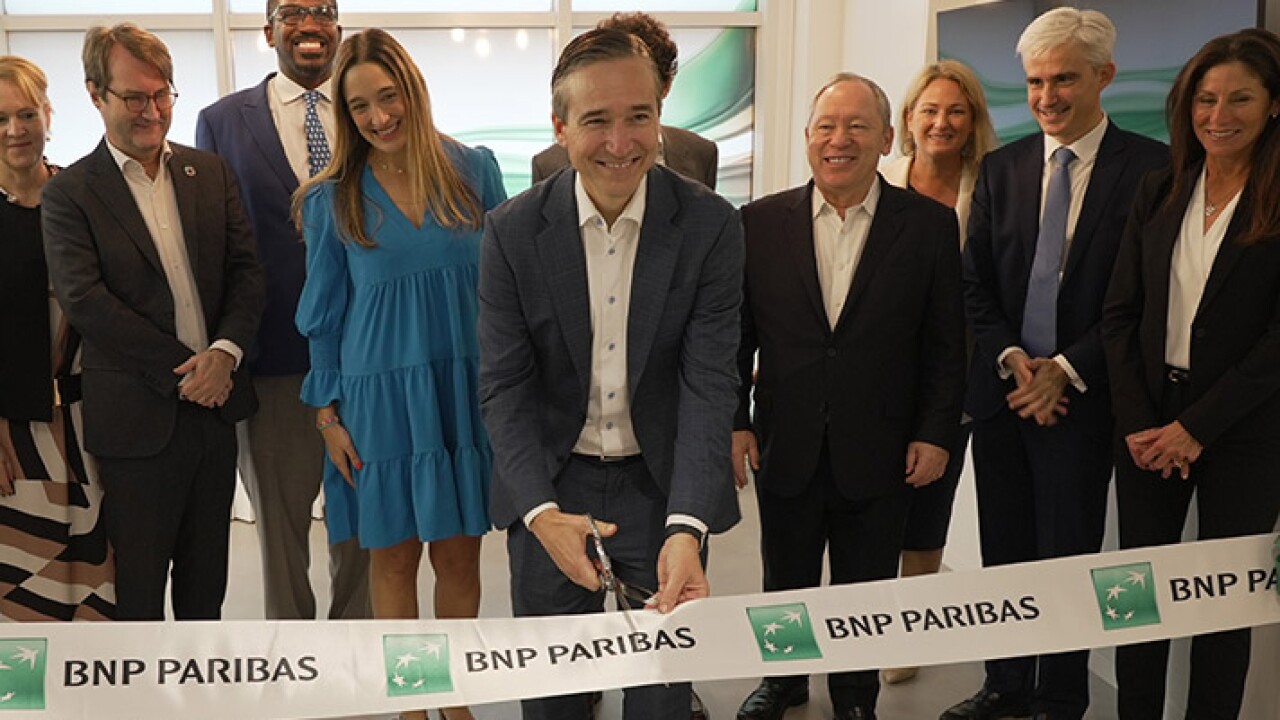

"BNP Paribas choosing Miami to open its newest office reinforces our community's status as a top financial market within the global economy," said Miami-Dade County Mayor Daniella Levine Cava.

December 7 -

The budget proposal keeps $16.3 billion in reserves and pays down an additional $455 million in debt. While providing $1.1 billion in tax relief to residents, the plan is $4.6 billion lower than the current fiscal year's budget.

December 5 -

Both debaters made salient points in defense of their positions, although at times they spoke over the other.

December 1 -

Delayed over the summer amid rising interest rates, Miami-Dade County is now set to come to market with its taxable revenue bond sale for PortMiami.

November 29 -

"Both our regions have a shared commitment to fostering economic growth, innovation and cultural exchange," said Mayor Daniella Levine Cava.

November 22 -

Fitch also affirmed the GOAA's AA-minus rating on $1.8 billion of outstanding senior lien airport facilities revenue bonds and A-plus on $867 million of subordinate lien airport facilities revenue bonds.

November 21 -

Florida outpaced the national average in overall labor force gains last month while the state's 2.8% unemployment rate was lower than the nation's 3.9% in October.

November 20 -

Proceeds from the deal, along with additional monies, were to have been used to fund the costs of the Royal Caribbean Cruises' campus project as well as a debt service reserve fund.

November 15 -

Moody's kept stable rating outlooks on Florida, Maryland and Virginia after moving the United States to negative. D.C.'s outlook was cut.

November 13 -

The top five bond financings have an average dollar volume of more than $1 billion.

November 13 -

Year-to-date, MIA has seen passengers levels at 113% of pre-COVID 19 levels, boosted by domestic travel, according to a report from BofA Global Research.

November 7 -

Lawmakers are looking for ways to slow the rising cost of property insurance, provide additional relief to victims of Hurricane Idalia, bolster efforts against anti-Semitism and support Israel while targeting Iran.

November 6 -

When set against high-profile public finance projects like American Dream and Legacy Cares, Florida's Brightline marks a rare success for investors.

November 1 -

October's total volume rose 29.3% to $37.156 billion in 661 issues from $28.738 billion in 614 issues a year earlier. New-money grew more than 30% while refundings were up by nearly 75%.

October 31 -

Surpassing $150 million in total investments, New York, Illinois, Pennsylvania, Texas, Ohio, Arizona and Georgia have joined Florida, Miami-Dade and Palm Beach counties and Miami Beach in supporting Israel financially in the wake of the deadly terror attacks by Hamas.

October 19 -

The study confirms the Bay is one of the most valuable in Florida, says Miami-Dade County Mayor Daniella Levine Cava.

October 18 -

Additionally, the Florida Treasury will follow suit and invest $25 million in Israeli bonds, said Jimmy Patronis, the state's chief financial officer.

October 12 -

At stake is nearly $800 million in Federal Transit Administration funds.

October 5 -

"People are just kind of sitting on their hands and being careful because MMD is raising yields every day and people don't know which way this is heading," said John Farawell of Roosevelt & Cross.

September 25 -

The Miami metro area unemployment rate declined to 1.9% from the 2.9% reported in August 2022.

September 15